India has around 24 life insurance companies, all offering online term insurance plans.

Basavaraj Tonagatti, a Certified Financial Planner, employs four parameters to arrive at the best term plans currently.

Under a term insurance policy, should the insured (policyholder) pass away during the policy period, his/her nominee will receive the Sum Assured. If the insured survives till the end of the policy period, the nominee will not receive any maturity amount.

This is life insurance in its purest form, least expensive and covers a large amount of life risk. There are variants. For example, the return of premium, term life insurance up to 100 years of age, a variety of riders and variety of claim payable options.

We suggest you keep it simple and straightforward and purchase it online.

Not only is that convenient, but since no insurance agents are involved, it is cheaper than offline term insurance plans and you suffer no undue influence. Moreover, along with the discount of DIRECT purchase, the companies will give you 8% on your FIRST YEAR PREMIUM. This is to promote cashless online transactions.

Anyone with financial dependents must buy this product immediately. Here's how we narrowed down on the best.

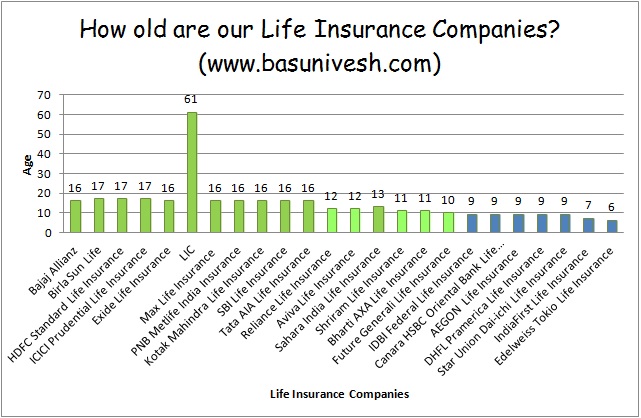

#1 - The age of the company

Among 24 life insurance companies, only 17 have completed 10 years or more. So the first filter will be be to eliminate the balance 7. The reason being that life insurance is a long-term contract between you and insurance company. Hence, the older the company the more comfortable I feel.

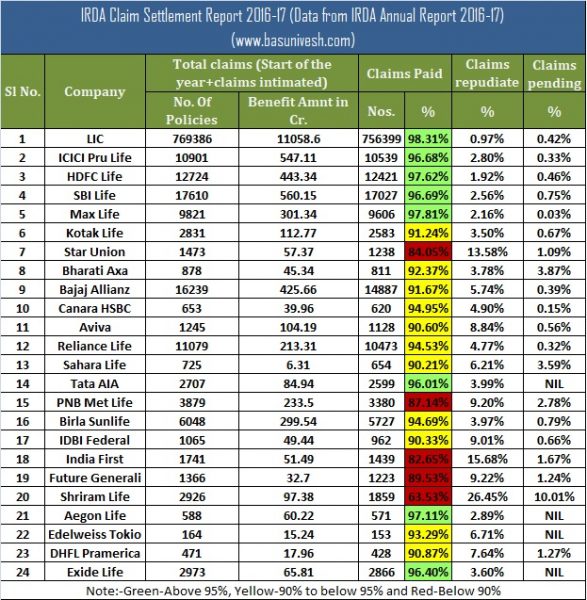

#2 - The Claim Settlement Ratio, or CSR

Around 8 companies are in GREEN (CSR > 95%), 11 are in YELLOW (CSR between 90% and 95%), 5 companies are in RED (CSR < 90%).

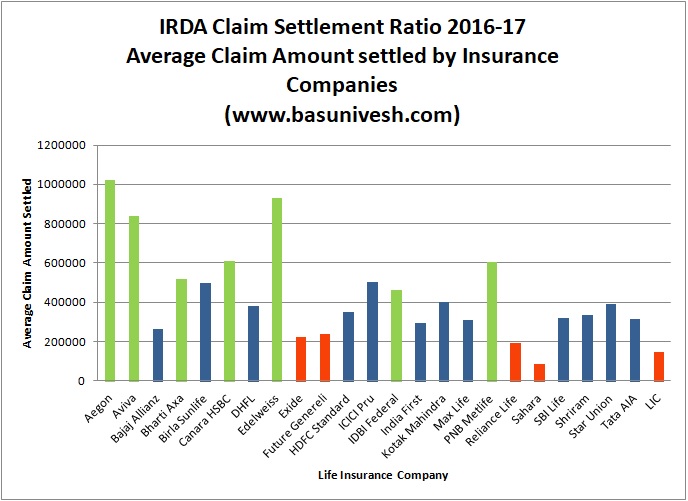

The CSR will not give you the clear picture about which type of products the insurance companies settled. However, we can assume the types of products they settled by looking at the average claim settlement amount of life insurance companies in 2016-17.

LIC is the lowest with Red, along with Sahara, Reliance Life, Exide and Future Generali. This shows that, even though LIC settled the highest number of claims, the majority of such claims are less than Rs 2 lakh Sum Assured. Hence, it is indicating indirectly that LIC’s claim settlement is mainly in the category of endowment plans but not term insurance.

Lesson: Don't rely solely on the CSR.

#3 - Premium cost

I have now further shortlisted the insurance companies and considering their premium.

- LIC (Oldest, government backed mammoth)

- ICICI

- HDFC

- Max Life

- Aegon Life (Last year, in place of this, I had recommended SBI Life's Term Life Insurance. I included this firm though it has been around for less than 10 years because of a favourable CSR and average claim amount settled).

Now I will consider an example of a healthy non-smoker:

- Age: 30 years

- Tenure of policy: 30 years

- Sum Assured: Rs 1 crore

- Premium payment: Annually

- Type of product: Vanilla term insurance plan with no riders or add-on features

#4 - Plan features

Now I will arrive at 2018's Best Term Insurance Plans in India.

This post initially appeared on BasuNivesh.com