This article was written by Florian Ielpo, head of macroeconomic research at

Unigestion, for the Morningstar UK website where it initially appeared.

During the first days of 2016, stock markets took a plunge. Since December 31, 2015, both the MSCI ACWI index and the S&P 500 had lost 6% at the time this note was going to press. The Sensex lost around 5% from its closing on December 31 to its closing yesterday.

Is this a sign of things to come?

The sequence of these market drops looks a lot like the price action of the markets in the second half of August 2015. The similarity extends to the People’s Bank of China’s (PBoC) renewed devaluation of the Chinese currency and to a further drop of the value of oil, which is already very low.

Let’s not jump to conclusions. After the summer, the markets recovered sharply during October as the alleged rumour of an emerging country-led recession was wiped out by three months of consistently positive economic figures.

While one week of market activity does not enable one to draw any form of accurate conclusions for the full year ahead, we believe that what has happened since beginning of the year highlights interesting patterns worth analysing and keeping note of.

The world is currently facing three issues:

1) The PBoC’s decision could be taken as a sign that China is doing worse than expected;

2) Manufacturing numbers in the U.S. are far from good;

3) Oil prices nearing $30 per barrel is a real issue for investment and growth in the Americas.

While we think these three elements remain risks to be monitored, we believe they are not part of the core scenario for this year. That being said, macroeconomic risk has increased and, until the situation in the commodity markets and in China stabilises, this has implications for investors.

China needs more devaluation

Over two of the first days of 2016, the Renminbi lost value versus the USD, moving from 6.49 to 6.56. This 1% variation in the currency rate reignited investors’ fears with regards to the ‘not-so-transparent’ Chinese economy.

We think that those fears are legitimate because the Chinese economy is difficult to read and it is partially geared by its government. China, however, shows limited signs of heading towards a recession for a couple of reasons.

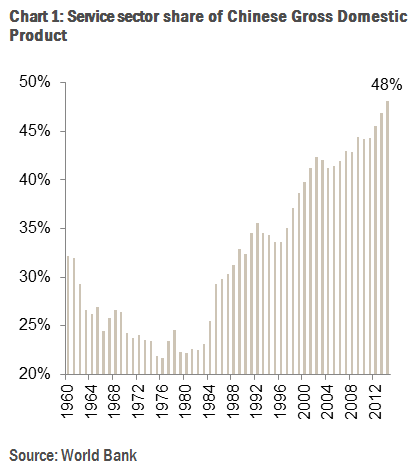

First, the service sector in China has been growing a lot over the past 30 years. This number has now this number has almost reached 50%. If this sector grows at around 6% per year, with a 0% growth in its industrial activities, China should still be growing by 3% per year. Not quite a recession, is it?

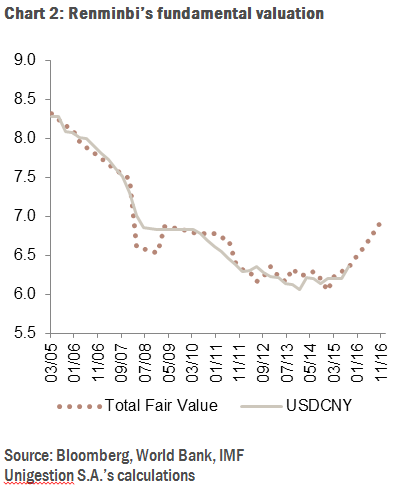

Next, let us look at the currency. Investors’ uneasiness with respect to the repeated devaluation of the Renminbi operated by the PBoC is perfectly understandable. Still, these devaluations make a lot of sense. Pegged to the USD, the exchange rate of the Chinese currency has been growing alongside the USD during 2014 and 2015, especially versus various emerging currencies. During this process, China lost a lot of its price competitiveness. The currency needs to be weakened so that the country stands a chance to compete against the rest of Asia. What makes the valuation of a currency is usually a mix between the net international investment position of the country and its relative inflation. Other factors can enter the equation, but in the case of China those two are particularly relevant. The current fair value is not as far away from the current market quotes and 6.5 versus the USD seems reasonable.

Now, incorporating the IMF’s inflation projections and a continuation of the lesser attractiveness of China for Foreign Direct Investments, this fundamental currency value could become seven by the end of the year.

Our view on this is that the devaluation of the Renminbi is a sign that Chinese authorities are taking their currency handicap seriously. Of course, China is not doing well, but this is no surprise. A worst situation could be one like Brazil, where everyone sees the issue and no one does anything about it. A Renminbi trading at seven, which is 12% devaluation in total, would be a partial compensation for the 20% increase in the US Dollar’s value over the past 24 months. It makes a lot of sense and we believe it is more likely to improve the Chinese situation than to deteriorate it.

U.S. Industry: Not so well but not that bad either

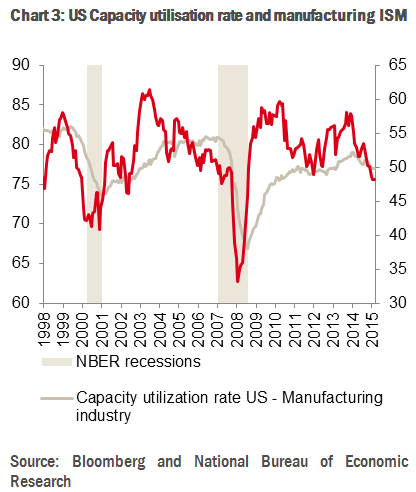

On January 4, the U.S. manufacturing ISM, a broadly followed survey tracking the mood in the U.S. industry, came out below 50 for the second month in a row. Below 50 is the level at which the indicator starts signalling that a recession is brewing.

The truth is that different industry-related indicators are saying the same thing: the activity in this sector is losing ground. The oil price levels and the massive loss of U.S. competitiveness rising from the USD’s appreciation have a lot to do with this situation.

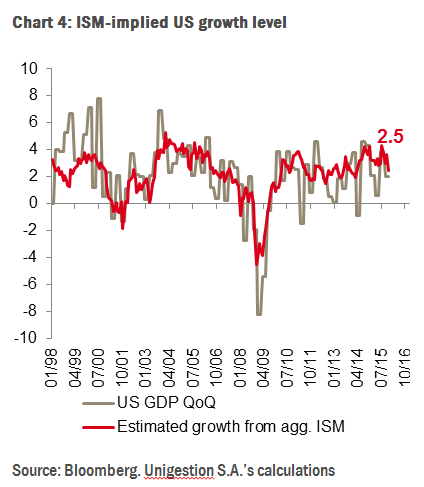

The above chart illustrates this evolution and gives some historical perspective to it. First, the situation is not problematic yet.

Historical experience suggests that the ISM can drop down to 46, as it did in 2002, without an actual U.S. recession.

Second, today, the service share to the US GDP is roughly 80%. The service sector has been doing very well recently as indicated by the ‘service’ ISM reaching 60 in July 2015, and currently at 55. This sector also exhibits a much lower variability than the manufacturing one.

We can examine what happens when combining both the manufacturing and the service ISM into a GDP growth figure. Based on today’s numbers, growth should be around 2.5%, which is the U.S. potential growth level according to our estimates and matches the economists’ consensus regarding the 2016 growth. From that angle, we need a further deterioration to be really nervous about the U.S. situation.