In the Small/Mid-Cap Equity category, Birla Sun Life MNC won the 2016 Morningstar Fund Awards. It beat contenders Mirae Asset Emerging Bluechip and SBI Magnum Midcap.

Birla Sun Life MNC has been around since 1999, with the fund size having grown over 6 times its size over the past two years as opposed to the category which has doubled in size over the same period.

An experienced portfolio manager and his expertise in the small- and mid-cap segment make Birla MNC an appealing fund choice. Ajay Garg, senior fund manager with Birla Sun Life AMC, has been managing this fund since 2009 with a mandate to invest in securities of multinational companies, or MNCs. Garg’s execution of strategy coupled with his expertise is a major driver for this fund.

Although not mandated to invest in the Small and Mid-Cap sector, the fund can tend to have upwards of half of their portfolio invested in this space. Given that the portfolio can tend to be slightly concentrated, there is the probability of a higher liquidity risk in the portfolio. Furthermore, a rally in the mid-cap space could impact performance.

The portfolio as on December 31, 2015 held about 40 stocks with about 69% of the assets being held in the top 10 holdings. Despite these factors leading to a riskier showing on the ‘riskometer’, the Birla MNC Fund has not failed to impress in terms of its performance.

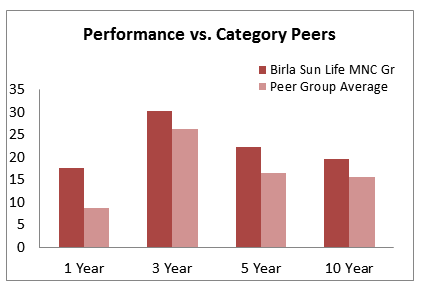

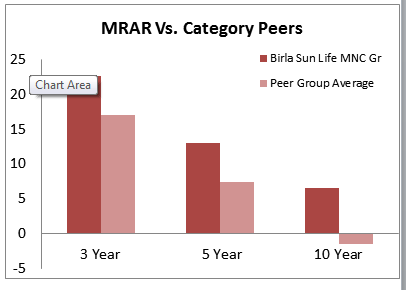

The fund has been one of the best performers in its category and returned 17.6% for CY15 as opposed to the category average of 8.81%. On a 3- and 5- year basis too, the fund managed to beat its category peers by a significant margin, returning 30.33% and 22.30% respectively, as opposed to a category average of 26.19% and 16.53%. On the Morningstar Risk Adjusted Return Basis, the fund has had an impressive performance record, beating 82%, 95% and 97% of its peers on a 3-, 5- and 10-year basis respectively.

While the portfolio is sector heavy portfolio on pharmaceuticals, financials, auto and auto ancillaries, the stock bets within the financial sector seems to have contributed significantly towards the overall performance of the fund.

Mahesh Patil, Co-Chief Investment Officer, Birla Sun Life AMC, answers queries on the fund.

- Birla Sun Life MNC Fund stands out in terms of its character and philosophy. Could you take us through the strategy and process behind the success of the fund?

The philosophy of the fund is to invest in quality multinational companies operating in India that are present across geographies, right from developing to developed markets, so that they have a range of products and the requisite experience to launch the right product at right time.

In addition, these companies have the technological edge compared to their peers and strong global brands that can be leveraged upon.

The fund manager follows a research-based investment approach. He maintains a well-diversified portfolio with over 40 stocks across more than 15 sectors. He strives to maintain high quality by investing in stocks which have superior return ratios and strong balance sheet.

The fund manager uses a bottom-up approach to pick stocks of companies that offer solution oriented and affordable products. Though the portfolio allocation is tilted towards high quality mid- and small-cap companies, it still maintains a moderate risk profile.

- The stock selection process seems to take various factors into considerations such as ESG, fundamentally strong companies, companies that offer higher liquidity and so on and so forth. Based on that, we would like to know what upside you seek to achieve from individual stocks and how do you look at them from a valuation perspective?

With a bottom-up approach to investing, lot of factors such as management strength, company’s product profile, consumer/customer feedback, market size/share, corporate governance adherence, and valuation of stocks, play a role in deciding on the stocks merit to be part of the portfolio.

We work towards identifying high quality global companies which have a sizeable opportunity. In this process, the fund manager builds a portfolio mix of stocks which have superior return ratios and a strong balance sheet, hereby allowing the fund to deliver superior returns over a medium to long term period. From a valuation perspective these names trade at a premium due to perpetual high growth rate of these companies.

MNCs have historically commanded a higher premium and continue to do so on account of multiplicity of reasons, most common of which are scarcity premium, higher growth premium, premium for global brand / reach / technology etc.

The fund manager also gives a lot of importance to companies that work closely with the regulators and give due consideration to its external and internal stakeholders which include customers, employee and other non-promoter stakeholders.

- Although you seem to give liquidity a lot of importance, the fund is highly concentrated with over 65% of its assets invested in the top 10 stocks. Could you take us through the risk factors on the fund and the process that are followed in order to mitigate these risks?

Though liquidity is important, it is not the most important factor as price discovery is generally correlated with liquid stocks. The fund manager’s endeavor is to spot potential winners early. Having said that, the fund tries to keep a mix of liquid and semi liquid stocks (stocks where value unlocking is yet to be done) and also maintains adequate exposure to cash to meet day to day redemption requirements.

- The fund has grown over six times over the past 2 years and is currently one of the largest funds in its category. While the increased interest in the fund is definitely a positive, does this impact stock selection and/or put any additional pressure on the management of the fund?

A strong research driven process helps in identifying new opportunities and the fund has been able to add new companies at periodic intervals.

We believe the size of opportunity in the MNC space is huge. The MNC universe will keep increasing as India remains the fastest growing economy in the world and is fairly supported by government relaxation of FDI norms from time to time. For instance FDI in retail, insurance, aviation was relaxed recently. From that standpoint, there is further scalability room available for this product. The fund is currently compared within the MNC category only but can be compared with high quality focus diversified portfolios too.