This article has been written by Paul Resnik, co-founder at FinaMetrica, and Gerda van der Linde, official representative of FinaMetrica in South Africa. FinaMetrica provides best-practice psychometric risk tolerance testing tools and investment suitability methodologies to financial advisers in 23 countries.

Risk tolerance is an individual’s general willingness to take risk in managing their financial affairs. It reflects the balance between having too much risk and too little.

An investor would not want to be overexposed to risk, thereby putting his or her financial wellbeing in danger. Nor would a person want to be underexposed to risk and miss out on financial opportunities. So risk tolerance is relevant to how people manage their financial affairs and, in particular, how well they sit with the riskiness of their investments.

There are many myths about risk tolerance, what it is, how it can be measured and applied in the financial planning process. Risk tolerance is commonly confused with other risk attributes such as risk behaviour or risk capacity. FinaMetrica has examined 10 common myths, tackles the assumptions behind them and explains the reality.

Myth 1: People’s risk tolerance is variable. When market are rising, there risk tolerance is relatively high but their tolerance falls when market crash.

The Reality

Risk tolerance is typically set by early adulthood and it decreases only slightly with age. Clients’ risk tolerance scores generally remain stable through the gyrations of the markets, though a major life event such as marriage or having children can change risk tolerance.

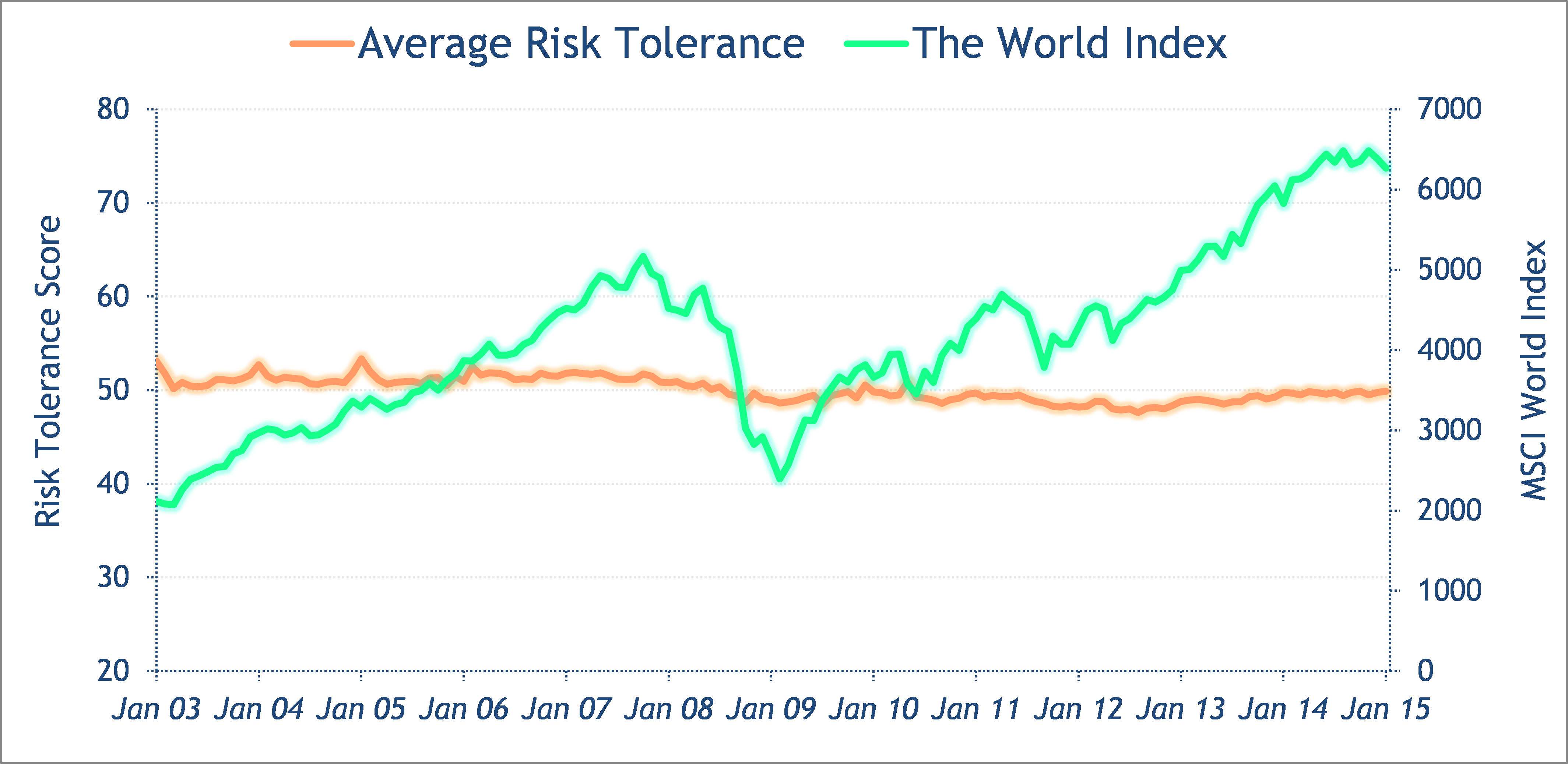

Notice from the chart below how little FinaMetrica risk tolerance scores changed through the market crash of 2007-08. What changes as markets swing is more often investors’ risk behaviour driven by their perceptions of risk, not their risk tolerance.

Our test scores on a 0 to 100 scale - mean 50 and standard deviation 10, and approximately 800,000 tests have been completed to date. We have periodically published monthly average risk tolerance scores which are, in effect, new samples from the same population. Average monthly scores from 1999 to 2015 are shown below.

FinaMetrica’s white paper, On the Stability of Risk Tolerance, reports six studies across 10 years which confirm the stability of risk tolerance. In particular, two of the test/retest studies show risk tolerance as being stable across the market turmoil of 2007-09.

Myth 2: A person’s appetite for risk is the same across all aspects of their life.

The Reality

Just because a person likes to take physical risks, it doesn’t mean they like financial risks or other sorts of risks. One’s appetite for risk on one area of life doesn’t necessarily transfer to other areas. Jackson, Hourany and Vidmar (1992) propose, for instance, that risk tolerance has four levels: financial, physical, social and ethical. While there is some evidence of generalised risk taking, there is stronger evidence of consistency within, but not between the different facets.

So someone who, for example, never buys shares and sticks to cash investment may be an avid paraglider. Or a chronic gambler may tremble at the thought of mountain climbing or have their life insured.

Myth 3: Risk tolerance will determine asset allocation within an investor’s portfolio.

The Reality

A risk tolerance assessment should tell the adviser the risk an individual is prepared to take in their financial affairs. But it is the risk profiling process that provides a proven methodology to ensure the suitability of investment advice.

Historically and even currently, many financial services companies and financial advisErs have mistaken asset allocation calculator questionnaires for risk tolerance tests. The ambiguity of these tests has led to confusion regarding clients’ risk tolerance. This is because questions relating to risk capacity, time horizon and financial situation form part of a questionnaire that suggests that “we propose asset allocations based on your stated investment objectives and experience, time horizon, risk tolerance and financial situation.”

FinaMetrica’s white paper, Risk Profiling: Art and Science, explains the risk profiling process in detail and the need to scientifically and individually assess risk tolerance in that process.

Risk profiling involves finding the optimal level of investment risk for a particular person. The following factors need to be assessed when conducting a risk profile. Risk required is the risk associated with the return needed to achieve goals. Risk capacity is the level of financial risk the client can afford to take and risk tolerance is the level of risk which the client would prefer to take. Risk profiling requires each of these characteristics to be assessed and compared to one another.

Often a mismatch exists between risk required, risk tolerance and risk capacity. Trade-offs then become necessary to solve these mismatches and give suitable financial advice to an individual.

The final step in the risk profiling process is to ensure that the client has realistic risk and return expectations so they can give their properly informed consent to and to implement an investment strategy on their behalf. The client must make their own decisions according to their own values and financial situation. So risk tolerance alone would never determine and asset allocation, understanding it is essential for both the investor and the adviser.

Myth 4: Risk tolerance testing is subjective and involves test providers applying their own judgements to measurements made.

The Reality

While some risk tolerance tests are subjective, this is not the case if the test is psychometric. Over the past 50 years, the discipline of psychometrics has been developed by psychologists and statisticians to measure psychological traits such as risk tolerance and intelligence.

Psychometrics provides a well-established scientific discipline for assessing risk tolerance through questionnaires and the application of internationally accepted psychometric standards. Such tests, as long as they are reliable and valid, provide objective measures of risk tolerance. Valid means the questionnaire measures what it purports to and reliable means that it does so consistently with known accuracy.

Both versions of FinaMetrica risk tolerance test exceed international psychometric standards with, respectively, reliabilities of .90 (25-Question) and .84 (12-Question) and 95% confidence levels of ±8 and ±10.

As mentioned many risk tolerance tests in the market don’t just assess risk tolerance, they often include questions relating to other matters including risk perception and risk capacity. These tests are flawed as they are likely to give inaccurate readings of risk tolerance given they ask about irrelevant factors, see Myth 6 for more details. Myth 5: Financial advisers can accurately estimate their clients’ risk tolerance.

The Reality

Independent studies show that advisers’ assessments of their clients’ risk tolerance are highly inaccurate. Strong evidence exists of gender stereotyping – advisers often overestimate the risk tolerance of male clients and underestimate the risk tolerance of female clients. Advisers in general also assign too much diagnostic value to other demographic variables such as income, wealth, cultural differences and marital status.

Adding in the fact that advisers are significantly more risk tolerant than their clients only increases the likelihood of their client’s over-exposure to risk.

Studies show that advisers' estimates of their clients’ risk tolerance correlate at about .4, which means that there are gross errors, two or more standard deviations, in one in six cases. Put another way, advisers would be more accurate if they made no attempt to assess clients' risk tolerance and simply assumed everyone was average. This illustrates the need for objective, psychometric testing of risk tolerance.

Myth 6: Risk tolerance and risk capacity can be assessed together in the planning process.

The Reality

Too often, advisers fail to separate out risk factors, that is, their client’s tolerance for risk, their risk capacity or capacity for loss and how much risk they need to achieve their goals (risk required). It is crucial to separate out these risk factors so that portfolio recommendations can properly align all three during the risk profiling process.

As the expert financial planning commentator Michael Kitces says in his blog, “Separating risk-tolerance from risk capacity just because you can afford to take risk doesn’t mean you should,” each risk factor needs to be assessed and considered separately.

Risk capacity questions such as “How much could your investment go down by without it significantly affecting your financial well-being?” should be assessed separately to risk tolerance. Risk capacity, like risk required, is a financial trait, different from risk tolerance, which is a psychological trait. Different factors impact on each and they therefore need to be assessed separately.

As Michael Kitces writes: “The financial questions - which might related to their need to tap the assets for income/withdrawals, the time horizon of the goal, and the availability of other assets - speak to the person's risk capacity” not their risk tolerance.

“Once separating out the purely financial matters, true risk tolerance becomes purely focused on a client's actual attitudes about risk. In other words, does the client actually have the mental inclination and desire to pursue a more favourable outcome at the risk of a less favourable result. Notably, these mental attitudes about risk have nothing to do with the ability to afford the risk - it's simply about the desire to pursue actions or goals that entail risky trade-offs (or not).”

Myth 7: A related myth is that questions on the time horizon of the investment, investor’s age and when the investor will retire are relevant to determine an investor’s risk tolerance.

The Reality

There’s no doubt that having an understanding of your client’s investment knowledge and experience is an important aspect of knowing your client. While this understanding may influence the final advice given, investment knowledge and experience are separate factors to a person’s risk tolerance.

Questions referring to past investment behaviour, experience, financial knowledge or time horizon, for example, are commonly mistakenly included in risk tolerance tests. However, including such questions in a risk tolerance test would distort its measure. Although time horizon, for example, might be relevant to the measurement of risk capacity or risk required, it is not relevant to risk tolerance, which is an enduring psychological trait.

Myth 8: Risk tolerance is the primary, if not sole, driver of risk behaviour.

The Reality

Many different factors influence an investor’s behaviour such as their risk tolerance, their financial goals and their perceptions of likely outcomes. Risk behaviour can change significantly with market cycles.

When investment markets are booming, for example, people tend to under-estimate the level of financial risk or perceive risk to be low. In contrast, in bottoming markets, risk perception is typically at its highest and some investors, out of fear of losses, sell their shares in favour of cash, as many investors did during the Global Financial Crisis. So, what changes here with the market cycle is a person’s perception of risk, which drives a change in behaviour, rather than their risk tolerance.

Many advisers think risk tolerance changes with major events such as a share market correction (Myth 1). But it doesn’t. Typically it is an investor’s risk perception that changes, driving a change in their risk taking behaviour if share prices suddenly drop.

Myth 9: It’s OK to ask couples to complete a risk questionnaire jointly, rather than each doing their own.

The Reality

When it comes to investing, women are generally less tolerant of financial risk than men. According FinaMetrica data, in 67% of U.S. couples, men have a higher tolerance for financial risk than their female partners. Where there is a material difference in their risk tolerance levels, in 83% of cases it is the man who is the risk taker.

This is slightly higher than risk tolerance levels reporter for male partners in the UK where, according to FinaMetrica data, in 64% of UK couples men have a higher tolerance for financial risk than their female partners. Where there is a material difference in their risk tolerance levels, in 87% of cases it is the man who is the risk taker.

In Australia, in 65% of Australian couples, men have a higher tolerance for financial risk than their female partners. Where there is a material difference in their risk tolerance levels, in 82% of cases it is the man who is the risk taker.

The main point is that financial advisers must not ignore the needs of the less risk-tolerant partner, who is in most instances the woman. Financial advisers often skip the process of separately assessing a couple’s risk tolerance and apply the male’s risk tolerance in determining a financial plan or superimpose their own preferences on the couple, which is dangerous and unethical practice.

Myth 10: As long as I’m using a risk tolerance questionnaire, I’ll be OK. I’m doing my duty and meeting compliance.

The Reality

Advisers are responsible for the processes and tools used in formulating advice. This responsibility cannot be delegated to a third party. Advisers must satisfy themselves that, at a minimum, any tool used is both fit for purpose and true to label.

The Financial Conduct Authority (UK), for example, makes advisers responsible for evaluating the tools that they use. Advisers must therefore conduct due diligence on any test they use to endure that it is accurate and reliable. FinaMetrica has developed a detailed due diligence questionnaire which can help advisers conduct due diligence process and choose a risk tolerance test.