Over the past two decades, Motilal Oswal Financial Services, or MOFS, has been coming out with their annual Wealth Creation report.

Wealth creation is the process by which a company enhances the market value of the capital entrusted to it by its shareholders. It is a basic measure of success for any commercial venture. For listed companies, MOFS defines wealth created as the difference in market capitalization over a period of last five years, after adjusting for equity dilution.

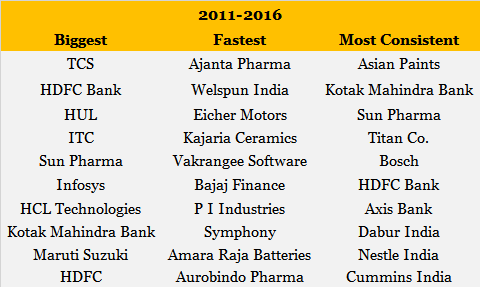

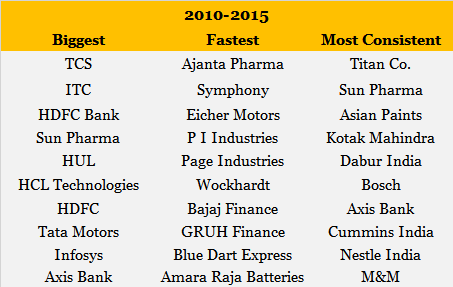

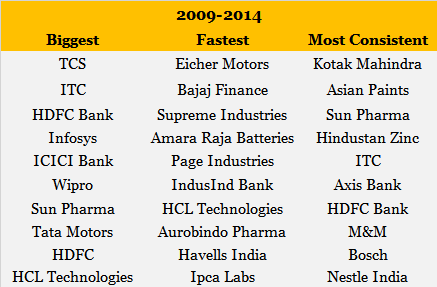

The top 100 companies are ranked in descending order of absolute wealth created, subject to the company's stock price at least outperforming the benchmark index (BSE Sensex in this case). These top 100 Wealth Creators are also ranked according to speed (i.e. price CAGR during the period under study).

TCS has once again emerged as the biggest wealth creator. The company retained the top spot it held even in the previous three study periods (2010-15, 2009-14 and 2008-13).

Ajanta Pharma has emerged as the fastest wealth creator for the second time in a row, with 2011-16 stock price multiplier of 53x (121% CAGR).

Asian Paints is the most consistent wealth creator over 2006-16, by virtue of appearing among top 100 wealth creators in each of the last 10 studies; and the higher 10-year price CAGR of 30%.

According to the study, its in its 21st year as of now, the top 100 wealth creators created Rs 28.4 lakh crore during 2011-16. Over this period, the Sensex CAGR was only 5% while wealth creation was at 18%. Wealth created is calculated in terms of change in market-cap of these companies between 2011 and 2016, adjusted for corporate events (merger, de-merger, issuance of fresh capital, share buyback).

The top five wealth-creating sectors included financials, technology and healthcare. Consumer/retail emerged as the biggest wealth creating sector. Metals and Mining, Oil and Gas, and capital goods lost out.