Columnist Chuck Jaffe writes of the demise of the star mutual fund manager in Market Watch. About that he is correct. A quarter century ago, stock fund managers festooned the covers of national magazines, and I was a hit at cocktail parties. Those days are long gone. Now managers toil in near-obscurity, and … well, I don't actually get invited to parties, but if I did, I'd be chatting with the potted plants.

The eclipse in manager fortunes is understandable. As Jaffe writes, the top U.S. stock funds once routinely outperformed the S&P 500 each calendar year.

Most famously, Legg Mason's Bill Miller generated a 15-year string from 1991-2005. For its part, Peter Lynch's Fidelity Magellan beat the S&P 500 nine years straight from 1975 through 1983, often by huge margins. While those were the two most spectacular examples, many other funds enjoyed substantial winning streaks.

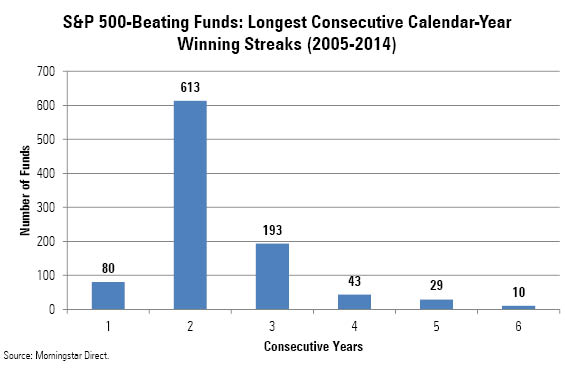

Today's picture looks very different. Morningstar's Jeff Ptak looked at the 968 U.S. stock funds (oldest share class only) that have existed during the past decade and found that none had beaten the S&P 500 for more than six straight years. Worse for the cause of active managers, four of the 10 funds that managed the feat were Nasdaq 100 index funds.

Still, that leaves six active funds with 6-year winning streaks. Initially, that seems impressive. A portfolio manager who accomplishes such a feat will have no shortage of speaking invitations, and likely also no shortage of new investors. Then again, there is the question of what monkeys could achieve if given enough darts. What winning streaks would occur through pure chance?

If you think you know that answer, you don't.

Determining the probability that a monkey will hit six straight black squares in 10 dart throws, on a board equally divided into black and white sections, is relatively trivial. Determining the probability of them doing so six consecutive times (but not more) out of 10 throws is not.

Fortunately, Morningstar's Olgay Cangur came to my rescue--thanks, Olgay!

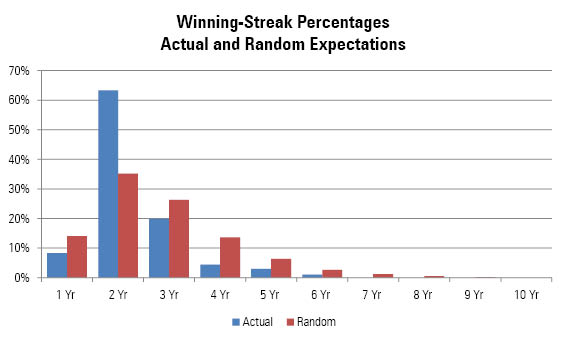

The chart below plots the actual showing of fund managers charted against the approximate expected showing (an exact closed-form solution not existing) of dart-throwing monkeys who had a 50% chance of landing in the black.

Happily for portfolio managers, they were likelier than a monkey to succeed for at least two straight years. The bad news is most humans never got past two. The monkeys had many more long streaks, outnumbering the managers at every year from three to nine, including a whopping 13.6% to 4.4% advantage for four years.

My take:

1) Very broadly speaking, the average U.S. stock mutual fund isn't better than a costless, unmanaged index.

You already knew that.

2) That managers are likelier than the monkeys to put together two straight winning years owes to the nonrandom factor of market trends.

Each dart throw is truly independent; but one year's stock market may be influenced by the recent past. To give a simple example, small-company stocks rebounded from 2008's debacle to outleg the S&P 500 in 2009 and 2010. The risk trade was on throughout the period, thereby enabling most small-company stock funds to outperform in both calendar years.

This same effect probably has hurt the active managers' abilities to post longer strings. An investment trend may occasionally persist for half a decade or more, for example with technology stocks during the past six years, but generally the waters are choppier. Two years this way, perhaps 18 months that way, and so forth.

3) Thus, looking at calendar-year winning streaks does not seem to be instructive.

Even in Bill Miller's case, where the long 15-year period covered a wide variety of market conditions (not so for Peter Lynch's nine-year skein, which rode an extended small-company bull market), the consecutive string does not seem to signify much. The fund had been fairly average before beginning its streak and was distinctly below average after finishing it. Is Miller a great portfolio manager? He was during that era, yes. But it's hard to say anything more meaningful about his abilities.

And for shorter winning stretches, such as two years vs. four years vs. six years, the results can occur entirely by accident. After all, a full 40% of the "best" fund managers by this measure aren't properly fund managers at all, but rather a team that built an index.

Here is a dramatic example of the failure of the winning-streak tally: The result for Warren Buffett. Next........