India has become the world’s most populous country according to UN population estimates, concluding a multi-century era of China holding the number-one spot. As its population surpasses 1.4 billion, one wonders whether India holds as much economic potential as other global superpowers.

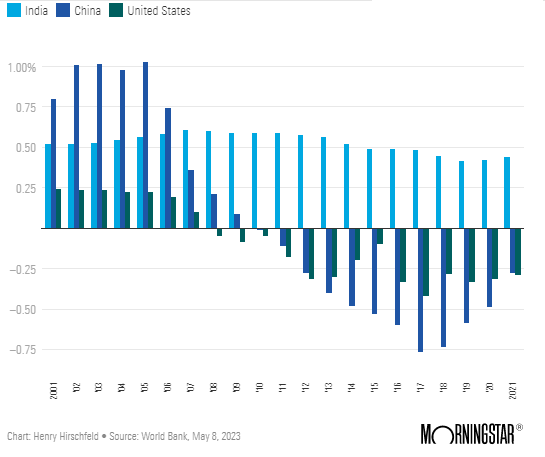

While its gross domestic product (GDP) still lags well behind that of the U.S. or China, the number of Indians of working age (those between 15 and 64) has continued to grow while the American and Chinese workforces are in decline.

Annual Change in GDP

This vast Indian workforce is a demographic dividend: an economic advantage caused by a change in a country’s age structure.

Developing countries tend to benefit from demographic dividends as their fertility rate decreases and more resources are diverted to education and health, increasing the country’s overall productivity. In the case of India, a growing working-age population has allowed the country’s pace of economic output to keep up with historically wealthier peers.

Demographic trends may not always indicate future economic prosperity. A variety of factors may influence a country’s overall wealth, including natural resource availability, macroeconomic policy, and geopolitical strife.

However, as Morningstar’s Head of Global Equity Research Daniel Rohr explains, long-term investors would benefit from considering what demographic change could mean for their portfolios.

While the influence of demography may be imperceptible quarter to quarter, he suggests, it can prove decisive in the long-term.

Consider China, which until last month, had been the world’s most populous country for multiple consecutive centuries. Its seemingly ever-expanding population, combined with increasing labor productivity and urbanisation, had sparked tremendous economic growth in the 1990s and early 2000s.

However, Rohr says changes to fertility and age composition have had a dramatic impact on China’s economic outlook. “In the next 10 years, we expect demographic change will drag on growth rather than drive it and radically reshape China’s economy. Population growth, already slowing, will nearly grind to a halt by 2026 amid falling births and a steady rise in mortality. The age composition of China’s population will change dramatically over the next 10 years,” ,” Rohr says.

This, combined with a shrinkage in China’s rural labor supply, is likely to have a negative impact on GDP.

Emerging Markets and India

Earlier this year, Philip Petursson, the chief investment strategist at IG Wealth Management, asserted that “we’re entering a 5-year cycle of outperformance on the part of emerging markets.” However, Petursson warns against being focused on countries rather than companies. “The solidity of countries is not as important as that of individual companies. It’s better to look at emerging markets as a broad category, rather than to look at individual countries. The goal is to diversify, and remember that it’s an area where active management can outperform.”

Emerging markets do not have an official, universally agreed definition, however, generally refer to markets of developing economies which have seen considerable economic growth and possess some, but not all characteristics of a developed economy. According to IMF data, the 24 countries making up the MSCI Emerging Market Index today combined to 13.4% of global nominal GDP in 1988. That number grew to 35.7% by the end of 2022. Over the past 10 years, emerging markets were responsible for 53.3% of the world’s nominal GDP growth.

The emerging-markets portfolio reflects the changing landscape. China has grown into the dominant emerging-markets economy, now representing more than 28% of the Morningstar Emerging Markets Index. India has had a similar trajectory, starting at about 2% of the portfolio in 1998 and growing to over 17%. Countries like Mexico and South Africa have steadily lost ground to faster-growing countries.

Some funds are overweight India. The Vanguard FTSE Emerging Markets Shares ETF has a 16% weighting compared to the category benchmark of 13%. It also has a large exposure to China and Taiwan. The iShares MSCI Emerging Markets ETF has a smaller weighting towards India (13.8%).

All the above information has been taken from Why investors should look at emerging markets again and How Australians can invest in India's growth and Guide to EMs

Also Read:

India has a very heterogenous set of investable opportunities

How do we increase per capital GDP?

Why India is at an inflection point

A frank assessment of the Indian economy