Vanguard has issued a new (short) report called Quantifying the impact of chasing fund performance. It delivers a familiar lesson: Don't sell low so as to buy high.

Many have told this story. Morningstar's Russel Kinnel, for example, has long published the "Buy the Unloved" funds series in the U.S., which examines whether investors are skilled at moving between investment categories (nope). At the fund level, several companies have estimated the size of the gap that separates what funds earn on paper versus what funds earn for investors (who can and do erode paper returns through mistimed trades.)

Vanguard's tale is a bit different. Unlike the aforementioned studies, which measure actual investor behaviour, Vanguard's research evaluates hypothetical decisions. Specifically, the report analyses every possible trade that could have been made among diversified U.S. stock funds during the time period from 2004 to 2013, assuming a rule of selling any fund that trailed its category's average total return over the trailing three calendar years, and funneling the proceeds from that sale into high-performing funds from the same investment category. The results, writes Vanguard, incorporate "more than 40 million return paths."

Yes, that's a lot of data.

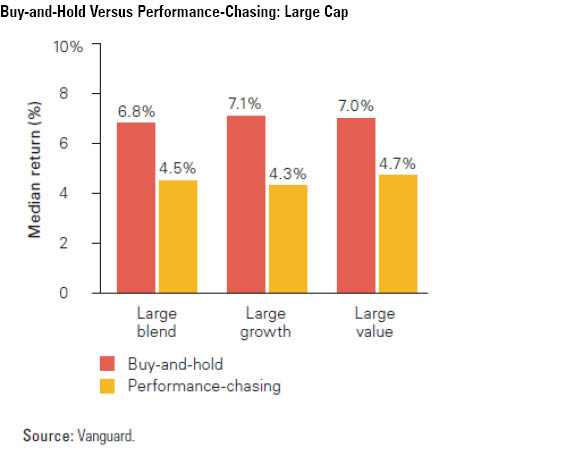

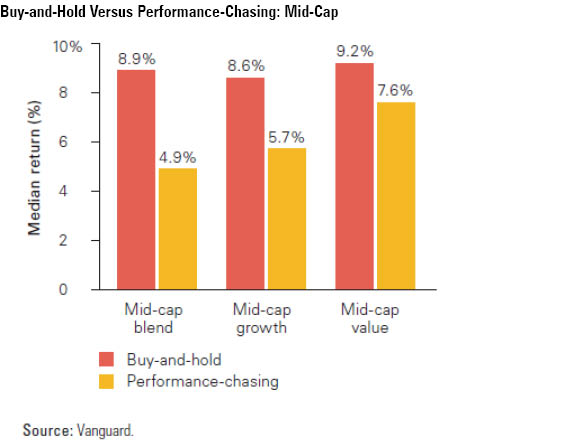

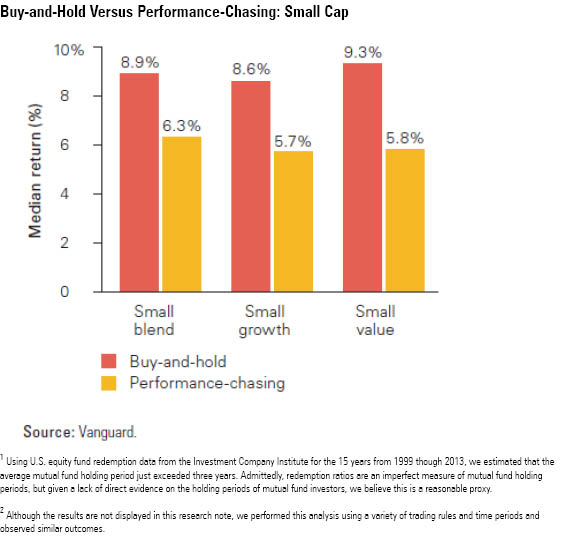

For each category, Vanguard shows the median annualised total return for two strategies. The performance-chasers operate as discussed above, initially buying every fund in the category in equal proportions, and then moving cash from losers to winners. The buy-and-hold approach also purchases every fund in equal proportion but makes no further trades.

As evidenced by the chart, buy-and-hold wins in a landslide for the three large-cap categories.

Performance-chasers fare similarly poorly with mid-cap stock categories.

And worst of all with small-company funds.

To read a more detailed review of this report by John Rekenthaler, Vice President of Research for Morningstar, click here.