If there is one word that has disappointed equity investors in recent years—that is ‘Infrastructure’. Infrastructure funds, which invest in stocks of infrastructure and other related industries, have underperformed since the year 2010. The going has got tougher for these funds in the recent market correction in 2013, just as investors thought that the theme was seeing some recovery. We review the key reasons for underperformance of these funds, and what the future holds for this beaten down theme.

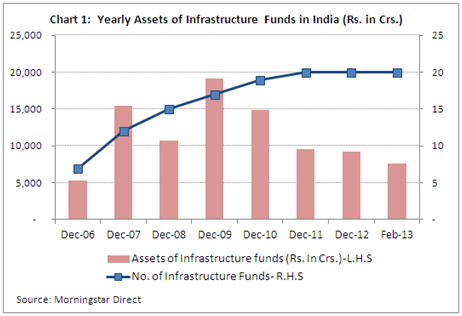

Assets of infrastructure funds fall to its lowest level in almost 6 years

Infrastructure theme funds have been around for a while in the Indian markets. The theme gained momentum in the heydays of year 2006 and 2007, when these funds were delivering high-flying returns. Seeing these returns, investors drove in flocks to these funds, and mutual fund companies also capitalized on the frenzy by launching a number of these funds in 2007 and early 2008. Six of these funds were launched during the year 2007, followed by another three fund launches in early 2008. The total assets managed by these funds stood at just around Rs. 5,000 crores at the end of 2006, and grew to almost Rs. 19,000 crores at the end of March 2008. However, as the financial crisis set in, the total assets of infrastructure funds fell sharply to Rs. 10,000 crores in late 2008. It was a disappointing year for these funds, as they delivered an average return of -59% in 2008, compared to -52% return delivered by Nifty index.

On the other hand, in the market recovery of 2009, the traction again started to build up for this theme. Fund companies launched new funds and investors once again started to pour money into these funds (although it may not have been as fervent as in the past). The total assets of these funds grew to almost Rs. 20,000 crores in September 2009, which was its peak. It has been mostly downhill for these funds since then. Total assets of infrastructure funds continued to fall through the years (Refer to Chart 1) and are now down to just around Rs. 7,600 crores at the end of February 2013, making it the lowest level of assets these funds have managed since mid-2007. Interestingly, in year 2012, the total assets managed by infrastructure funds fell by 4%, despite these funds delivering a return of 25% (on average) during the year. It points to continuing outflows from such funds.

Individual infrastructure funds have taken it harder on the chin, in terms of the fall in their assets over the years. ICICI Prudential Infrastructure Fund, which was the largest infrastructure fund during the hey-days, managed assets in excess of Rs. 5,000 crores in March 2008. Its assets have now been knocked down to a humble Rs. 1,500 crores at the end of February 2013. Similarly, DSP BlackRock TIGER, which used to manage assets in excess of Rs. 4,500 crores in early 2008, has seen its assets shrink gradually to Rs. 1,294 crores at the end of February 2013. Other large infrastructure funds have also seen a similar shrinkage in assets over the years.

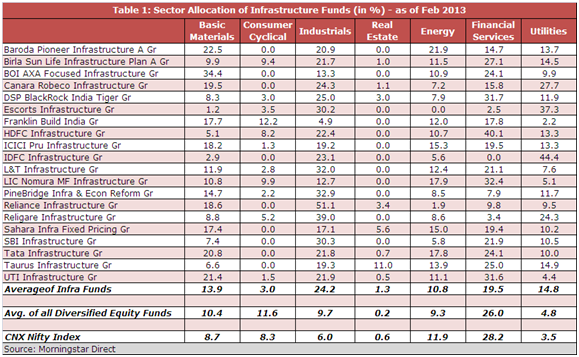

Infrastructure funds in India and their sector allocation

Infrastructure funds invest in stocks of infrastructure and ancillary industries. Therefore, their investment universe is quite large and includes sectors like financials, industrials (capital goods & engineering), utilities, energy, consumer cyclical (primarily auto), basic materials (includes metals, cement, chemicals and building materials), real estate and communication services (telecom). Infrastructure funds generally avoid sectors like healthcare, technology and consumer defensive (FMCG). Because of their more diversified nature, we consider these funds along with other diversified equity funds within Morningstar, and classify them as a large-cap or small/mid-cap equity fund, depending on their historical portfolio allocation.

However, infrastructure funds do keep a higher weightage to certain sectors. Presently, these funds have the highest allocation to industrials sector, where average allocation stands at around 24% at the end of February 2013. A typical diversified equity fund maintains an allocation of just 9.7% (on average) to the sector at the end of February 2013. Financial services sector has the second highest allocation in portfolios of infrastructure funds, with an average allocation of 19.5% at the end of February 2013. Other sectors to which infrastructure funds have high exposure are utilities, basic materials and energy. Refer to Table 1 for sector allocation of infrastructure funds.

Performance of infrastructure funds is largely a sea of red

As mentioned earlier, infrastructure funds had delivered strong performance in the years of 2006 and 2007, therefore popularizing the theme then, and prompting investors to flock to these funds. Infrastructure funds had delivered an average return of 53.38% and 82.73% in 2006 and 2007 respectively. Sectors like capital goods, metals, power and real estate had delivered high-flying returns in these two years, helping the infrastructure funds to capitalize on the same. However, these funds got beaten down badly during the financial crisis of 2008, and delivered an average return of almost -59% during the year, compared to -52% delivered by CNX Nifty index. The market recovery of 2009, once again helped these funds to gain traction, and they delivered a return of almost 80% on average, compared to about 76% returned by the CNX Nifty index in that year.

However, from there, it has mostly been downhill for these funds. The year 2010 was disappointing for infrastructure funds as they delivered only a 7% return on average, compared to around 18% returned by the CNX Nifty index in that year. The poor performance of sectors like capital goods, realty, metals, power and oil & gas during the year attributed to the underperformance of those funds. The situation worsened further during the market downturn of 2011, and these funds fell by around 33% (on average), trailing the Nifty’s 25% decline during the year. Interest sensitive and cyclical sectors were beaten down during the year, therefore taking a toll on infrastructure funds. Despite the markets recovering in 2012 and rate sensitives doing quite well, infrastructure funds trailed other diversified equity funds in terms of performance during the year. Infrastructure funds delivered an average return of 25% in 2012, compared to almost 28% returned by the Nifty index. The Morningstar Large-Cap category and Small/Mid-Cap category returned 29% and 39% respectively during the year.

To make matters worse, the going has got tougher for these funds in the recent market correction of 2013, with the interest-sensitive and cyclical sectors getting beaten down this year, so far. YTD in 2013 (upto March 28, 2013) infrastructure funds have posted an average loss of 12.5%, compared to a loss of 3.7% posted by the CNX Nifty index. Meanwhile, over the same period, large-cap and small/mid-cap funds have returned on average -6.66% and -11.30% respectively.

A look at the trailing returns of infrastructure funds portrays a sea of red, and amplifies the extent of carnage in this theme over the years. Refer to Table 2 for trailing returns of infrastructure funds versus indices (ended March 28, 2013). Several of these funds were Morningstar 5-star rated funds in late 2007 and early 2008, but have been stripped down to Morningstar 1-star or 2-star rated funds as of today. Over the past 5 years (ended March 28, 2013) infrastructure funds have delivered an average return of -4% (annualized), compared to 3.7% (annualized) returned by the CNX Nifty index. The performance looks even more distressing over the trailing 3-year period. Individual funds like Reliance Infrastructure, Escorts Infrastructure and SBI Infrastructure stand out as the ugly ducklings, but other infrastructure funds have also underperformed significantly. For example, Reliance Infrastructure Fund has posted a dismal return of -20% (annualized) over the past 3 years, which looks drearier than the average return of -7.6% (annualized) posted by all infrastructure funds over the same period.

Conclusion

Thematic funds are subject to higher risk—of the underlying theme underperforming in certain years. However, the infrastructure theme has been an underperformer for an extended period of time, now. We had also written an article in late 2010, on the underperformance of infrastructure funds then. It may be difficult for individual investors to identify themes or make accurate sector calls on a consistent basis. In that case it probably makes sense to invest in a diversified equity fund, and leave that call to a fund manager, who will increase exposure to certain sectors if they look favourable.

A key reason for the underperformance of infrastructure funds is the slowdown in the investment cycle. Although there are some talks now that the investment cycle will pick up in the near future, the patience of some investors who have stood by these funds over the years must be wearing thin, and they would be probably looking for an appropriate exit opportunity. After all, we don’t want to be in an “Emperor without his clothes” situation—do we?