This article has been written by Suvishesh Valsan, AVP – Research & Real Estate Intelligence Service, JLL India.

Sales of residential units declined significantly over the last two years, particularly in the initial periods.

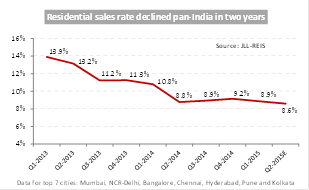

The number of units that are sold from both new and old projects every quarter form the sales rate, and from 14% in 1Q13 this has steadily declined to below 9% as of mid-2015, thereafter remaining stable at low levels.

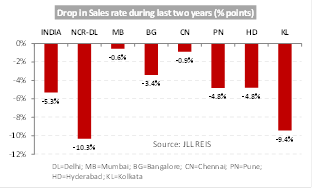

This trend has been witnessed across the seven leading metros, and the situation is particularly grim in markets such as Delhi-NCR, where the sales rate has declined by 10%.

Despite a big fall in Pune, Hyderabad and Kolkata, the sales rates of these cities still remain in double-digits at 12-13%. Mumbai’s fall was moderate, owing to low sales rate throughout the said period.

Typically, there are five broad factors that influence real estate markets. These include the country’s GDP and employment scene, credit availability, interest rates, housing supply dynamics and consumer confidence.

A look at each of these factors reveals that the formula for revival could lie within the reach of builders and policymakers.

1) GDP and employment scene

In contrast to the housing sales rate, India’s GDP has been rising consistently over the last two years from 6.9% y-o-y growth in fiscal year 2013-14 to 7.3% in 2014-15, and is expected to be over 7.5% in 2015-16. Also, the monthly reports of leading recruitment firms in India suggest that hiring activity has picked up pace, particularly in the last year.

2) Credit availability

RBI data on the growth in home loans as well as the growth in credit to the construction sector (including loans to public housing agencies) reveals healthy credit offtake. Home loans have grown at a 17% y-o-y average over the last two years (until May 2015) whereas bank credit given to the construction sector grew at 22% y-o-y - one of the highest levels of all sectors.

3) Interest rates

CPI inflation has declined sharply by around 3% in the last two years and it now stands at 5% (as of May 2015), which is well within the comfort zone defined by the Reserve Bank. Consequently, the RBI has responded with three rate cuts (totalling 75 basis points) since the start of 2015, with a possibility of more rate cuts in the near-term.

4) Housing supply

Developers have consistently launched close to 60,000 units every quarter since 1Q13 despite the slowing demand. As a result, developers’ unsold stock has mounted, particularly in NCR-Delhi, Mumbai and Chennai.

5) Consumer confidence

With above factors portraying a positive picture for the economy, the influence on consumer confidence is positive. This is also borne out by various market reports. However, the rising consumer confidence has not translated into higher demand for apartments.

More recently, developers have responded with controlled launches to counter low sales, although this should have been done earlier if market signals had been taken seriously. However, consumer confidence in real estate must rise meaningfully in order to reverse the dwindling sales rate. For that, developers must exhibit construction progress in order to avoid fear of delays in completion. Given that 27% of units are selling near completion, this fear could be legitimate. Passing into law of the Real Estate (Regulatory) and the Land Acquisition Bills have the potential to increase market transparency and improve consumer confidence.