With Reliance Vision, one can’t help but get nostalgic about its past. This fund has been around for a long time – over 20 years. Down the road, Reliance Natural Resources Fund was merged into this fund.

The fund house started with the launch of two equity funds–Reliance Vision and Reliance Growth. The performance of these funds made the fund house a hit and the AMC leveraged it along with the Reliance brand to gain investors’ attention.

The fund manager’s approach in Reliance Vision always tilted towards the aggressive. He capitalized on momentum in the mid- and small-cap space when the need arose, had no qualms about churning the portfolio frequently and never shied away from taking short-term opportunistic calls, and towards that end tended to maintain a high cash strategy (which is no longer the case). The portfolio tended to always be tight, and the latest one has just 32 stocks with the top 10 holdings cornering 58% of the portfolio.

Investors comfortable with this investing style were well rewarded. A return of 74.58% in 2002 and 155% in 2003 saw investors flock to the fund on the back of this performance. They would have been a disappointed lot when the fund underperformed rather dramatically in 2004 with a return of 19.81% (category average: 30.18%). But it bounced back in 2005 with 53.47% (category average: 46.58%)

As the fund’s assets swelled, performance stabilised. It outperformed but not glamorously.

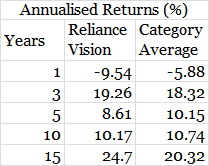

Unfortunately, over the past decade, the fund underperformed the category average every year, barring three (2006, 2008, 2014).

(Check the performance data here).

Nevertheless, Morningstar’s analyst believes the fund remains a viable proposition for patient investors who can digest volatility and are comfortable with a sector heavy portfolio where a major portion of the assets under management are invested in three to four meaningful sectors. You can read the latest analysis here.

- Category: Flexicap

- Star Rating: 3 stars

- Analyst Rating: Bronze

- Fund Manager: Ashwani Kumar

- Expense Ratio: 2.27%

- Launch of fund: 1995

The fund has been assigned a ‘Bronze’ rating. A Bronze-rated fund has advantages that outweigh disadvantages and has sufficient analyst conviction to warrant a positive rating (as against a Neutral or Negative). A Bronze fund has notable advantages across several, but perhaps not all, of the five pillars—strengths that give the analysts a high level of conviction. The five pillars are People, Process, Price, Parent and Performance.