There is an old market saying ‘Don’t confuse genius with bull market’.

When all your stocks are levitating it’s easy to conclude that you are a financial genius and the world has just been unkind thus far, not recognizing this exceptional talent. Given a choice of attributing a good outcome between luck and skill, most people believe it is all skill and vice versa for a bad outcome – that’s just human nature. But having known this bias, it is for us to guard against.

So while the pink papers have blaring headlines heralding the mother of all bull markets and business news channels are busy cutting cake on live television, it’s important to rid oneself of any creeping delusions of greatness. No better time to review one’s investing mistakes. In an earlier essay, we had mentioned how as investors, we are jealous of sportspeople who get to see frame by frame action replays and can take immediate and precise corrective action. For us, all we have is our old notes and rationales written before buying and selling stocks and the brutally honest trade blotter. With a hat tip to Chetan Bhagat (author of The 3 Mistakes of My Life), here’s a post-match analysis of three of our investing mistakes.

Mistake 1: Where we forgot who we were

To put our investing philosophy in one line, we look for companies with superior growth prospects that can be self-financed i.e. having capital self-sufficiency. Once in a while though we get tempted by mean reversion trade where the driving factor is neither growth nor capital self-sufficiency, but valuations. The argument of such trades is generally that, things are so bad and valuations so depressed, they can only get better.

We started buying Jammu and Kashmir Bank in April 2015 at about Rs 90 per share. The broad rationale was that the market was painting all mid-size public sector banks with the same valuation brush but J&K Bank had a superior franchise (moat) in their home state of J&K as evidenced by their dominant market share in loans and deposits.

They made mistakes while lending outside the state and the confession on asset quality had happened over the past 12 months. (Profits declined from Rs 11.9 billion in F14 to Rs 5.1 billion in F15, primarily on account of higher provision for bad loans. The rationale then was that the good bank (J&K franchise) is intact with high return ratios and the bad bank (lending outside the State) had seen its peak woes. As markets recognized this, the stock would re-rate. To be sure, while we were writing this rationale, the actual operating metrics for the bank were deteriorating but by using some contortion of the mean reversion logic, we had convinced ourselves that this is the bottom.

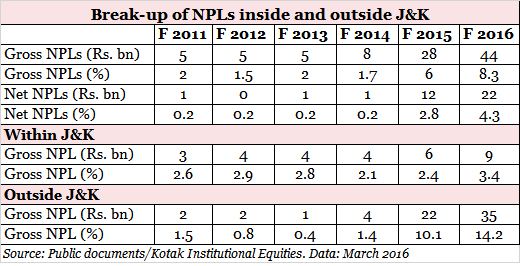

Things turned out differently. Asset quality woes outside the State kept deteriorating with gross bad loans reaching a whopping 14% of loans outside the State. Even within the State asset quality worsened progressively even before the political situation turned for the worse.

This mistake makes us cringe even today as we not only abandoned our style, we also paid no heed to our own guidelines of assessing turn-around stories. Don’t jump in with a story; wait for some confirmation of the promised turnaround in the operating metrics. Even if that means having to pay a bit higher, one has significantly improved the odds of not being stuck with a dud. If we had been batting, this dismissal would be categorized as ‘lapse in concentration’.

Mistake 2: Where we extrapolated too much

We distinctly remember the Investor Day that Bajaj Group had organized at their Akurdi Plant some years ago. The first half of the day was about the auto business while the post lunch session was for the new financial services business. At that time, the market capitalization of Bajaj Auto was far larger than that of Bajaj Finance (BAF).

We had gone to the Investor day fully prepared with questions about Bajaj Auto and had a ‘let’s hear what they say’ attitude towards BAF. Evidently, other investors had done the same thing as Rajiv Bajaj and his team were peppered with so many questions that the lunch break had to be shortened while Sanjiv Bajaj and his team had to coax out questions from the audience. But we came back impressed with the growth opportunity in the consumer durables financing space and the passion of the young CEO of BAF, Rajeev Jain.

We started buying the stock in February 2012 at about Rs 700 per share. (The stock has since undergone a 1:10 split).

The years 2011 to 2013 were generally difficult for finding domestic growth opportunities but BAF was growing well. We wanted to keep an eye out for excessive growth chasing tendencies which normally manifest themselves in either acquisitions or in the case of financial stocks, venturing into higher risk lending lured by higher yields. We got worried when BAF decided to venture into construction equipment and financing road projects when the infrastructure sector was beleaguered with issues and loan against shares when the markets were insipid. The stock had doubled for us in a short span of 10 months and on headline valuations was no longer attractive. Our reflex action was to sell out of the position. In hindsight, we had settled for a 2-bagger when we were potentially sitting on an 18-bagger and counting. (BAF split adjusted price as on April 28, 2017 was Rs 12,758.5).

The forays into road financing and loan against shares in hindsight were controlled experiments by a dynamic management and even today they constitute just 6.5% of the loan book and there haven’t been any asset quality accidents there. But we got sucked in by the cocktail of narrative and unrealized gains and let go of a huge alpha creator. To be fair, Rajeev Jain and his team had always communicated that these forays were in the nature of testing the waters and we could have held on to see if the management walked the talk, which they did. But we opted to extrapolate them into an Armageddon in our minds and paid through our nose for our vivid imaginations in the form of opportunity costs.

Mistake 3: Where we did not extrapolate enough

One of the toughest asks of a public market investor is IPO investing. One has no way to calibrate the management meeting based on past interactions and a decision is expected to be taken based on one hour interaction.

We met REPCO Limited, a housing finance company based in Chennai in March 2013. We liked the business strategy and focus but had asset quality data only till September 2012 and the bad loans number had inched up from 1.4% to 2.1% between March and September. The management assured us that there was seasonality at play here and asset quality numbers typically improved by March. We had no way to calibrate what we were being told and opted to play it safe by not subscribing to the IPO but making a mental note of checking the asset quality numbers subsequently.

When the numbers did come out, what the management had told us was borne out but the stock had moved up to Rs 210 from the offer price of Rs 172 and was trading at almost two times book value. We thought it was expensive from a 12-month standpoint and let it pass. Frankly, we did not have the breadth of imagination to assess the profitable opportunity size in affordable housing and the ability of REPCO to execute well in the space. Had we not restricted our thinking to just one year forward numbers and thought of REPCO as a 25% earnings compounder, making the buy call would have been easier. We essentially analyzed a compounder with a cyclical framework. Since F13 REPCO has delivered an earnings CAGR of 23% and stock CAGR of 45%.

Having anchored our thinking to the investment decision made at Rs 210, we could not bring ourselves to buy the stock ever again. The question “You didn’t buy at 210, why are you buying at 300?” is a very uncomfortable one to answer but the sooner one learns to swallow pride in these situations, the better.

Confessions are no guarantee that sins won’t be committed in future. But when it comes to investing, one at least hopes to not repeat earlier mistakes and make newer and better ones in future.