A reader recently made a pertinent point. He said that if he had invested in Franklin India Bluechip long ago, he would have made more money via lump-sum investing than a systematic investment plan, or SIP.

His bone of contention: Why do financial advisers extol the virtues of systematic investing when lumpsum investing makes the investor more money?

Since he did not specify what “long ago” was, I took the liberty of fixing my own time frame and seeing what the numbers threw up.

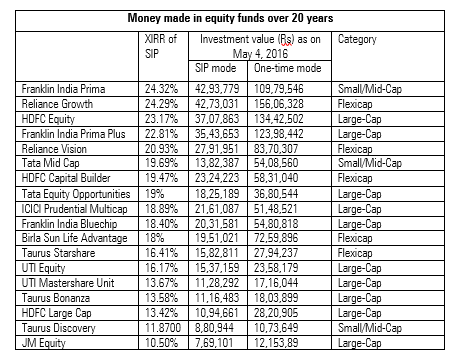

The table below shows that he has indeed made a valid point. In fact, it was not just one fund, but 18 funds that proved his statement right. And in certain cases, the difference was over Rs 27 lakh, a figure that even a die-hard champion of the SIP mode cannot ignore.

How we arrived at the below list:

- All the funds refer to growth schemes of regular plans

- The time period taken was 20 years

- SIP tenure: May 1, 1996 - May 1, 2016

- SIP installments: 240

- Amount invested via SIP: Rs 2,40,000

You can access the SIP tool here.

So why then do financial advisers (including Morningstar) keep advising investors to opt for an SIP? Would it not be wiser to just invest lumpsum amounts when the market is low?

While that does have the virtue of reasoned logic, it does not necessarily hold true in reality. Because in the real world, there are other factors and emotions at play.

When you invest in a bad market, the chances of you raking in huge returns on your investment is high. Appealing though it may sound, it means that you are now hostage to market timing. What if the market plummets after you invest? The fear of regret cannot be underestimated or brushed aside.

Let’s say you invested in the market in January 2008 when the Sensex was at around 21,000. Of course, you had no idea whatsoever that the market had peaked. Can you imagine the psychological impact of seeing the worth of your investment by December 2008 when the Sensex dipped to a measly 8,500?

There are other factors at play too.

You have to know when to get in and when to get out. And this is not a one-time incident. Since this would be your investing strategy, you would have to keep timing the market over the years to decide the best time to enter.

You have to ignore the noise around you. Fear plays a very important role and you will have to restrain yourself from pulling your money out when everyone is heading for the exits. And there are always plenty of opportunities to do so. Look at the drama played out over the past two decades that impacted the stock market: Asian financial crisis (1997), dotcom meltdown (2000), the India-Pakistan stand-off that brought both sides close to war (2001), the 9/11 terrorist attacks on the Twin Towers in New York (2001), war in Iraq (2003), global financial crisis (2008), and the eruption of the European debt debacle (2010). In 2013, there was a pall of gloom hanging over Indian investors as the market reeled under talks of tapering by the U.S. Federal Reserve. It sent the rupee crashing in an economy that was already battling with a slowdown. And in 2015, we had the de-pegging of the Swiss franc, Renminbi’s devaluation, Greece on the verge of crashing out of the euro, bursting of China’s stock bubble, a bloodbath for commodities and sliding crude oil prices.

In fact, during such market upheavals, you not only have to exercise restrain from pulling your earlier investments out, but you have to put in lumpsum amounts during such periods.

All in all, you have to be ready to tide over some sleepless nights in exchange for the higher return you will get if you go against the tide. Most investors do not have the emotional and psychological bandwidth to do so.

But most importantly, would the cash be available to invest at one go? In the example mentioned above, you would need Rs 2.40 lakh in 1996. Investors don’t have huge amounts of money to invest at fixed intervals. Putting away small amounts every month or quarter actually works well for salaried individuals who have massive outflows by way of children’s fees, living expenses, and equated monthly installments, or EMIs.

The good thing about systematic investing is that the pressure on your resources is low and consistency is maintained. Not to mention the convenience and hassle-free benefits of the money getting deducted automatically from your bank account and you not having to keep tabs on the market movement.

So unless you are convinced of getting your market timing absolutely bang on everytime, opting for SIPs is more realistic from a logistical and psychological standpoint. It also helps overcome some of the psychological impediments that can bedevil investors.