According to Tim Strauts, markets research manager at Morningstar, starting withdrawals as a bear market hits can seriously impair the sustainability of a retirement portfolio over time.

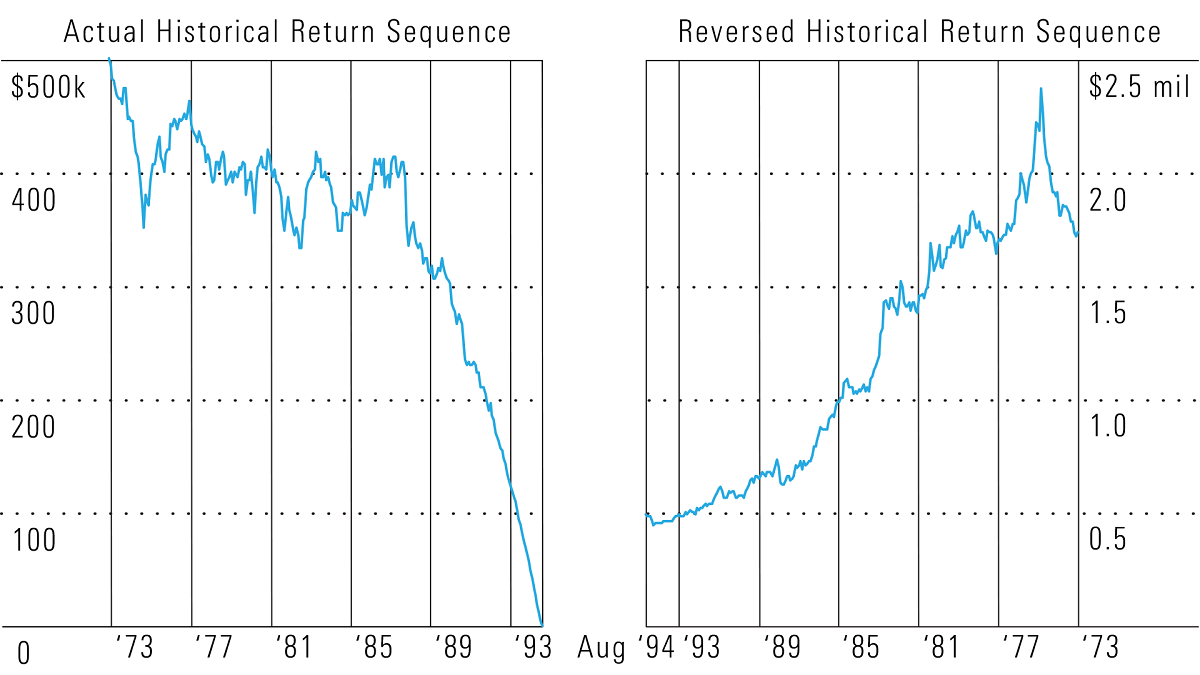

The point in time that a person chooses to retire will affect the ability of his portfolio to last throughout retirement. The chart below demonstrates this by showing how the sequence of market returns affects how much a portfolio can grow while sustaining needed withdrawals in retirement.

Both images look at a hypothetical 50% stock/50% bond portfolio with an initial value of $500,000 and assume a withdrawal rate of 5% annually, adjusted for inflation.

The image on the left assumes a person retired on January 1, 1973--right before a bear market--and began making monthly withdrawals. The result was that the portfolio ran out of money by August 1994.

The image on the right illustrates a hypothetical case where the historical returns occurred in reverse chronological order: The returns from 1994 occurred before the returns from 1993, with the returns from 1973 occurring last. By reversing the sequence of returns, the portfolio experienced high returns in the early years and low returns in the later years. As a result, the portfolio increased substantially over time--more than tripling in value--despite the ongoing 5% withdrawals.

To watch this on video, click here.

This hypothetical example highlights that in the early years of retirement, a portfolio being eroded simultaneously by a bear market and withdrawals may not be able to rebuild wealth, even if good returns are experienced in later years. This is relevant because people who retired right before or during the financial crisis experienced large declines in portfolio values early in retirement. Unfortunately, no one can predict what the market might do in the critical early years of their retirement. This is why it is particularly important to manage this risk through effective asset allocation and potentially reducing withdrawal rates if returns are poor in the first few years.