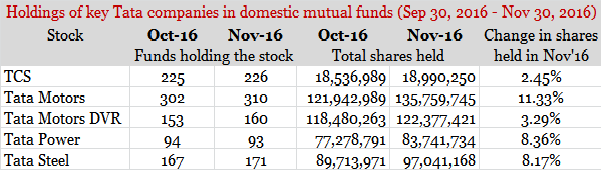

The fund research team in Morningstar India culled out data from Morningstar Direct and noted a few key trends. In November 2016, fund houses added substantial positions in key Tata Group companies.

Mutual funds continued to buy Tata Motors, with fresh allocation of 1.38 crore shares. Given the robust product pipeline for JLR and good demand for the Tiago, which witnessed month-on-month growth, resulted in building investors’ confidence. The recent announcement to hike the prices of their cars across segment will also enhance their profitability going forward. Tata Motors DVR which has consistently been seeing selling by mutual funds through the year also witnessed buying activity, albeit in smaller quantities.

Also Read: Tata Motors is attractively valued

This stock witnessed heavy buying by mutual funds through the year and the trend continued in November. Power generation and distribution stocks edged higher during the month aided by a strong show from Power Grid Corporation of India Ltd.

Also Read: Why I would not invest in a Tata Company

Mutual funds pruned exposure to TCS in October but turned out to be net buyers in November. The stock witnessed positive tailwinds as signs of improvement in the U.S. economy led to increase in stock price of Infotech companies. The remarkable improvement visible in U.S. financials helped build confidence in Indian IT revenue growth which resulted in increasing the allocation in the stock.

Also Read: What is the fair value estimate of the TCS stock?

The stock has been witnessing buying by mutual funds since June, with many funds initiating exposure to the stock as managers turned positive on the sector hoping that the worst is behind us.