A few years ago, the market regulator, the Securities and Exchange Board of India, or SEBI, sought to address the problem of mis-selling by distributors who would push schemes that earned them high commissions. The investor would blindly go in for it only to realise later that the fund did not suit his/her risk profile.

To give the investor an idea as to the risk associated with a particular fund, SEBI introduced colour coding two years ago.

By ensuring that every fund needed to identify itself with a colour code, it made is relatively easy for an investor to understand the risk associated with that fund.

Here is what each colour indicates:

- Blue: Low risk. Debt-oriented schemes would earn a blue label.

- Yellow: Moderate risk. Schemes that are a blend between equity and debt could be categorised here.

- Brown: High risk. This would be the pure equity offerings.

However, just having three categories is restrictive and does not convey the message entirely. For instance a dynamic bond fund would not have the same level of risk to principal that a liquid fund would. Nevertheless, the asset management companies were forced to give all such schemes a blue colour code. Similarly, a large-cap diversified equity fund that invests only in blue chips would be less risky than an micro-cap fund. But that would not be conveyed clearly to the investor since both are equity funds and both are entitled to a brown colour code.

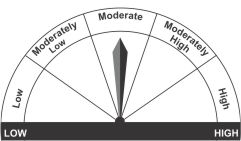

This prompted SEBI to go one step ahead. From July 1, 2015, colour coding will no longer be employed to indicate the risk levels. The ‘riskometer’ takes over. The risk level of a scheme will be displayed through a speedometer-like mechanism which is seen below.

The ‘riskometer’ is more detailed in the sense of categorising funds under one of the five levels, as three levels can be quite restrictive. Moreover, being a pictorial meter, it does convey a clearer understanding of risk. Unlike the colour which symbolically depicted the level of risk, here the risk level is categorically stated.

As can be seen, the five risk levels would be low, moderately low, moderate, moderately high and high.

Low: Principal is at low risk

Moderately low: Principal at moderately low risk

Moderate: Principal at moderate risk

Moderately high: Principal at moderately high risk

High: Principal at high risk

So an example of 'low' would be a liquid fund. On the other hand, an example of 'high' would be a sector fund or a mid- and small-cap fund.