To most people, risk evokes scenarios of investing in micro cap stocks or commodity funds. But in reality risk comes in various forms. And this in turn affects your portfolio's performance. You cannot manage the risk in your portfolio if you have no idea how to recognise it.

Here are three basic risks that affect an equity and debt investor.

Inflation risk

One of the big risks for investors in fixed-income securities is that their investments may not earn enough to keep up with inflation. To help mitigate the risk that inflation introduces to a portfolio, you need to be on the offensive. Even modest inflation can erode your savings. How you position your portfolio to fight inflation is critical.

If you money languishes in a savings bank account, you are already on the losing end. Even if you put it in a fixed deposit, post tax the returns need to be higher than inflation.

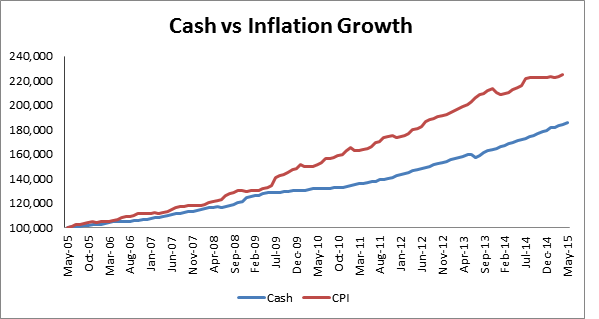

The graph below clearly shows how inflation has moved upwards over a decade. The movement of the Consumer Price Index (CPI), which measures inflation, and the return on cash, as measured by the return on a 364-day Treasury Bill (T-bill), proves the point.

It is for this reason that every investor must have some equity exposure in their portfolio. Over time, it is equity that helps create wealth.

Valuation risk

According to Morningstar Investment Management's Chris Galloway, the key investment risk faced by equity investors is the risk that you overpay for an asset.

The best time to be buying is when prices are cheap relative to the underlying value of the company. Unfortunately that is the time when investors shirk stocks and flock to them when the market is on a roll.

According to Galloway, the key thing for investors is recognising periods where assets are rather undervalued and seeking opportunistically to take advantage of those.

In times when valuations are stretched, it pays to be patient.

This point has been tackled in much more detail in Make your portfolio safer with risky investments.

Galloway believes that capital preservation is the key to building wealth. He also believes that permanent losses are driven not only by valuation (overpaying for an asset) but also fundamentals (deterioration in asset quality or cash flow). The key to managing valuation and fundamental risk is to avoid overvalued assets and diversify across investments whose cash flows are driven by different factors.

Interest rate risk

Interest-rate risk is the risk taken by fixed income investors that interest rates will rise after they buy the bond or invest in a fixed deposit. Stated another way, it is the risk that a bond's yield will rise (as its price falls) after it has been purchased.

Rising rates are bad for people with debt but a lifesaver for fixed income investors whose investments are tied to interest rates. If interest rates are slated to fall, then it would be wise to lock the fixed income allocation of your portfolio in long-term debt funds or fixed deposits. If interest rates are slated to rise, then it would not be wise to lock in your money at lower rates.

However, that is not the case currently in India.

The industry, on the one hand, is clamoring for lower policy rates and its equivalent transmission by banks in the form of lower lending rates. Inflation, on the other, is spoiling the party.

As long as the monsoon plays truant, it is going to impact inflation. If inflation is not brought to heel, the RBI governor will go slow on lowering rates.

India's consumer-inflation rate rose more than expected in June as food prices increased, weakening the case for further interest-rate cuts by the central bank.

The consumer-inflation rate climbed to 5.40% in June from a year earlier, compared with 5.01% a month earlier. According to Bloomberg, most economists have ditched calls for a fourth cut in 2015.