While much of the street is divided in its view on whether payment banks will complement the existing banking infrastructure or disrupt it, we are of the opinion that payment banks will complement full-service banks.

In fact, any payment bank will be devoid of the two most important benefits of running a banking franchise: (1) Low cost of funds through large sticky customer deposits; (2) the ability to lend money at a rate commensurate with the risk taken.

As a payment bank, the entity will be limited by the amount of Rs 100,000 ($1,500) per customer that it can accept and no more. To attract these deposits, they may in fact have to pay some interest to the customers, to compete effectively with the low-interest paid for current account and savings account (CASA) deposits at traditional banks.

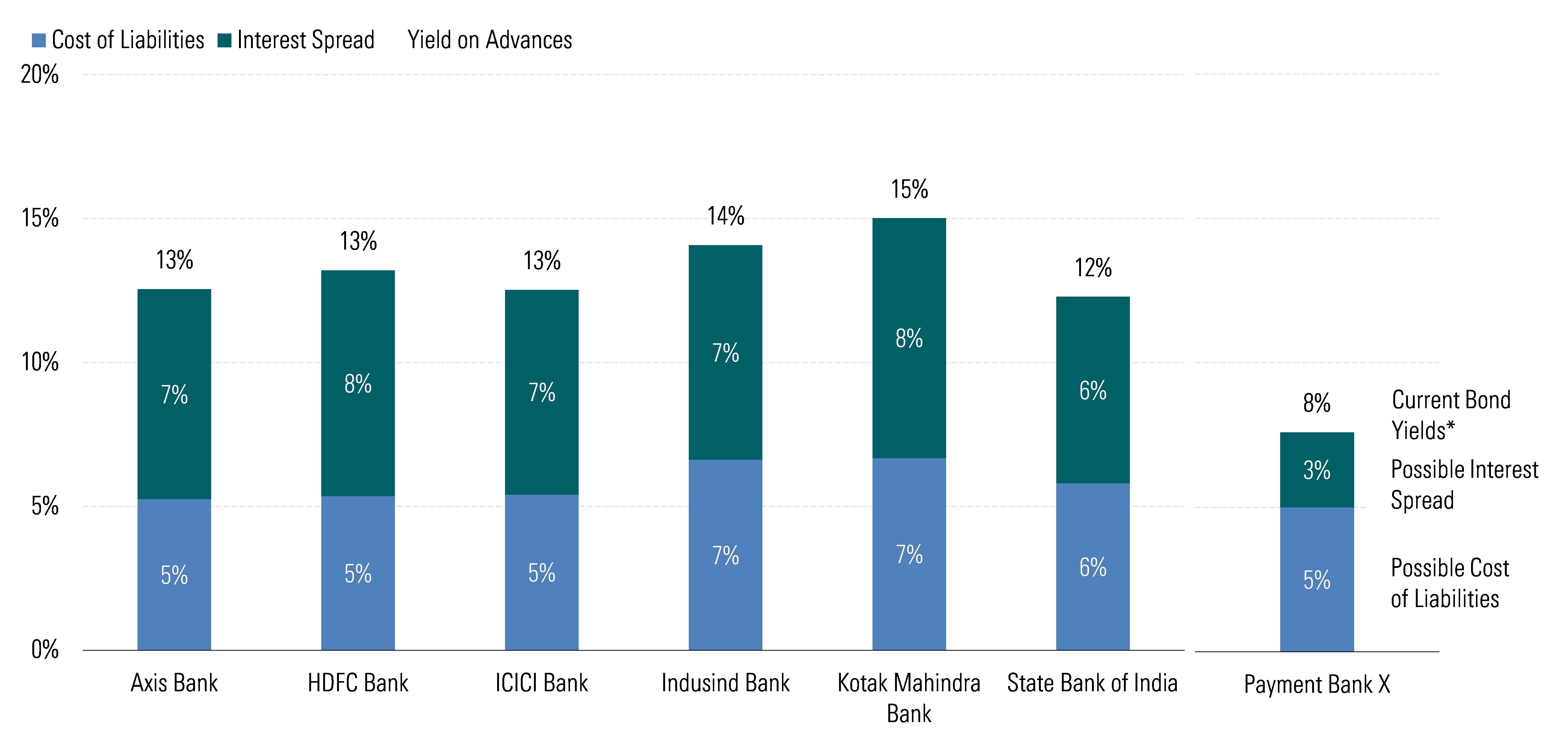

Furthermore, the entity cannot lend money and is only allowed to invest its excess cash (after meeting cash reserve ratio and liquidity ratio requirements) in government bonds and inter-bank money market, both of which offer lower rates of return than what banks make as yields on advances. The cost-advantage source of moat is evident across our India coverage list as each narrow-moat rated bank makes a spread of 6%-to-8% above its cost of funds.

We believe, given the above two constraints, the spreads for a payment bank will be a lot thinner. The business model will then be mainly volume driven on a thin margin, and also based on fee generated from additional services sold for the bank to its customers via a lead-generation model.

Profits earned by a payment bank, will depend on the interest they have to offer to customers and the fee per transaction or lead generated.

We have estimated the interest spread for a payment bank by taking the current yield on 10-year government treasury bonds and the lowest offered cost of liabilities in the market. The payment bank could potentially have to offer higher interest rates on deposits to attract deposit balances. Even if they offer the same rates as traditional banks as we have assumed in our bar chart below, the spreads earned look much thinner than traditional banks further supporting our thesis. The lower spreads, or revenue, will also have to support operating expense s for the payment bank.

ANNUAL INTEREST SPREAD EARNED BY EACH BANK (March 30, 2015)

Undervalued banks: ICICI Bank and State Bank of India

- Both State Bank of India (SBI) and ICICI Bank are trading in a four-star range, at a 28% and 20% discount to our fair value, respectively, as the market remains concerned about the asset quality of the bank's books. . ICICI trades at price-to-estimated 2017 book value of 1.4 times, versus our Rs 327 per share fair value of 1.8 times. SBI trades at price-to-estimated 2016 book value of 0.9 times, versus our Rs 334 per share fair value of 1.3 times.

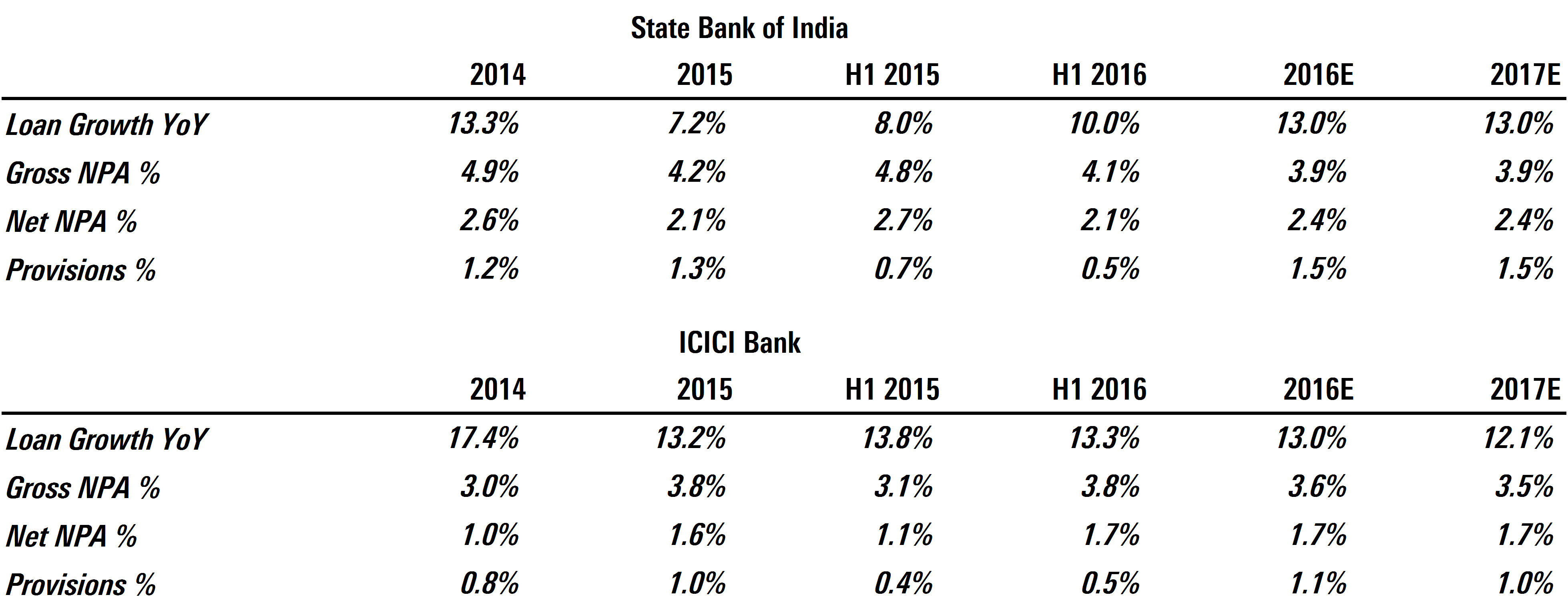

- Both lenders have taken large write-offs and impairments for loans in the power, infrastructure and steel sectors in the last few quarters as the macro-economic issues surrounding these sectors remain unresolved. Taking these write-offs into account however, we believe the gross non-performing loans as a proportion of total loans and provisions-to-loans will not be very different from historic averages and are already built into our forecast and fair value estimate for these two banks (as the exhibit shows). Furthermore, we remain confident that as these issues get resolved and when credit growth picks up as the economy recovers--both banks should realize the benefits of operating leverage through their large corporate loan book. As back-end processing costs for large transactions gradually come down the benefits of digital payments should be felt here, possibly a bit more than the retail banks where volume of transactions are likely to remain high despite per transaction costs going down.

ASSET QUALITY METRICS

Morningstar’s research may also be accessed via Bloomberg, Thomson Reuters, FactSet, Capital IQ, Markit Hub and our institutional website http://select.morningstar.com/