The Union Budget 2017 was unveiled this morning. Here are the proposals only pertaining to the income tax of individuals.

- Personal income tax rate slashed from 10% to 5% for individuals earning between Rs 2.50 lakh and 5 lakh per annum.

- A surcharge of 10% will be levied on individuals earning between Rs 50 lakh and Rs 1 crore.

- Consequent to the combined effect of the new Section 87A rebate and the reduction in tax rate for those earning Rs 2.5 lakh to Rs 5 lakh, the tax burden for those with income up to Rs 3 lakh would be zero.

- Since even individualls falling in the higher tax bracket will also be eligible for the reduced 5% for income between Rs 2.5 lakh and Rs 5 lakh, even individuals falling in higher tax brackets will pay lower tax by Rs 12,500 per person.

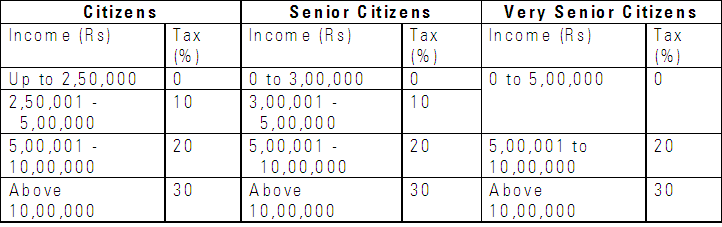

Current Income Tax Slab (click on image to enlarge)

- Surcharge on income above Rs 1 crore: 15%

- Education Cess: 3%

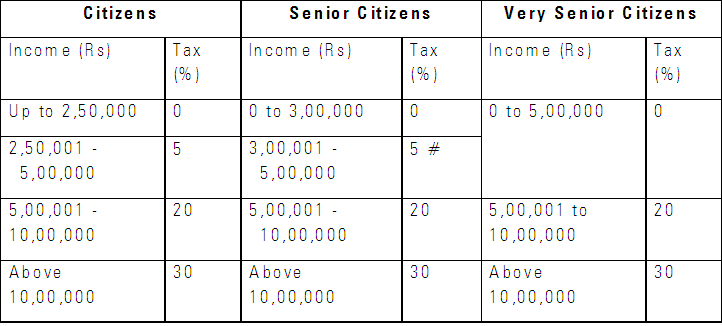

Post-Budget Income Tax Slab (click on image to enlarge)

- Surcharge on income between Rs 50 lakh and Rs 1 crore: 10%

- Surcharge on income above Rs 1 crore: 15%

- Education Cess: 3%

# While it would be commonly assumed that senior citizens too would avail of the lower rate, the Budget text did not explicitly make a mention of the Rs 3,00,001 to Rs 5 lakh bracket of this age group.