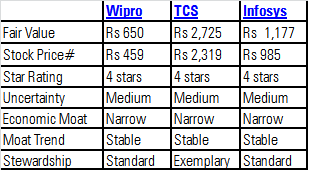

Equity analyst Andrew Lange takes a look at the latest quarterly results. of three infotech stocks: Wipro, Infosys and TCS.

We present his views below.

Infosys

We believe the firm is moderately undervalued at these levels.

Infosys reported solid second-quarter results, but the company lowered its full-year revenue guidance. Infosys is seeing cautious discretionary spending from clients. As a result, Infosys lowered its full-year revenue growth forecast to 8-9% in constant currency from 10.5-12%.

Management commentary around pricing pressure in traditional services such as business process outsourcing (BPO) also served as a long-term warning that IT service vendors need to be investing in and growing their digital and cloud practices to counter growth and margin pressure. To that end, Infosys has been hard at work reeducating its workforce on Digital Thinking initiatives while aiming to leverage artificial intelligence (AI) and automation to help with efficiency and productivity.

For the second quarter, Infosys estimates that it saved 2,387 employees worth of effort through AI and automation. We have lowered our full-year revenue outlook in alignment with the company’s guidance.

You can read more here.

TCS

We think investors should consider investing in this leading Indian-based vendor.

Tata Consultancy Services reported a sluggish performance in what is typically a strong quarter. Much of it was blamed on macroeconomic uncertainty which had led to cautious discretionary spending by clients.

Earlier in the quarter, TCS had warned of soft demand within its banking, financial services, and insurance (BFSI) business, which largely played out. Surprisingly, the company also noted a slowdown in its retail and consumer packaged goods (CPG) business.

Addressing secular growth worries, management sought to quell concerns by indicating an inevitable return to more normal spending patterns, which we agree with. Despite short-term headwinds, on a longer-term basis, we think clients will need to continually invest in their technology (whether that be services, applications, or infrastructure) in order to remain competitive in a globalized world.

One silver lining was the fact that TCS experienced no contract cancellations, instead, the firm only experienced project delays. When normalized spending does return, we believe TCS will remain a go-to vendor for many of the world’s largest enterprises given advantages in scale, branding, expertise, and intellectual property.

You can read more here.

Wipro

We recommend Wipro to investors seeking exposure to the Indian outsourcing and IT services market.

Wipro reported solid second-quarter financial results. IT services revenue was at the higher end of the firm’s revised guidance for the quarter, owing to good ongoing demand within the Americas. However, foreign exchange headwinds continued to heavily affect Wipro’s European results, and this is proving to drag on the company’s overall reported results.

Nevertheless, Wipro continues to focus its efforts on its underlying technology, people, and processes to improve its market standing and long-term relevancy. Such relevancy is indicated by recent IT service and digital deal wins across a gamut of industries.

We think Wipro remains a top-tier global IT services provider.

You can read more here.

# Price on November 2, 2016, at the time of writing the post