Franklin India Smaller Companies had a bad run in 2007 and 2008, but went on to redeem itself. It has beaten the category average every year since and matched it in 2011.

The fund is currently topping the chart in the YTD return of the Small/Mid Cap category. But at Morningstar, we never recommend that an investor considers such a short time frame or scouts for the latest chart topper.

The trailing 5-year returns are impressive too. The fund again stands out with an annualized return of 25%, second to DSP BlackRock Micro Cap. In the 3-year time frame, the fund finds itself in the top quartile with an impressive annualized return of 39%, but not a chart topper.

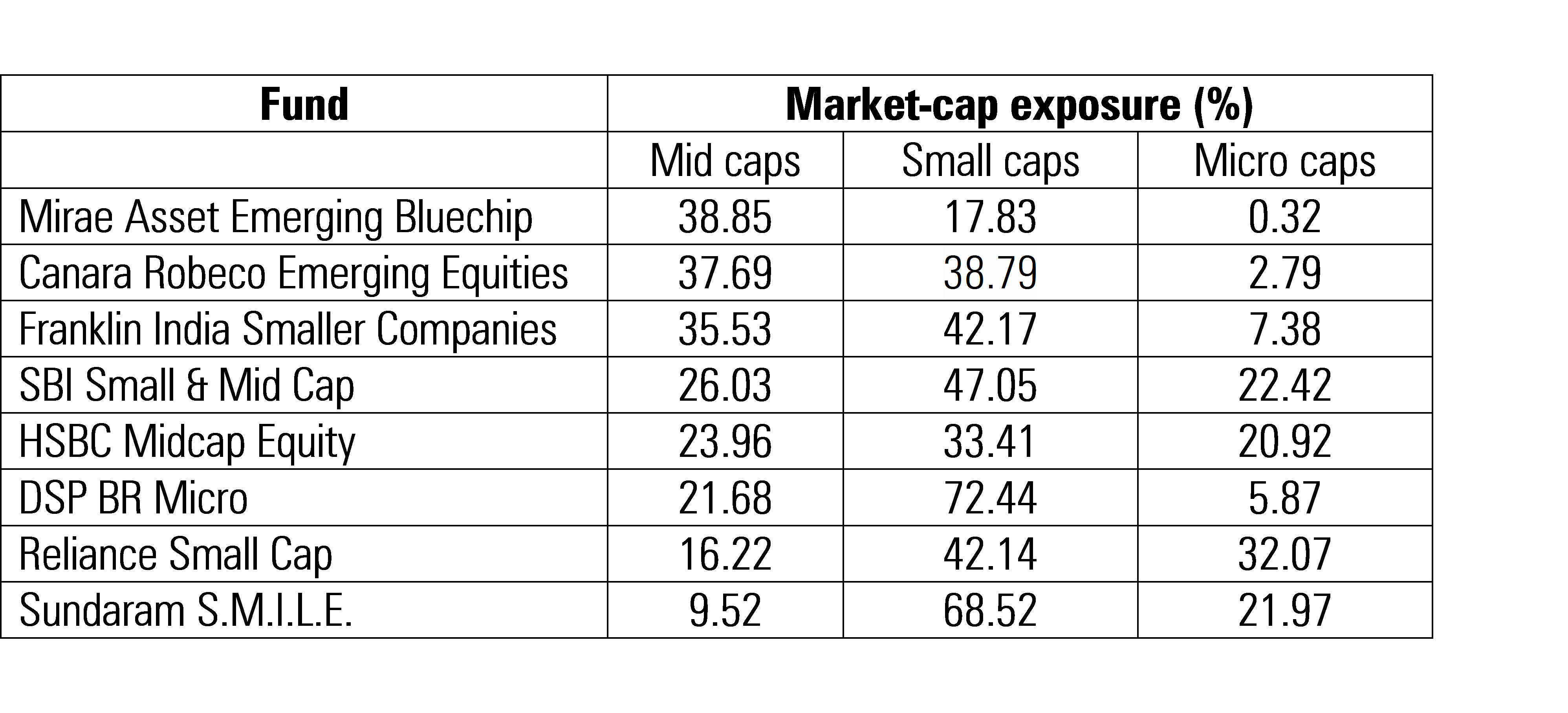

True to its name, the fund has a strong focus on smaller fare. But the funds that compete with this one, in terms of performance, all have differing tilts towards mid-, small-, and micro-cap stocks. Naturally, this changes the complexion of the individual fund portfolios. Yet, all of them fall under the same category.

For instance, according to the latest disclosed portfolios, DSP BR Micro and Sundaram S.M.I.L.E. have massive exposure to small-cap stocks, while Reliance Small Cap bets heavily on micro caps. Mirae Asset Emerging Bluechip has a strong bias to mid caps while Canara Robeco Emerging Equities is fairly equally tilted towards mid and small caps (see table below).

Hence, when narrowing down on funds in this category, one should make it a point to understand the nuances of the investment process and the fund manager’s investing style.

Senior fund analyst Himanshu Srivastava has given Franklin India Smaller Companies a ‘Silver’ rating.

Here are four points he makes:

- Fund manager Janakiraman joined the fund house in May 2007 and assumed the role of a lead manager for this fund in February 2011. He has extensive research experience in the small/mid-cap segment.

- The fund has performed impressively under Janakiraman’s watch (February 2011 through September 2015). Under him, the fund gained 25% annualised to the CNX 500 Index’s 9% and the category’s 20%. It also delivered a noteworthy performance on the Morningstar Risk-Adjusted Returns front, outperforming 95% of the category peers.

- Janakiraman selects companies that can generate consistent and sustainable earnings growth over a business cycle, have low leverage and reasonably high returns on equity. He is not very rigid on valuations, so long as the company fulfills his investment criteria. The process is robust and Janakiraman can make it work.

- Janakiraman is flexible while constructing the portfolio. In order to accommodate the fund’s burgeoning size, he increased the number of holdings in the portfolio from 40-50 stocks to 60-70 stocks. Additionally, he also lowered the concentration in its top 10 holdings.

You can read a more detailed note on the analysis here.