This article has been contributed by Amay Hattangadi and Swanand Kelkar of Morgan Stanley Investment Management.

In August 2010, Eric Schmidt of Google said that “every two days now we create as much information as we did from the dawn of civilization up until 2003” and since 2010 the pace has only hastened.

To put this into a Malthusian construct, human ability to meaningfully process information is growing at a snail’s pace, if at all, and it has to contend with this steeply exponential glut of information. In today’s world, apart from a voice call, one can count at least seven other methods including Facebook walls and WhatsApp messages as communication media.

To think about it, from an era of once-a-week trunk calls or postal letters, we end up checking at least seven sources of communication every few hours for new messages.

It’s not too different in the markets; just two decades ago, each company in India produced just an annual result and there were only a handful of research houses covering a handful of stocks. While Infosys changed that in 1998 with quarterly reporting, the pendulum has now swung to the other extreme. There are 48 analysts2 on average covering each of the 50 stocks in Nifty which means that every quarterly result season a harried investment professional has to contend with 2,400 messages, just on the Nifty names.

The retail investor does not have it easy either. Seven business news channels have burgeoned in the past 15 years and with a plethora of talking heads recommending new stocks by the minute, it is humanly impossible to keep pace.

Clearly from information hoarding we have to make a diametric shift to information choosing and it’s not an easy transition. As professional investors, we have tried a few things to battle this barrage.

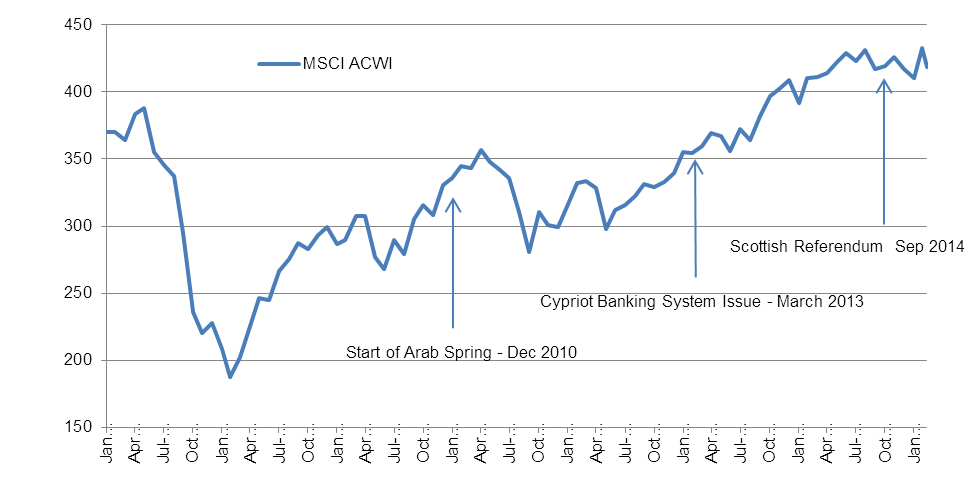

The most effective way of reducing information overload is self-analysis. Thinking back about what consumed a lot of time but eventually proved to be irrelevant, is a good starting point. In the past few years, we have spent time understanding the Scottish referendum, Cypriot banking system, the intricate details of Middle Eastern regimes and their vulnerabilities but as an investor (as opposed to a day trader) it would be difficult to pin-point these events on the stock market chart (see chart below).

Closer home, at one point we obsessed over the impact of Mobile Number Portability (MNP) on the market shares of telecom operators or on de-regulation of savings bank rates on market share of deposits for large banks - neither events produced even a blip on these metrics.

We are prone to focussing on maintenance information which is more about next few days and weeks rather than think about long term trends. In words of the legendary Barton Biggs “...I tend to set aside the reports and articles that I know I really want to read carefully, with the idea that I am going to go through all the maintenance stuff and the junk quickly and then focus on the heavyweight material.

What happens unfortunately is that the maintenance material takes longer than it should and I end up carrying around the good reports in my briefcase ... In other words, I have processed the junk and haven’t read the good reports”.

Guy Spier in his recent book The Education of a Value Investor talks about how he has split his office into a busy room with phones and computers and a library where no electronic devices are allowed. The library is meant for immersive reading or thinking. In our information gluttony we hardly spend any time assimilating thoughts and in absence of a good digestive system that converts foods into useful nutrients, information consumption is just Garbage in Garbage Out. It is in these sessions of information Sabbath that the probability of Eureka moments increases. Remember, Archimedes was not hunched over his smartphone but was taking a long soaking bath when that flash of brilliance came.

As writer Charles Assisi pointed out in a recent column, when social media is the primary source of information, there is a risk of getting into an echo chamber like environment. Algorithms highlight and push information and opinions similar to what one has consumed in the past, making all inputs monochromatic. It is essential to seek out information that is contrary to one’s beliefs which in investing terms means reading the sell reports on your largest portfolio holdings first. In the field of chess, it is now fairly well established that a combination of man and machine is superior to either of them. Use of technology can definitely improve one’s ability to sort through information.

Michael Mauboussin highlighted this in one of his recent reports that aiding one’s bottom up stock picking with quantitative screeners will likely enhance results and so will seeking out information through internet alerts or Twitter, rather than passively consuming whatever is being pushed to you. Finally, the most important skill is to let go – reconciling to the fact that there will always be many things out there that one possibly cannot know about. The insecurity that one is missing on a vital piece of information leads to mindless consumption. It’s like spotting a pasta counter tucked away in a corner at a wedding reception, after having finished dessert. Have you missed out on the best dish in the buffet? Will you grab another plate or be content with the fact that you have already had a good meal and cannot consume every offering on the menu.

While the era of information overload might be a recent phenomenon, Sherlock Holmes had nailed the issue about 125 years ago. When Watson chides him for not knowing that the earth goes around the sun, Holmes says that one’s mind is like an empty attic and one should be very careful about what one stores there. Whether the earth goes around the sun or the moon is of the least consequence to him and his work. Attaining a Holmes like Zen state of information processing is a tall ask, but that should not deter anybody from making a start.

To read other columns by the authors, click here.