This column was written by Anoop Bhaskar, Head - Equities at UTI Mutual Fund for the India Markets Observer.

As the horns of a bull market get more visible, so has investor participation. A myth perpetuated over the years is that quality matters in a bear/flat market, not in a bull market. In fact, goes the perception, returns are inversely correlated to the quality of the company as the market rises!

The stronger the underlying market move, the greater it appears is the willingness of investors to accept companies with mediocre historical track records in the hope of a “great” turnaround.

Do “quality” companies outperform their more inconsistent peers during bull markets or are they consigned to generate all their long-term outperformance from periods of market declines? Should one change an equity portfolio to participate in a changing market scenario, a “horses for courses” kind of portfolio strategy, or should one have a disciplined resolve to succumb to temptation irrespective of the returns being generated by so-called non-quality stocks.

Finally, what is quality? Is it corporate governance or business profitability?

Defining quality

Quality, for the purpose of this study, is defined as cash generated by the company from its operations (before capital expenditure) on a consistent basis.

Operating Cash Flow being defined as Profit

After Tax plus Depreciation less change in Working Capital. In other words, OCF = PAT + depreciation – change in working capital.

Why OCF?

It is a fairly good measure for ascertaining the ability of a company to grow its sales without impairing its terms of trade i.e. higher sales do not need to be “forced” by giving longer credit to distributors nor require a buildup of inventories.

As a rule, the scaling of sales should be self financing, the plant and machinery required to generate the sales may be bank funded. It also does not penalise capital intensive industries.

The consistency of generating OCF over a business cycle reflects a company’s inherent strength and the industry’s growth potential.

The second element is size and relevance. A cut off Rs 500 million was chosen as the threshold level of PAT being reported by companies to eliminate smaller companies from the sample size. Against this backdrop, we searched for companies which generated positive OCF during the same period.

Third, sample size. Over 500 companies were part of the sample size, companies which had been part of BSE 500 since January 2003 till March 2014 and even those which exited the index during this period. Excluding banks and non-banking financial companies, or NBFCs, a total sample 466 companies were classified into four quadrants based on their consistency of generating OCF.

Fourth, for calculation of returns generated by each quadrant, the outliers – highest and lowest return generating companies, 2 in each quadrant were ignored.

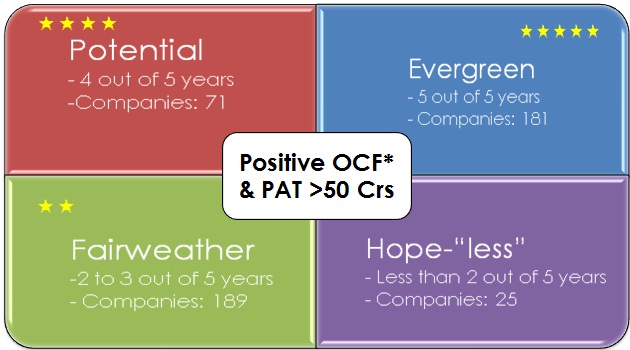

The categorisation

The 466 companies (excluding NBFCs and banks) were classified into four quadrants based on the consistency of generating positive OCF.

• Evergreen

Companies which generated positive OCF (and PAT exceeding Rs 500 million) for each of the 5 financial years ended March 2014.

• Potentials

Companies which generated OCF and PAT for 4 out of the last 5 financial years.

• Fairweathers

Companies which generated OCF 2 to 3 years out of the preceding 5 financial years.

• Hope “less”

Companies which generated positive OCF less than 2 times out of the past 5 financial years ended March 2014.

A market cap adjusted index for each quadrant was created and the performance of each quadrant was analysed across a market cycle.

The results

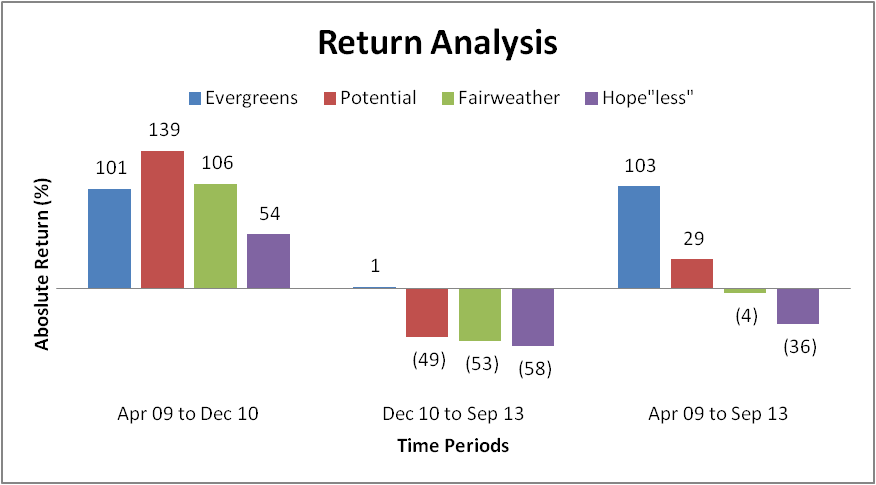

First, the slam dunk. As is well documented, after the boisterous 2003-08 bull market, post 2009 till September 2013, the tide turned in favour of companies generating consistent positive OCF (and PAT). The Evergreens and Potentials easily outpaced their peers in the Fairweather and Hope“less” quadrants. The Evergreen segment reporting a +103% return as against the Hope “Less” segment registering a negative return of 36% during the 4-year period starting April 2009.

Given the background of the global financial crisis, investors the world over re-discovered companies which were generating free cash flows and required minimal capital dilution to fund growth. The same came to the fore in India as well. Companies which were able to grow their business with minimal equity dilution and sustained cash generation were rewarded by investors. Investor preference, it seemed, had turned a full circle.

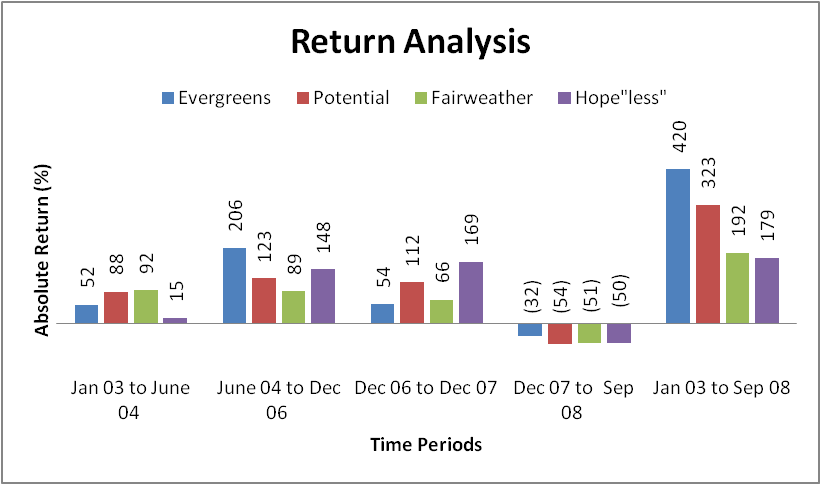

Did the same strategy give similar returns during the 2003-08 bull market? Surprisingly, the results were similar.

The Evergreen and Potential segments were able to outpace their peers in the Fairweather and Hope “less” segments during the bull market.

Though there was a period when the lower quadrant companies outperformed. Incidentally, this was the period immediately prior to the market declining! As good an indicator as one could get of the market peaking.

So what’s the verdict?

“Leopards don’t change their spots”. Similarly, mediocre companies rarely turn great, despite investors believing to the contrary! Several studies in the U.S. have revealed that companies find it more difficult to convert themselves from an also ran to an industry leader. The converse, unfortunately, is more true and something investors need to guard against.

Mediocre companies stay that way; it is only the business cycle which makes them attractive to investors. Contrary to perception, investing in companies with a consistent track record, while appearing to be a boring investment style, tends to generate the highest sustainable returns over the longer term.

Our study of the top 500 companies since 2003 clearly shows the benefit of focusing on companies with a more consistent track record rather than chasing companies with a patchy track record in the hope of an “eternal” turnaround. It is a sound strategy even in a bull market. Alas, it is more difficult to practice!

Additionally, high performing companies tend to have lower beta, as compared to their more inconsistent peers, which would make a portfolio less volatile. If the aim is to increase the beta of one’s portfolio, limit one’s adventurism to the third quadrant, i.e. companies which have reported a PAT of Rs 50 crore or more and positive OCF for at least two of the preceding five years.

Stay away from the Hope “Less” segment, these are companies which are always in a perpetual turnaround mode, especially, during every bull market. They always need to raise equity to fund that “eternal” turnaround.

Finally, prepare yourself for a full market cycle – a bull run and its ensuing fall. While investing, measure your returns over a complete cycle.

And never forget that the “paper” profits of fourth quadrant companies can easily convert to “real” losses, when the markets turn.

This column was written by Anoop Bhaskar, Head - Equities at UTI Mutual Fund for the India Markets Observer. To view the other contributors, click here.