This article has been written by Mahesh Padmanabhan of Relax With Tax.

The Budget has brought about some changes which will have a direct impact on an individual’s savings. The key points that affect personal taxation and finance have been discussed below.

Increase in the threshold tax limits

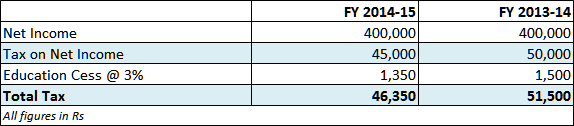

The “zero” tax slab for individuals has been enhanced by Rs 50,000 thus saving an additional tax of approximately Rs 5,150. The proposed “zero” tax slab is Rs 3 lakh for senior citizens and Rs 2.5 lakh for other individuals.

Let’s see how this works out with an example:

Increase in limit for tax saving investments

The limit for tax savings investments, such as PF, PPF, NSC, and even the home loan principal repayment, has been proposed to be raised by Rs 50,000 from the current Rs 1 lakh to Rs 1.5 lakh. This proposal again should save another at least Rs 5,150 in taxes for individuals.

The investment ceiling under the PPF scheme has also been revised upwards from the current Rs 1 lakh to Rs. 1.5 lakh. PPF has always been a very safe investment option for individuals who could leverage the reasonably good tax free yield of about 8.7% by investing in names of family members.

Let’s see how this translates into actual figures.

Nanda’s investments in provident fund and her life insurance premiums total to Rs 1 lakh. She cannot afford to invest more as she is a single mother taking care of a child whose school fees amount to Rs 48,000 annually.

With the new proposal, Nanda can further reduce her tax by approximately Rs 5,000 without making any additional investment. Compare this with the earlier year where the school fee payment would have not fetched her any tax break though she was obligated to meet it.

Increase in the limit of interest on loan in respect of self occupied house property

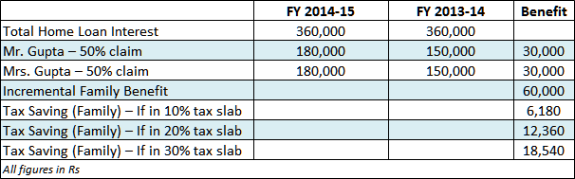

The deduction for home loan interest for house property used for self occupation has been proposed to be enhanced by Rs 50,000 from the existing Rs 1.5 lakh to Rs 2 lakh.

Let’s evaluate how this benefits the Gupta couple.

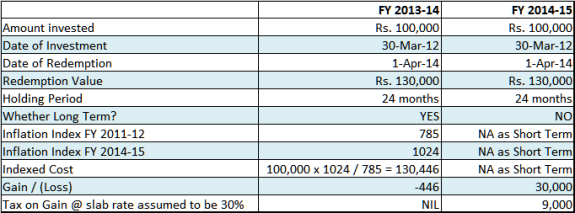

Change in taxability of funds

The changes proposed to the taxability of mutual funds other than equity oriented funds are the shifting of tax rate from 10% to 20% and the change in the holding period from the current 12 months to 36 months for the asset to be treated as long term.

This would impact individuals who were looking at investing in short-term money market funds that could have generated tax neutral income by using cost inflation indexation between multiple financial years.

An example to illustrate this is stated below:

This may mean that in order to avoid paying taxes, you may need to hold the investment for more than 36 months, which may need to be independently evaluated vis-à-vis the safety and yield of a bank fixed deposit.