A wise investor would put in a lot of effort prior to the purchase of a stock. And that information is what will help him decide when to sell. After all, we need to know what makes a business great to realise when it is no longer so. But kicking a stock to the curb can be tricky. By selling winners too soon, you could be your biggest enemy on the path to riches.

Sanjay Bakshi needs no introduction to the investing community. This value investor is well known for his moat investing philosophy. But here we collated his views over the years (sources mentioned at the end) on when to sell a stock. And when not to.

Should you sell when the stock is overpriced?

We are operating in one of the world’s most rapidly growing economies and businesses are nowhere close to saturation. For us, a 5% or 6% growth is a slowdown. We have a lot of growth to see and our businesses have very long runways of future growth ahead.

Businesses that can deliver growth without stretching balance sheets and without taking in more capital (through the issuance of new equity shares) and where the quality of growth is excellent in terms of incremental returns on capital—they will increase per share value for stock holders over the long term. That potential growth in value is sometimes mispriced by markets even if the stock has appreciated a lot already. Under those circumstances, it would be a mistake to sell.

You shouldn’t look at how much money you’ve made, but look at the potential value of the business 10 or 15 years down the road and then take a decision.

Do not focus on the stock price but on performance of the underlying business. As Warren Buffett says, focus on the playing field, not the scoreboard. Too many investors look at the score board; they tend to focus on the current stock price, the current P/E multiple or the percentage gain in the stock price in relation to the gains in some index or some other stocks.

This is how investors think with regards to the price of the stock they own:

- The price has shot up so rapidly. I better sell.

- It’s selling at XYZ P/E multiple which is so high compared to the past P/E multiple history of the stock, or the P/E multiple of the stock market, or the P/E multiple of other similar businesses. I better sell.

- Anchoring to historic or near term P/E Multiple

- If I plug in the assumptions that I used in my original expected return model, then at the current stock price, the model will predict a very low future expected return. I better sell.

- Anchoring to ultra-conservative assumptions used before buying despite seeing far better performance.

That kind of thinking works well with other types of value investing, in particular, with classic Graham-and-Dodd style of value investing. But I don’t think it applies to moat investing.

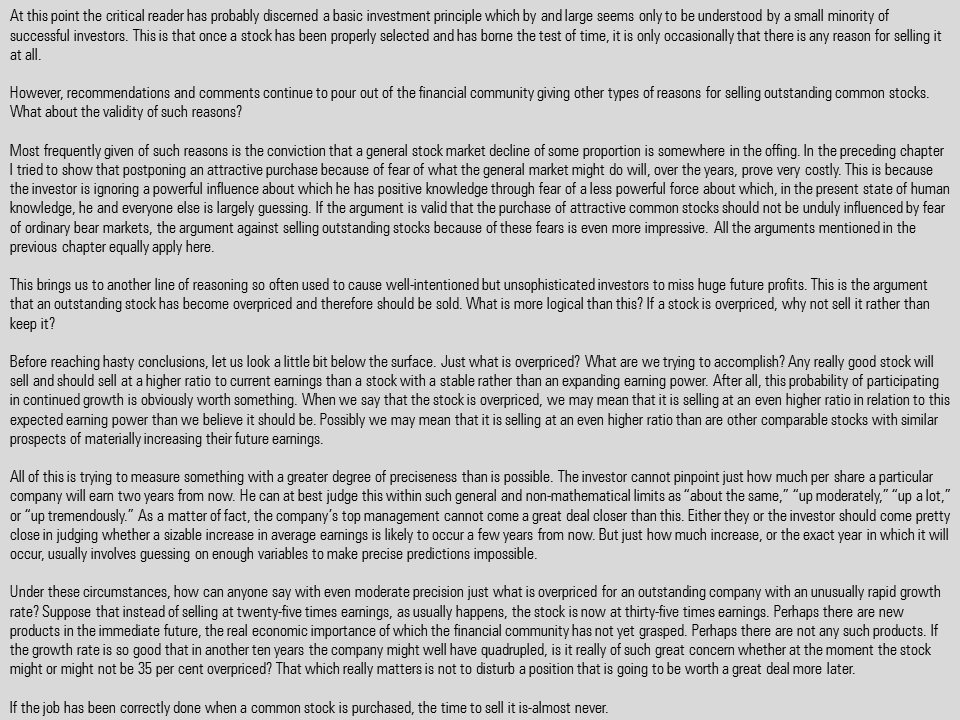

Buy great businesses at reasonable valuations and sit on them for a long-long time. Very successful investors did so and did not sell the great businesses they had bought by giving in to any of the three temptations I listed above. In particular, they did not overdo the excel modelling to keep calculating the future expected returns based on current stock price. Nor did they worry about selling a stock simply because it was not quoting at a P/E multiple which made the stock look expensive. Rather they followed Philip Fisher’s advice who wrote this in his classic book on investing titled Common Stocks and Uncommon Profits.

(Please click on the image below to expand it)

Which logically brings us to the next question: Should you buy a stock even if it is overpriced?

One of the most counter-intuitive ideas in value investing in high-quality businesses is the power of averaging up. Very few value investors appreciate this power. If you've picked the right kind of business, which will be worth several times current market valuation in a few years' time, don’t hesitate in buying its shares simply because they are selling at an all-time high market valuation. Focus on the potential future value a decade or so from now and how much money is there to be made between now and then.

Value investors get pleasure from seeing the prices of their stocks fall from their cost because they can then buy more shares at an even lower price. I don't have any issue about averaging down.

What I find surprising is that many value investors avoid investing in businesses simply because their stock prices are selling at an all-time high. Moreover, they refuse to buy more shares at prices higher than their cost, even though management has executed even better than what was originally estimated by the investors. In a sense, the investors fall for "anchoring bias" where they anchor to their cost price and keep hoping the stock price will fall below that price so they can buy more shares.

The reality is that in high-quality businesses, there will be multiple times to buy more shares, and one must never focus on the cost price of existing shares or the fact they happen to be selling at an all-time high price and much higher than one's own initial purchase price.

John Templeton's quote on the subject of when to invest: "The best time to invest is when you have money. This is because history suggests it is not timing which matters, but time."

Source: Fool.com, Forbes, Safal Niveshak

What factors must guide the sell move?

The decision to sell is complicated. One needs the right dosage of detachment, but then one also needs to be very much attached to the right kinds of businesses and people who run them.

The first thing to ask is whether the business is delivering what you envisaged. By and large, is the business is delivering performance in line with your long-term projections? Some slippages must be tolerated. Some mis-allocation of capital decisions must be tolerated.

It’s important to not measure this performance every quarter. Just because the information is available, you don’t have to use it. Imagine if companies were required to provide monthly performance, not just quarterly. How important would those numbers be? More data does not result in more insights. Often, it results in bad judgments.

Equally important is to determine whether or not that performance is coming from variables envisaged and not some other factor. If the answer to that is overwhelmingly yes, then you could get pleasantly surprised as great businesses tend to do better than earlier envisaged. So, to help determine if you should hold or sell a business that’s really working for you, use what I call as blue sky scenario. Basically, it means that you should not use the same assumptions you used when you bought the stock. This is especially true when the business you bought into is doing far better than you had anticipated.

If you bought the right type of business, then there is likely to be tendency for it to deliver better than what you envisaged. If you see that tendency play out after you have invested, don’t ruin it by staying with the original model. Your model has to be adaptive. If the performance is far better (or worse) than you envisaged, you have to change the model unless the improvement (or deterioration is likely to be temporary).

As Keynes used to say, when facts change, I change my mind. You have to have the same mindset when it comes to investing in both directions. That is, if the business is delivering far poorer performance than what you had envisaged earlier, and that performance is likely to continue because the moat is impaired, then your original model needs to be re-worked and it may well turn out to be the case that you should sell the stock. You have to have the ability to be detached from the outcomes, based on dispassionate analysis of real, meaningful data (not noise).

Having said that, there is no business so good that it can’t be ruined as an investment at some price. That’s basic common sense. My point is that when it comes to scalable moated businesses, then the normal rules that work with other types of businesses don’t apply.

Selling out of a great business just because its market value has gone up is almost always a bad idea. But “almost always” does not mean “never”. Between “almost always” and “never” there is a gap which you should think deeply about.

While doing so, keep in mind that:

- A dominant, scalable, moated business run by a great manager will much more likely present you with pleasant surprises than unpleasant ones;

- There comes a price at which even a great business, if bought at a fancy price, will deliver you a mediocre (or even a negative) return even after counting those pleasant surprises.

Source: Equity Master, Fundoo Professor, Safal Niveshak

Should you sell because another stock looks better?

If something is working for you, and you don’t have cash and if something else turns up and you like it a lot, then you should sell what’s working for you only when what you want to buy will give you a significantly higher expected return. Otherwise, just hold on to your great businesses and let them compound your capital for you.

Source: Safal Niveshak