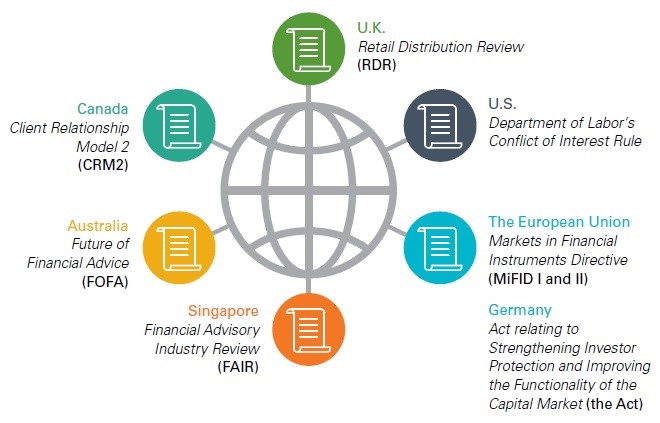

In the wake of tightening regulatory framework around the world, a Natixis global survey of 2,550 advisers covering 15 countries finds that stringent regulations could limit access to financial advice for lower balance and mid-tier clients.

Source: Natixis

While the survey does not include the views of Indian advisers/distributors the findings are relevant for our markets as the results echo the feedback of Indian advisers. Advisers in India too feel that retail investors would be left unadvised if SEBI goes ahead with its proposal to bar distributors from offering advice.

The Natixis survey says that advisers hold reservations about the implications of new regulations for individual investors. A large number of advisers were also concerned that regulations may restrict their ability to deliver the level of service desired by clients.

Hindrance to growth

As for their own growth prospects, 43% believe new regulations sweeping across the global industry could limit their ability to prospect for new clients.

Globally, advisers believe this level of regulatory scrutiny holds dramatic implications for their practices. More than eight in ten say heightened regulation and disclosure requirements are challenging to the growth of their business. But advisers’ hopes for asset growth are not pinned solely on market performance. Only 47% believe market gains will help their books grow. Instead, they believe clients, both old and new, will be a primary driver of asset growth. Nearly eight in ten believe they will have to acquire new clients (78%) or gain a larger share of wallet from their current clients (77%) in order to meet their business expectations.

The consequences of reform

As the wave keeps rolling, advisers will adapt. Seven in ten say they will make at least some changes in their business model as a result of new regulations, and close to half (48%) say they will need to change their business model in order to sustain business growth. Specifically, advisers anticipate a number of changes ahead: 38% say they will likely disengage with smaller clients, 29% plan to increase the use of passive strategies for lower balance clients, while 26% say they will change their fee structure. Overall, these changes will require advisers to think differently about how they manage their practice.

Higher cost for clients

Ensuring they are in compliance with new regulations will likely require that advisers redirect time and resources to this critical business function. More than three-quarters believe increased regulations could even lead to higher costs for clients.

The full report can be downloaded here.