Among fixed income funds that are run using a duration-based strategy, three from IDFC AMC rank as worthy candidates: IDFC Dynamic Bond Fund, IDFC Super Saver Income Fund – Investment Plan and IDFC Government Securities Fund – Investment Plan.

Their most appealing aspect is the presence of portfolio manager Suyash Choudhary and an investment strategy that gels well with his skill set. Choudhary is a seasoned manager in running duration strategies. His strength lies in his in-depth understanding of the macroeconomic environment, ability to anticipate interest rate movements, and identify attractive investment opportunities across market segments. He is at his best investing in an unconstrained manner and the investment strategy allows him to do so.

IDFC Dynamic Bond Fund and IDFC Super Saver Income Fund – Investment Plan have a common strategy and investment approach. Here Choudhary seeks to add value by taking active duration calls rather than credit bets. He therefore plies a fluid investment approach which allows him to invest across the yield curve and segments — government securities, corporate bonds and money market instruments. Also, he does not shy away from taking contrarian calls if he believes the risk/reward is favourable.

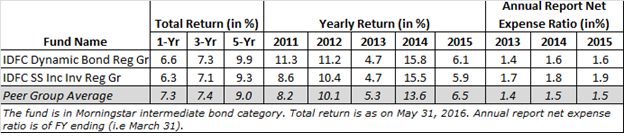

Though the funds have commonality on almost all counts, they differ in terms of expenses. IDFC Super Saver Income Fund – Investment Plan is a more expensive sibling of IDFC Dynamic Bond Fund. Infact its expense ratio has been consistently rising (2013 – 1.70%; 2014 – 1.80% and 2015 – 1.86%) which is a cause for concern. The high expense ratio has also impacted the fund’s performance as can be seen in the table below.

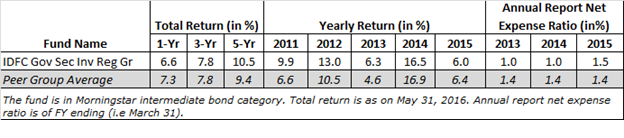

Like the other two funds, the investment strategy plied in IDFC Government Securities Fund – Investment Plan is also rooted in duration bets. Here the manager scouts for investment opportunities in the government bond segment which means, the fund stays clear of credit risk – and to a large extent liquidity risk. The fund has also performed well under Choudhary’s stewardship.

Clearly, there is uniformity in the investment approach with which all the three funds are managed; and pleasingly, the strategy plied in them complements Choudhary’s investment style and skill set. He is an expert in government bond segment and understands its dynamics extremely well. He uses the same to good effect in the funds he manages. Another noteworthy aspect of the investment approach is that Choudhary takes a relatively long-term view and do not pay much heed to news flows. Therefore, he does not mind enduring short-term underperformance and stick to his view and investment style.

Having said this, the strategy has some inherent risks. For instance, the strategy of freely moving across the yield curve has hurt the funds showing in 2015 when the manager’s expectation of yields softening on the longer end of the yield curve didn’t pan out as expected. Likewise, the penchant of taking contrarian calls can prove counterproductive as well. Also, the investment strategy’s success depends largely on Choudhary’s skills, which means there is key-man risk here.

Nevertheless, we draw confidence from Choudhary’s presence at the helm which in our opinion is a big positive. We believe his skills and research-driven approach should hold the funds in good stead.

In the light of the same, we have assigned all the three funds a Morningstar Analyst Rating of ‘Bronze’.

You can read a brief analysis of each. All are regular plans of growth schemes.

You can also read about IDFC AMC’s short-term strategies here.