Being one of the youngest employees at Morningstar, I am often told by my colleagues the importance of saving and planning for retirement right away. One tends to scoff at such advice since lifestyle costs weigh heavily on the pocket even though family obligations are minimal. And of course, procrastination is not such a bad thing since time is on my side. Ironically, it is for this very reason that makes the early twenties the best time to start saving.

Don’t take my word for it. Let the numbers speak.

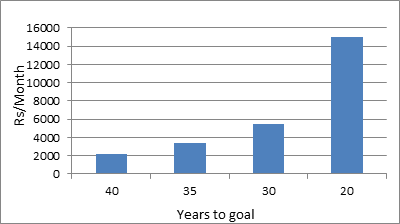

Let’s say that you start saving at the age of 25 with the purpose of accumulating Rs 1 crore by 65. For ease of understanding, let’s assume the rate of return as 9%. To amass this corpus, one would need to invest Rs 2,140 on a monthly basis for the next 40 years.

Delay this exercise by just 5 years. If one starts investing at the age of 30, acquiring the same corpus would require an investment of Rs 5,460 every month. Alright, that too sounds doable. Now let’s push it back further.

If one starts investing by 50, s/he would have to shell out Rs 51,700 every month for the next 10 ten years to reach the target of Rs 1 crore.

The graph below puts the power of compounding and the perk of investing early into perspective.

Now let’s look at this same instance in another way. The longer you wait, the larger the corpus you will need. If you have 40 years to achieve your goal, you would need a little over Rs 10 lakh as a principal amount over the 4 decades. If you have just 10 years, you would need Rs 62 lakh. This difference goes up to astronomical heights as you near your goal. Just by starting early, you can accumulate so much more wealth.

So here’s the clincher. Start now.

The best way to do it is by investing in equity. Time is on your side so you can afford to ride all the market upheavals. You have less at stake and less worry that a dip will put you off your retirement plan. Invest consistently. Start a systematic investment plan in a good diversified equity fund and invest small amounts every single month. It will eventually pay off.