The Indian equity market has traditionally seen an outsized influence of foreign institutional investors, or FIIs, as their net flows have dictated the tone of the market. However, over the past year or so, the market has shown a surprising trend where strong domestic institutional investor, or DII, flows have made it more resilient.

Net FII equity flows showed a sharp decline from $16.2 billion in 2014 to $3.3 billion in 2015. However, DII flows showed a sharp increase from $-4.9 billion to $10.2 billion in the commensurate period. The rising domestic participation is a welcome development not only for the financial markets but also for the broader economy.

See Graph: FII and DII equity flows

There are several reasons why we are witnessing a resurgence in domestic participation in the capital market. These factors, mentioned below, are quite secular in nature and hence the domestic investor base is likely to become an increasingly influential force going forward.

In the past, Indian households have channelized a large portion of their savings into the physical assets of gold and real estate. Physical assets accounted for about 60% of household savings in 2013-14 and nearly 70% in 2011-12. High inflation and, consequently, negative real return was one of the prime reasons for households shying away from financial assets. Further, poor equity returns and successive stock market scams in the nineties also hurt investor confidence.

See Graph: Households underinvested in financial assets

There are nascent signs that the trend is gradually changing and households are navigating towards financial savings. To corroborate, domestic mutual fund flows into the equity market has been positive for six consecutive quarters in a row, making it the longest period of continuous net inflow since 2000. India is witnessing a period of SIP (systematic investment plan) boom.

See Graph: Increasing number of fresh SIPs getting opened every month

This shift to financial savings isn’t visible in equities alone. Take, for instance, bank term deposits. In this fiscal year so far, banks have collected Rs.5.3 trillion in term deposits, up 23% over the same period a year ago. The anecdotal evidence also suggests that the government has mobilized much higher than anticipated money under various small savings scheme this fiscal year.

A significant reason for this trend towards financial assets is a paradigm shift in the Reserve Bank of India’s, or RBI’s, monetary policy. Since end 2013, the central bank has committed itself towards containing inflation. Real rates have been positive for 24 months in succession, which is instrumental to bring back the confidence of investors towards the monetary savings channel such as stocks, mutual funds, fixed deposits and other financial savings scheme.

Also augmenting the case for higher equity flow is the substantial attention paid to investor education over the past few years. SEBI now mandates mutual funds to spend 0.02% of assets on investor education. This education process has heightened investor awareness about the merits and risks of equity investing. It also supplements the overall improvement in the regulatory environment.

At a more structural level, the JAM trinity (Jan-Dhan, Aadhar and Mobile aiming at financial inclusion), reduction of cash-only transactions in real estate and gold, and direct transfer of subsidies into beneficiaries’ bank accounts (DBT scheme) will gradually force the money out of physical assets into financial assets (real estate sector is one of the most fertile grounds for creation and deployment of unaccounted funds).

A related factor that explains the increased interest in equity market is the underperformance in other asset classes.

Gold prices went up significantly over the last decade thereby increasing its attractiveness for investors. However, prices have fallen over the last few years with international gold prices now 44% below its 2011 peak levels. India’s gold imports have consequently shrunk by about $20 billion from the levels of 2012 partially reflecting lack of demand from investors.

Similarly, property prices are finally cooling off as unsold inventory has now risen to an all-time high. Property demand has contracted with higher real rates dampening investor interest.

On the other hand, positive returns generated by domestic equity markets (many mutual funds have generated positive returns) have proved to be an attractive alternative.

See Graph: Underperformance in alternative asset classes

India is currently witnessing a 401(k) moment analogous to that seen in the U.S. In 1980, a comparatively miniscule 46 lakh households in U.S.-owned mutual funds, a 5.7% penetration rate. Post required legislative changes in 1981, retirement funds money flowed into 401(k) plans and Individual Retirement Plans, or IRAs. As of end-2014, of total retirement assets of $24.7 trillion, the size of assets in 401(k) plans was at $4.6 trillion with $3.1 trillion of this invested in mutual funds, and in IRAs was at $7.4 trillion with $3.5 trillion in mutual funds.

See Graph: Retirement savings flows: The tax-saving, retirement investment 401(K) plan emerged early 1980s and rose multi-fold since then

In India, historically, hardly any retirement money came into mutual funds or equities. However, in a landmark event last year the government permitted 5-15% of the Rs 8.5 lakh crore Employees Provident Fund Organisation (EPFO) to be invested into equities.

As a starting step, from July 2015 EPFO agreed to invest 5% of its incremental corpus in equities through exchange traded funds, or ETFs. While the investment is still in the early ramp-up stage (expected to be around Rs. 5,000 crore by March 2016), this has the potential to serve as a balancing role in the equity markets.

In the U.S., 401(k) plans control a significant portion of all financial assets. In India, similar schemes are likely to pool in significant savings and match up to other domestic financial institutions as well as FIIs.

Impact of this trend

The re-emergence of the domestic institutional investor base is likely to lead to a few changes in the equity market going forward.

Increased domestic interest has created a new source of demand for Indian equities. Corporates viewed this as an opportunity and matched it with increasing supply of equities in the primary market. In 2015, capital raised by corporates via primary issuances was at a 5-year high of Rs 1,269 billion.

Going forward, as long as domestic flows remain robust, the IPO pipeline is likely to remain strong.

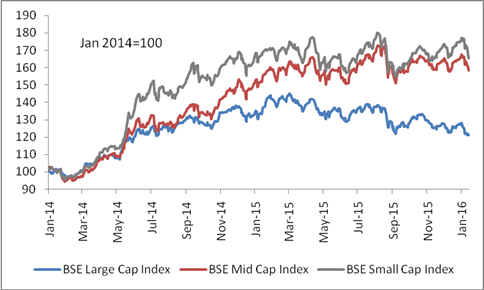

- Out-performance of small and mid-cap stocks relative to large-caps

Generally, mid and small-cap stocks tend to be driven more by local fund flows rather than global fund flows since FIIs invest mostly in large-cap stocks. This has played out in the Indian stock market in 2015. FII equity investment last year was very muted compared to the earlier years. On the other hand, DIIs continued to invest money though out the year. Consequently, the allocation to mid and small caps was more, leading to their outperformance.

This column appeared in the online publication of India Markets Observer. The outlook for various asset classes, perspectives on the industry, investing insights, interviews of fund managers, and the entire list of contributors, can be accessed here.