Everybody knows that there are active funds, and there are passive funds. Those are the terms used across the industry--by investment consultants, financial advisers, the media, fund companies, you name it.

That language, however, has become outmoded. It was fine until about a decade ago, when active funds were active funds and index funds were not. But in recent years, it has strained to keep up with changes in the fund industry. The result: Semantic confusion, as people use the same words to state different things.

"Active," for example, currently has two meanings.

One is that a fund is managed, so that it does more than mimic an index. (This definition is not as straightforward as it sounds, because index funds sometimes deviate from their benchmarks, so as to reduce trading costs. But in practice, one can usually draw the line.) The other definition of active is that a fund incorporates a market viewpoint.

The question then becomes how to describe an exchange-traded fund, or ETF, that emulates an esoteric index. Consider an investment manager who creates a 15-factor stock-selection model, builds an index that consists of the model's 50 highest-scoring stocks (recalculated quarterly), and launches a fund based on that index. That fund would be passive according to one definition of active, and highly active according to the other definition.

Similarly, the term "passive" also does double duty.

Passive refers to a fund that is unmanaged, as the fund is based on an index and--aside from decisions about how to implement the index cost-effectively--involves no additional judgment. Passive also indicates a fund that does not reflect an investment view, as its portfolio merely copies that of a market. As with active, the term passive is asked to do more than it can. (The chess analogy is that the piece is "overworked," by asking to watch two squares. If pulled away to protect one square, it no longer can defend the other.)

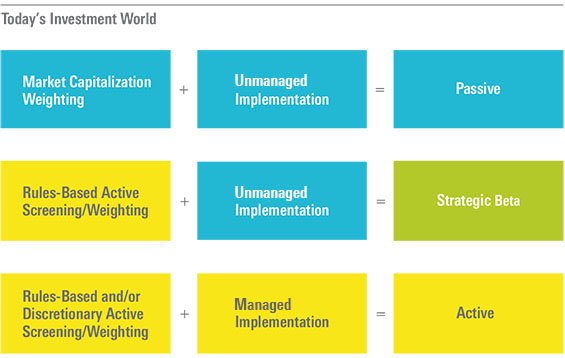

The duo of Passive/Active becomes the trio of Passive/Strategic Beta/Active. (Strategic Beta is often called "smart beta.")

Passive funds are those that hold all securities within a given marketplace (unless, per this article's previous caveats, the funds are sampling securities so as to reduce their costs). They hold them in proportion to that security's overall worth. That is, if Alphabet carries an aggregate value of $480 billion and McDonald's a value of $107 billion, as is the case at the time of this writing, then the fund must own both Alphabet and McDonald's, and must have 4.5 times as many of its assets in Alphabet as it does in McDonald's.

Anything else causes the fund to leave the top row. This is the case even if those actions are typically not regarded as "active." A quantitative screen that narrows an investment universe so that the fund does not hold everything in the market disqualifies a fund from being Passive, even if that screen is run only periodically, meaning that the fund is unmanaged except for occasionally rebalancing. An equal-weighted index also removes the fund from Passive consideration.

There is but a single path to being Passive--and infinite paths to being something else.

Strategic Beta funds spend their insight upfront. Strategic Beta sponsors create indexes that reflect their investment views. Those views could be moderately idiosyncratic, as with a value-style index, or they could be highly idiosyncratic, as in the aforementioned example of an index built by a 15-factor model. Either way, the fund company implements its beliefs, and the resulting fund is not Passive.

However, while basing a fund on an index is a necessary condition for being Strategic Beta, it is not a sufficient condition. The index must be followed on an ongoing basis. While this sounds like something that a fund based on an index would obviously do, that is not always so. Dimensional Fund Advisors, for example, uses judgment to exclude some index holdings from its portfolios. Thus, its funds land in the bottom row, as Active funds, as opposed to being categorized by Morningstar as Strategic Beta.

(Yes, I confess, I have previously written about DFA as being a strategic-beta company. It is one in spirit. The organization has strong market views; creates indexes to reflect those beliefs; and launches funds that are based on those indexes. All those line up with Strategic Beta. The company has an active mindset for its day-to-day management, however. That puts DFA into the Active box by Morningstar's scheme--but it doesn't alter the company's legacy, as a proponent of the Strategic Beta mindset.)

Active funds are what remain. They are funds that deviate from market-capitalization weightings when being set up, and which are then managed on an ongoing basis. That management could be through the use of human judgment, or it could be strictly quantitative. (After all, a computer program is also a form of management.)

This chart remains a work in progress. Although "active" has been removed from the middle column, so that it no longer is called into duty to describe a fund's daily activities, it continues to appear in multiple places. It is on the left column as well as on the bottom right. Also, Strategic Beta funds and Active funds, as defined in the chart, share the common characteristic that they are not Passive. What to call that feature? The chart has already used the word "active," after all.

Well, one step at a time. If this column helps to get people thinking more carefully about how these popular descriptors are overused, then mission accomplished.

Also Read:

The active versus passive debate

Fund investing: Algorithms or Simplicity

What no one told you about passive investing

How to pick active funds