Regular Morningstar users would have seen the popular star rating for funds that we assign to mutual funds on a scale of one to five and may have also noticed a recently-introduced feature, the Analyst Rating for funds that runs on a scale of Negative, Neutral, Bronze, Silver and Gold.

Why do we have two different ratings for funds, how do we arrive at both ratings for a mutual fund, what does each stand for--or does not stand for--and what are the differences between the two? Here are the answers.

Morningstar Rating: Background

When Morningstar started collecting mutual fund data in the early 80s in the United States, it was difficult for an investor to assess a fund's performance, as each fund is unique by way of asset class it invests in (stocks or bonds etc), its investing style (largecap vs smallcap, for instance) or risks it takes to achieve its return (high volatility or low).

Looking at a fund's performance over any timeframe in isolation is not much helpful for investors: you can't compare a bond fund that outperformed most peers and clocked, say, an 8% yearly return in a tough market for fixed income to a stock fund that lagged most peers and delivered 10% in a bull market where other equity funds rose even more. Or two equity funds that delivered the same return in a given time period but one took on a lot of risk and underwent great volatility while the other sailed a comparatively smoother ride.

In 1992 in the U.S., we introduced the Morningstar Rating for funds on a scale of one to five stars that later came to be popularly known as star ratings and became a widely-used measure in the industry to assess a mutual fund's performance.

Understanding the Morningstar Rating

The Morningstar Rating is a quantitative measure of a fund's historical risk-adjusted performance, after accounting for costs, compared to peers in the same category.

A fund's risk-adjusted performance is calculated by using a proprietary measure Morningstar has developed, which takes into account a fund's standard deviation (or volatility) it has undergone to achieve the return.

So a fund that achieved high returns but also took high risk will have a lower star rating compared to a fund that achieved slightly less returns than the previous fund but took on far less risk.

We also subtract from the returns the costs (expense ratio, loads etc) the fund has incurred.

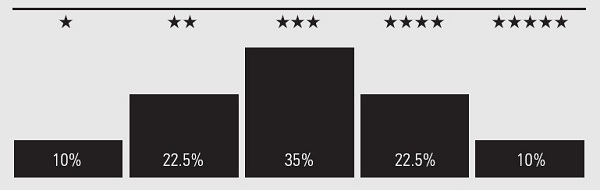

Finally, we compare a fund only with its peers in the same category and funds are rated on the basis of risk- and cost-adjusted performance on a bell-curve basis in the ratio presented in the image below:

For any fund to be rated, it must have completed three years in existence and should belong to a relevant category.

So we won't initiate the star rating on any fund that is less than three years old or which belongs to a category like Global where each fund is different in terms of investing area and style, or Funds of Funds, where we do not have enough funds to compare each other with.

The star rating for each fund is recalculated (and changed, if need be) at the end of each month.

Another aspect of the star rating: a fund may have completed three years and achieved a star rating. At this point, its star rating is computed on the basis of its three-year performance (that is, risk- and cost-adjusted performance versus peers).

But as soon as the fund completes another two years (five years in total), its star rating will become a computation of both its three-year and five-year performances, with greater weightage being given to the latter as we believe that longer-term performance is what matters more. So on for when a fund completes 10 years in existence, where the star rating will be computed after giving greater emphasis to the 10-year performance but also its five- and three-year performances.

For instance, the overall Morningstar Rating for the popular HDFC Top 200 is five stars based on its long-term performance even though its lukewarm performance in the past one year gives it a four-star rating for the most recent three-year period.

Quick guide to the Morningstar Rating

What is it?

It’s a visual measure of a fund's historical risk- and cost-adjusted performance, compared to other funds in the same category. It's calculated quantitatively, meaning we have no control over how a fund gets rated and Morningstar's own view on the fund has no bearing on the rating.

What is it not?

It's not an endorsement by Morningstar. We do not recommend investors simply go out and buy four- or five-star funds and shun the rest, as we believe past performance is not always an indicator of future returns, even though studies show the star ratings do have predictive power (several, if not all, funds that did well in the past may have enough qualities in place to sustain their outperformance in the future).

What should it be used for?

Since the Morningstar Rating is a measure of a fund's risk-adjusted historical performance, it should be used to screen winners to have a closer look at and to then examine what drove their performances and if they can sustain such performance in the future.

How many funds have the Morningstar Rating?

Any fund that satisfies our criteria of having completed three years and fits in a relevant category will be rated. We currently have ratings on about 2,000 funds across the broad equity, fixed-income, allocation (also called hybrid or balanced funds) and money-market categories.

Analyst Rating: Background

Even as investors globally loved the simple one-to-five scale and the star rating became a handy way to look at and understand a fund's historical risk-adjusted performance, we also felt the need to use our experience of analyzing mutual funds to see which have the potential to outperform going forward.

Through decades of mutual-fund research globally, Morningstar fund analysts arrived at the conclusion that what really drives mutual-fund performances were factors they started calling the five Ps: people, parent, process, performance and price.

Thus, in late 2011, we introduced the Morningstar Analyst Rating for mutual funds, our qualitative, forward-looking view of a fund’s potential to outperform peers over the long term. We have three ratings on the positive scale--Gold, Silver and Bronze--along with a Neutral and Negative.

Understanding the Morningstar Analyst Rating

The Morningstar Analyst Rating is our view on a fund's potential to beat peers in the future. Our analysts evaluate a fund for the five Ps that we believe are critical in dictating a fund's long-term performance and arrive at a rating that is a codified expression of our collective view on the five Ps.

Along with providing a fund rating, Morningstar fund analysts also produce a written analysis that explains what drove the fund's rating, along with supplementary information on the five Ps.

A fund with a Gold rating means the fund distinguishes itself across the five pillars and has our highest conviction. A Silver fund has strengths across some pillars but not all. It has our analysts' high conviction. A Bronze fund has advantages that outweigh disadvantages and has sufficient analyst conviction to warrant a positive rating.

A Neutral fund isn't likely to deliver standout performance while a Negative-rated fund has a flaw that is likely to hamper future performance and is considered inferior compared to peers.

Once a rating has been issued, the analyst monitors developments at the fund and may upgrade or downgrade the rating after any event that may have altered his view on the fund.

Unlike the quantitative Morningstar Rating where the top 10% get five stars, we don't assign Analyst Ratings on a fixed scale and rate each fund on what we think are its merits.

Also, given our philosophy towards investing, our Analyst Rating is long-term in nature and does not imply a Gold fund would outperform a Neutral fund in the next few months or a year. We believe the fund will outperform over a full market cycle of at least five years.

Quick guide to the Analyst Rating

What is it?

It is Morningstar's forward-looking view on a fund's ability to outperform category peers in the long term. A Gold fund implies our analysts have the highest conviction in its potential to beat its category over a market cycle.

What is it not?

A Gold rating for a fund is not necessarily a 'Buy' signal; in that it is not our view on the asset class the fund operates in, but only on the fund's ability to beat peers. So when we rate an equity fund a Gold, we do not mean we believe stocks would see superior performance compared to other asset classes, but only that the Gold-rated stock fund will likely outperform most other stock funds.

Similarly, a Silver-rated small-cap fund does not mean we believe you should prefer it over a Bronze large-cap fund as you would first still need to decide what type of funds your portfolio needs with respect to your asset allocation, investing horizon, risk profile, etc.

What should it be used for?

After deciding on your asset allocation and which type of funds would make a good fit for your portfolio, you should look at the Morningstar Analyst Rating for various funds for those categories, go through the reports that explains the rating and then decide if it should be a constituent in your portfolio.

How many funds have the Analyst Rating?

We currently have Analyst Ratings on 56 funds belonging to the Large-Cap, Small and Mid-Cap and the ELSS categories. We will keep adding funds to our coverage list and will also roll out ratings on fixed-income funds in the future.