Ever since long-term capital gains tax, or LTCG, has been introduced on gains from equity mutual funds, the debate on whether investing in an Unit Linked Insurance Plan or mutual fund revived with a vengeance.

The reason ULIPs are popular among investors is because they are marketed and sold as a great investment option, which also provide insurance cover. They are advertised as ‘the perfect product’, which combines the features of both, an insurance cover and the benefits of a mutual funds, under a single plan. Mis-selling of these products is rampant as insurance agents receive huge sales commissions.

Although ULIPs have emerged as a good alternative to mutual funds as a tax-saving instrument, taxability alone cannot be the parameter to decide on a good investment option.

Before we get to a conclusion about which investment is better, let's understand both.

What is an ULIP?

ULIP is an investment-oriented insurance plan. A portion of the premium paid goes towards charges (explained below), a small portion goes towards providing an insurance cover, and the rest gets invested in a fund of your choice. The funds are managed by a fund manager and you are allocated units of the selected fund.

Mutual funds are purely an investment vehicle, that pool in the savings of many investors and invest them in diversified instruments. They are managed by fund managers, who invest the money in line with the investment objective of the fund.

Charges

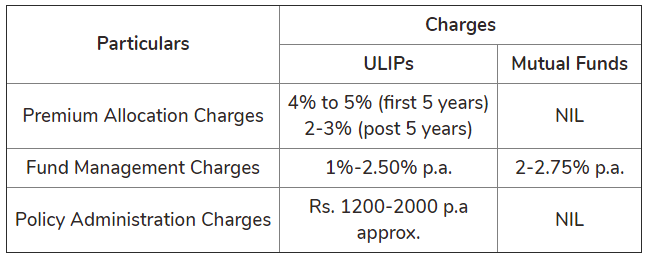

ULIPs have many costs or fees, that reduce the overall returns form the policy. The common charges are:

- Mortality (cost of insurance)

- Premium Allocation

- Fund Management

- Administration

- Surrender or Discontinuance

- Switching

Mutual funds, on the other hand, have only fund management charges and exit load (if any, on early redemption).

From the table above, it is clear that the amount invested decreases when it comes to ULIPs.

Returns

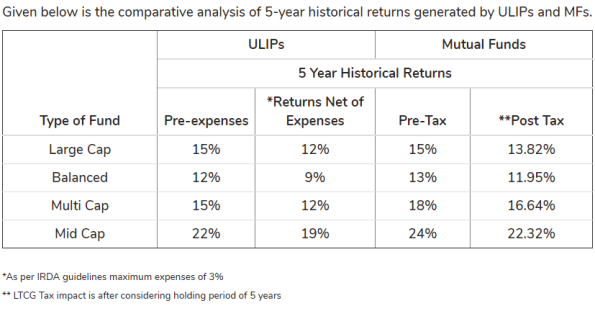

In ULIPs, due to the charges mentioned above, the amount that gets invested to generate returns, is much lower than the actual premium paid. This significantly impacts the returns that ULIPs can generate. For example, if a person invests Rs 100, 4% which is Rs 4, gets deducted as Premium Allocation charge, and only Rs 96 is invested.

It is evident from the data that even if we consider the impact of LTCG tax of 10% on historical returns, mutual funds still outperform ULIPs.

Liquidity

ULIPs have a lock in period of 5 years. Hence, in case of any emergency, you cannot encash your policy.

Open-end mutual funds have no lock in and can be liquidated at any point of time. However, there may be minimal exit load charges applicable, if funds are redeemed before a specified period (usually 1-3 years). Thus, from a liquidity perspective, mutual funds are a much better investment option.

Tax Saving

If the idea of investing in ULIP is to get the benefit of Section 80C deduction, a better option would be to invest in an Equity Linked Savings Scheme, or ELSS. This is a diversified equity mutual fund that qualifies for the same deduction. Further, it has lock in of only 3 years, as compared to the ULIP's 5 years.

In addition to better liquidity, ELSS have historically generated much better returns than ULIPs in the long run.

Never mix Investment with Insurance

ULIPs do exactly this, and hence, it is much wiser to opt for a term plan. Since the premium you pay for the same amount of cover will be much lower, the balance can directly be invested into mutual funds.

Ideally, you should consult a trusted financial planner. Their unbiased approach and expertise enables them to compare and analyse various products. Moreover, it is recommended keeping your situation and goals and risk profile in mind.

This post initially appeared in Happynessfactory.in