This article has been written by Mark Mobius, Executive Chairman of Templeton Emerging Markets Group, for his blog.

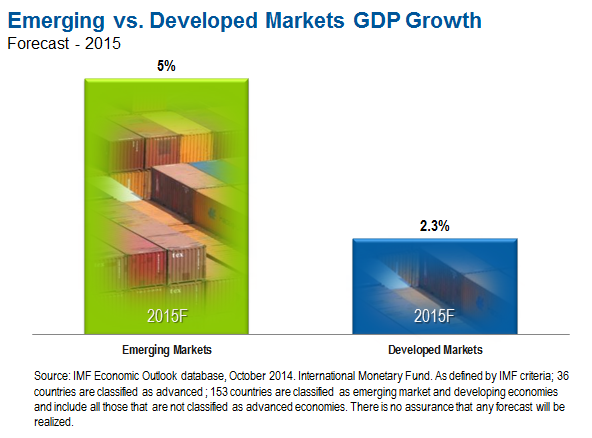

We at Templeton Emerging Markets Group believe high economic growth rates will remain a key attraction of many emerging markets in 2015.

Even with major economies like Brazil and Russia slowing down, overall economic growth in emerging markets during 2015 is expected to be comfortably in excess of developed markets, with China and India likely to drive the Asian region to particularly strong growth.

Moreover, many emerging markets, among them China, India, Indonesia, Mexico and South Korea, have announced or embarked upon significant reform measures that differ in details but are generally aimed at sweeping away bureaucratic barriers to economic growth, encouraging entrepreneurship and exposing inefficient industries to market discipline.

Most are also looking to rebalance economic activity away from export- and investment-heavy models to become more oriented toward consumer demand.

The Association of Southeast Asian Nations, or ASEAN, economic community planned for 2015, which will bring 10 economically diverse Southeast Asian countries together into a single economic organisation, represents another strand of reform in which more technologically advanced emerging economies are becoming increasingly interconnected with less-developed neighbours who possess resources of low-cost labor and commodities, to the potential benefit of both groups. The reform measures have had some short-term costs, but we believe that, should governments succeed in driving them through, longer-term benefits could soon begin to feed into economic growth figures. The emphasis on market discipline could also create a closer correspondence between emerging-market growth and corporate profitability.

We are enthusiastic about the potential of new technology to accelerate growth trends, with some Internet and mobile communications-based technologies in particular offering less-developed countries the opportunity to potentially leapfrog generations of economic change in more mature markets and move directly to efficient modern systems. (See chart on global smartphone sales.) This factor could be a particularly dynamic driver of development in frontier markets that include much of Africa, which could give additional impetus to markets that already benefit from highly favorable demographics, abundant natural resources and low starting points in terms of existing per-capita gross domestic product.

Potential Challenges Ahead

We do not disregard issues such as the recent weak economic performances in Brazil and Russia as well as the market-unfriendly direction of policy in those countries, nor do we dismiss the potential for Chinese military assertiveness in the South China Sea to create tensions or the profound nervousness displayed by investors at any sign that US monetary policy might be tightened. However, we believe both Russia and Brazil have the resources to bounce back strongly should more appropriate policies be adopted. With Russia in particular, much risk already has been discounted in exceptionally low equity valuations as of December-end, though the Russian government’s unwillingness to soften its stance toward Ukraine could elicit more sanctions that result in a negative environment for investors, among other potential risks. Chinese maritime assertiveness should be placed in the context of other foreign policy moves such as the “Silk Road” initiatives aimed at improving relations and building trade with neighboring countries.

With regard to developed-market monetary maneuvers, it is important to note that many major developed countries are still loosening policy, with Japanese quantitative easing likely to be highly significant for Southeast Asia. Recently, exceptional levels of money creation have remained largely outside real economies as the velocity of money has slowed sharply, evidenced by the declining loan-to-deposit ratios of banks in the United States, Europe, Japan and China. As banks become more confident and resume lending activity, stocks of newly created money could begin to influence the real global economy.

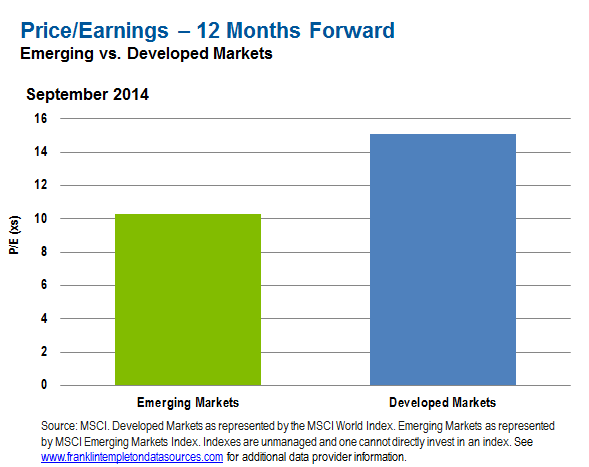

As of December-end, the favorable trends in emerging markets appeared under-recognised in equity valuations that generally stood well below those of developed markets. Even after recent rallies in some emerging markets, they continued to appear relatively attractive to us in relation to history, particularly if very low bond yields and interest rates for savers are taken into account. With our ground-up stock investment research metrics continuing to identify what we believe are attractive long-term investment opportunities, we remain optimistic about the potential of emerging markets.