This is the right time to explore the scenario of falling interest rates and take a prudent look at alternative investment avenues to bank fixed deposits. Historical data provides evidence on how in a falling interest rate environment fixed income funds have performed better than bank fixed deposits. Today, there is no dearth of fixed income products available in India’s financial markets, although the risk and reward they offer, will vary depending on an investor’s preferences.

Over the last 18 months, the RBI has been following an accommodative monetary path, adding liquidity and reducing policy rates. An economic environment with low demand led to declining interest rates; while the government’s historic decision of demonetisation has channelized cash into the banking system. Evidently, surplus bank liquidity and low interest rates are here to stay.

How does one deal with a falling interest rate scenario?

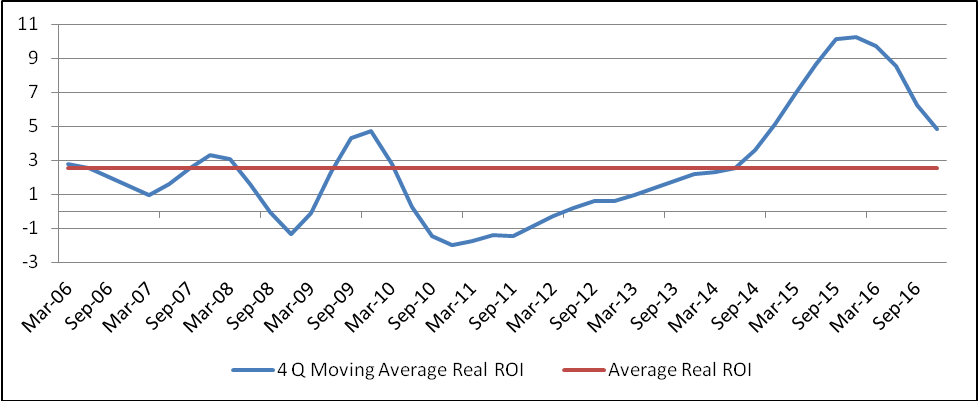

Whenever there is a sharp movement in interest rates, it’s the fixed income portfolio that needs restructuring. Take the current scenario, where though a decline in lending rates is good news for home loan buyers, a decline in Fixed Deposit (FD) rates are a cause of worry. With rates for deposits falling to below 7%, retail investors are feeling the pinch. As FDs lose their sheen, investors must look at alternatives. While depositors are somewhat disheartened by the fall in deposit rates, let’s remember India is one of the few countries that offer an attractive positive real rate of interest (refer to below graph). And as such fixed income funds should remain a good part of an investor’s asset allocation.

Source: Bloomberg and internal research

While equity mutual funds are more glamorous and get written about often, fixed income funds have attracted sizeable investments. Over the last 16 years, fixed income funds constitute about 65% of the mutual fund industry with assets under management of Rs10.75 lakh crore - nearly two-thirds of the mutual fund industry’s total assets of Rs16.46 lakh crore.

Fixed income funds work well in an investor’s fixed income portfolio.

Over the years, fixed income funds have delivered fairly attractive, market related returns for investors. Undoubtedly the returns generated by fixed income funds have been higher than those delivered by bank deposits in the past. Even though nominal interest rates appear low from a historical perspective, the real rate of returns adjusted for inflation are indeed at the upper end of what it had been in the last 10 years.

Here's a look at the returns generated by the CRISIL-AMFI Income Fund Performance Index as on December 30, 2016. (source: AMFI India.com)

- 1 year: 13.38%

- 3 years: 11.03%

- 5 years: 9.4%

- 7 years: 8.5%

- 10 years: 8.7%

The core allocation to fixed income should be done keeping in mind the investment horizon and risk appetite. We believe most investors will find Credit Opportunities Funds an attractive investment category for their medium-term needs. This category has historically delivered around 200 basis points over bank deposits. With complete flexibility on withdrawal and noteworthy tax benefits particularly for holding over 3 years, the overall returns from fixed income funds on a post-tax basis become even more attractive. As an investor would I not look to restructure my debt portfolio for efficiency and better returns?

Why fixed income funds are able to deliver higher returns than bank deposits.

The mutual fund industry has amongst the lowest cost of intermediation amongst financial services. As against the Net Interest Margin (NIM) of the banking sector which tends to be over 300 basis points, the mutual fund industry operates on a significantly lower expense ratio. From a credit perspective, unlike banks, the fund industry operates in a different credit space. Most of the portfolio of the mutual fund industry is rated above investment grade. However, the banks' orientation is much different, as they are involved in project loans which are underwritten at the inception of a project with an underlying project risk, whereas the fund industry usually invests in operating companies. At a time when the banking sector’s Non Performing Assets (NPAs) are touching alarming levels, the Mutual Fund industry continues to have a pretty good portfolio quality.

Mutual funds offer much to choose from.

The mutual fund industry offers a menu of options for fixed income investors to choose from – ranging from very short-term deployment to long-term investment. For most investors who have the ability to set aside money for a few years, I would recommend considering Credit Opportunities Funds. We have also seen fund managers doing a fairly good job of managing credits over the years. Investors with a shorter time horizon will find ultra-short term funds a good option in comparison to traditional bank fixed deposits. For those who are not worried about liquidity, close-ended funds or Fixed Maturity Plans (FMP), as they are popularly known can be a good option

Even as investors fret over falling yields on fixed income instruments, mutual funds have the ability to position themselves to benefit from falling interest rates, particularly by skewing the portfolio towards longer maturity papers.

Most fixed income schemes are fairly liquid and able to meet redemption requests on a day-to-day basis, while bank and corporate FDs have a fixed lock-in period.

They also offer significantly lower taxation. For investors holding schemes for three years or more, fixed income schemes can take the benefit of lower taxation under LTCG (Long Term Capital Gain). This can effectively bring down the taxation to 10-15% thereby yielding much better post-tax returns for investors in higher tax brackets.

This post initially appeared in the India Markets Observer 2017 where you can read the perspectives and views of other experts too. It is available to all for FREE. All you need is a minute to register.

Download your copy Now!

The views are personal and not necessary those of the organization.