In December 2015, Motilal Oswal came out with their Mid to Mega - 20th Annual Wealth Creation Study.

In that study, they looked at the performance of 2,000-odd Indian companies in 5-year windows. Based on market cap, they classified stocks as Mega (top 100), Mid (Next 200) and Mini (the balance).

The objective being to evaluate how many smaller companies moved into the next league.

There are 3 crossovers relevant to the buyers of stocks:

- Mini-to-Mega

- Mini-to-Mid

- Mid-to-Mega

Data suggests that of the above, Mid-to-Mega is the most profitable in terms of risk-adjusted returns, and most plausible in terms of associated probability.

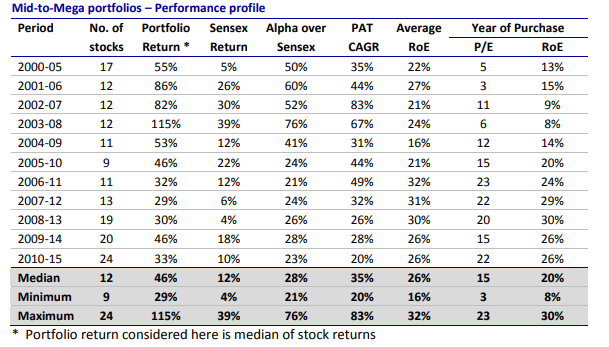

From 2000 to 2015, across 5-year time windows, Mid-to-Mega stocks delivered median return of 46% with relatively low risk as indicated by healthy portfolio RoE of 20% and reasonable P/E of 15-23x in the year of purchase. Probability of Mid-to-Mega at 5-12% is also significantly higher than the other 2 crossovers.

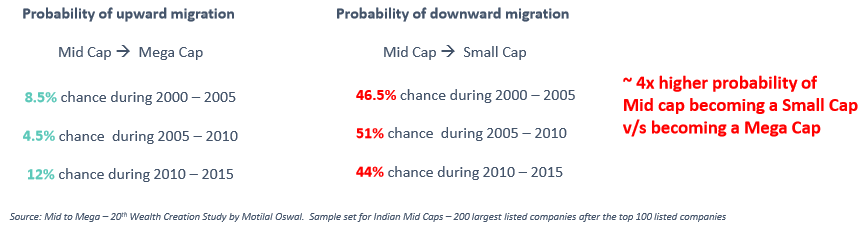

DSP Mutual Fund recently revisited this data wearing a probability hat and concluded that:

- There is a 4:1 chance of a mid cap becoming a small cap than becoming a mega cap

- Hence there is a greater chance of a mid cap destroying value v/s creating value

And so...

If you get it right with mid caps, you can really hit the ball out of the park. But the terrain is fraught with danger too. An investor or money manager must have a solid framework in place to evaluate mid-cap stocks to invest in. Equally important is that the framework must help eliminate value destroyers.