Change in name of scheme

- Mirae Asset Mutual Fund

- With effect from: October 18, 2016

Mirae Asset Ultra Short Term Bond Fund will be renamed Mirae Asset Savings Fund. Further, to avoid any confusion pertaining to the name of the plan of the scheme, the Savings Plan shall be renamed as Regular Savings Plan, with effect from the same date.

- Invesco Mutual Fund

- With effect from: October 1, 2016

Invesco India Gilt Fund – Long Duration Plan has been renamed Invesco India Gilt Fund. Invesco India Gilt Fund is an open-ended gilt fund. Despite the name change, all other terms and conditions of the scheme remain unchanged.

Resignation of fund manager

- Mirae Asset Mutual Fund

- With effect from: October 1, 2016

Sumit Agrawal, co-fund manager of Mirae Asset India Opportunities Fund, or MAIOF, and Mirae Asset Great Consumer Fund, or MAGCF, has ceased to be the fund manager or part of the key personnel of the AMC.

Fund manager change

- Quantum Mutual Fund

- With effect from: October 1, 2016

Sorbh Gupta has been appointed as Associate Fund Manager - Quantum Tax Saving Fund.

- IDBI Mutual Fund

- With effect from: October 3, 2016

Anshul Mishra has been appointed as the fund manager for IDBI Top 100 Equity Fund. Mishra is now be managing the fund in place of V Balasubramanian.

Change in exit load

- Tata Mutual Fund

- With effect from: October 1, 2016

Tata Regular Savings Equity Fund has had a change in its exit load. If redeemed on or before expiry of 90 days from the date of allotment, the exit load will be 0.25% of net asset value, or NAV.

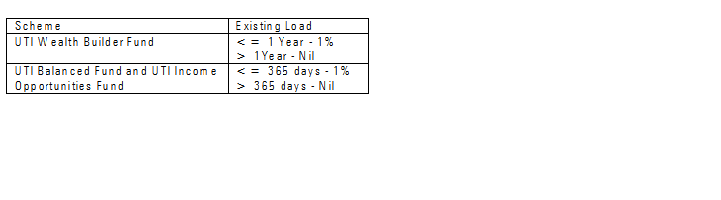

- UTI Mutual Fund

- With effect from: October 3, 2016

UTI Mutual Fund has announced change in exit load structure for the below schemes.

Redemption / Switch out within 12 months from the date of allotment – up to 10% of the allotted units: NIL

Redemption / Switch out within 12 months from the date of allotment – beyond 10% of the allotted units: 1%

After 12 months from the date of allotment: NIL

SWP options

- Reliance Mutual Fund

- With effect from: October 1, 2016

The fund house has introduced the Half Yearly Option and Yearly Option under the Systematic Withdrawal Plan, or SWP.