Sunil Singhania, CIO - Equity Investments at Reliance Mutual Fund shares his views on the current market scenario and what factors to keep an eye on.

Where we stand today on market specific parameters

- Turnaround in macro variables bodes well for earnings growth

Earnings growth of the Indian stock market has been extremely subdued over the last two years. However, as macro variables are all falling in place, earnings growth is set to recover in FY16. Indeed, Indian earnings are expected to grow at the fastest pace in India compared to any other large equity market. (Source: Bofa ML research)

|

Country

|

EPS growth (% yoy)

|

Growth in 2 years

|

|

2015

|

2016

|

2017

|

| India |

17.6 |

19.1 |

13.9 |

40.1 |

| Korea |

31.7 |

6.3 |

8.6 |

40 |

| Japan |

14.7 |

11.4 |

8.3 |

27.8 |

| EM |

6.2 |

12.6 |

12.9 |

19.6 |

| South Africa |

4.4 |

13.4 |

19.8 |

18.4 |

| China |

4.2 |

13.2 |

10.4 |

18 |

| Europe |

2.5 |

11.9 |

10.7 |

14.7 |

| U.S. |

1.3 |

12.8 |

12.8 |

14.3 |

| Brazil |

-16.8 |

21.7 |

22.5 |

1.3 |

| Russia |

-24.3 |

16.9 |

23.2 |

-11.5 |

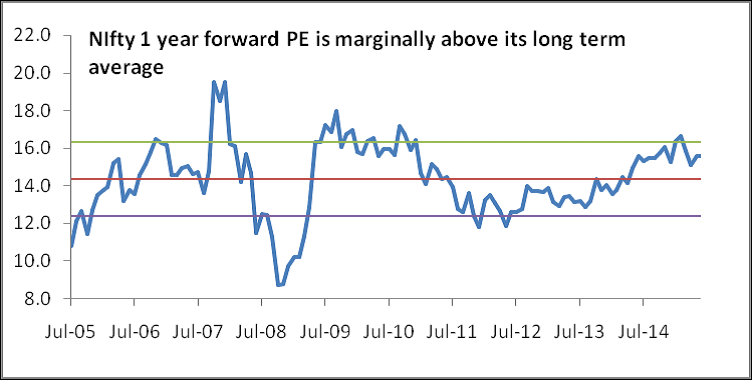

After recent reasonable consolidation, the Indian market is trading at near long-term average valuations on Forward Price to Earnings (PE) basis. Nifty index is trading at 16.3 times of FY16 earnings. India's market cap-to-GDP at 77% is much lower than its 2007 peak of 105%. The Indian equity market is relatively underpenetrated compared to market cap-to-GDP ratios in developed markets (US 140%, UK 130%, Japan 105%).

Source: Bloomberg

- Early signs of shift in domestic investors' preference towards equities

Despite the run-up in the last 15 months, domestic ownership of Indian equities remains near record low levels. Prior to 2014, domestic household investors withdrew from equities for 6 years. There are multitudes of factors responsible for this apathy of local investors towards equities. Not only was overall gross savings coming down in last 8 years but also share of financial savings as a percentage of total gross savings came down significantly. Within financial savings, equity assets as a percentage of total financial assets have fallen to 3.8% (compared to 6% in 2007). This was largely driven by savings flowing into alternative asset classes like gold and real estate.

- Alternative assets turning less attractive

Gold and real estate have yielded muted returns in the last two years and are turning less attractive due to increased regulations. Equities, on the other hand, have outperformed significantly. In fact, there are early signs of domestic investors favoring equities over other assets. Mutual Funds saw highest ever annual inflows in FY15 of Rs 68,000 crore compared to net outflows in the previous 6 years (Source: Bloomberg). History suggests that investors preference towards an asset class lasts many years. We may well be at the beginning of this lasting shift in investors preference towards financial assets in general and equities in particular. Given the pent up demand for equities and rising attractiveness from absolute and relative standpoint, domestic flows could rise substantially in the next 3-5 years.

Overall, in a world where growth is scarce, deflationary concerns abound and interest rates are trending upwards, India provides a rare favorable blend of high and rising growth, supportive inflation and downward interest rate trajectory.

Factors that could aid the market over the next 12 months

If any of the below materialise, it could be significantly positive for the market in the coming quarters.

• Long pending reforms get implemented - GST and land acquisition bills get cleared and implemented in the coming year.

• Financial conditions ease materially - Policy rates are cut much more than expected by the market and domestic liquidity conditions become benign

• External environment both from demand perspective and capital flows perspective turns supportive.

Factors that could aid the market beyond the next 12 months

The government has undertaken a series of reform steps that are good in the medium term while they may not yield immediate results. The government is clearly working with medium term objectives of removing bottlenecks and increasing transparency and efficiency. We envisage a situation where lot of these reforms would start yielding results thereby taking India to a higher growth orbit.

Few of these policy actions which may have positive impact in the next 1-3 years are as follows:

• Full benefit of interest rate easing will start to positively impact overall demand as well as corporate profitability.

• Benefit of above cited supply side reforms start to yield returns. Full benefit of DBT, spread of DBT to cover fertilizer and food subsidies, GST and new age Indian infrastructure projects can simultaneously result in higher potential growth.

• Realised benefits of soft reforms in critical areas of governance and ease of doing business.

In every growth story, there will always be short-term challenges. Our advice is to look at the big picture. Keeping an eye on the near-term events but please don’t get carried away by them. As I tweeted a few days back, "India’s GDP at $4 trillion in a few years is all that matters to long-term investors”. For others there is monsoon, Greece, interest rates, etc to worry about".

Keep the faith!