History does repeat itself.

A stock market carnage and investors want to kick their stocks to the kerb. Suddenly, a litany of risks have sprouted which were nowhere in sight when the stocks were on a journey to the moon. In fact, a blizzard of commentaries warning that a correction was just a matter of time was conveniently ignored.

Last month, an investor told me that he is struggling with a certain decision. He made an amazing amount of money from his investment in a mid-cap fund, much more than anticipated. That’s good, isn’t it? You would think so till you read his articulation of the dilemma he found himself in.

Should I exit the fund and book profits? Yes. That sounds smart.

But what if the market goes up even more and I miss out? Then leave the money there and wait for the market to keep rising.

But what if If I leave the money in the fund and the market slumps? That too is a risk.

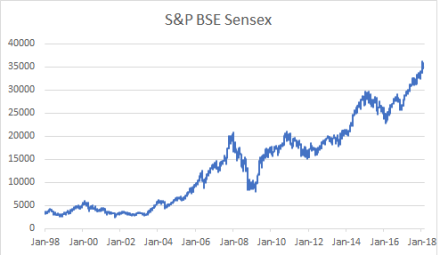

All the above uncertainty and playing of various scenarios in his mind paralysed him into inaction. Now, as the Sensex moved from a high of 36,443 last Monday (January 29), to a low of 34,520 yesterday, he will probably rue the day he decided not to sell.

There is a reason that financial advisers shout themselves hoarse on the need to have something tangible to work towards. State a goal in terms of time frame. Alternatively, have a return target and a plan of action on whether you will withdraw just the gain and keep the capital invested or will pull out the entire investment. In other words, have an investing thesis so that the market does not make decisions for you and your wealth does not become a source of anxiety.

An investment thesis basically involves putting your money behind a principled decision. It could apply to the process behind picking up a stock, deciding when to exit your investment, to why you should bet on horses. An investment thesis relies on a well thought out strategy and hence applies to any form of investing.

A report in Business Line recently revealed that 80% of investors in direct plans pull out money within a year. During volatile markets, almost 60% of redemptions were in less than three months. These investors would have acted differently had they started out with a plan in mind.

In 2016, Howard Marks shared some interesting advice in his newsletter. A pilot’s description of his job as “hours of boredom punctuated by moments of terror” could well be an analogy for investing too. He goes on to say that a big mistake investors make is to look to the market to figure out what is going on and take cues from it. But the market is not a fundamental analyst. The market is just a barometer of investor sentiment. It should not be taken too seriously. It falls. It will always do so. And always make a comeback.

Monika Halan from Mint uses numbers to make a good point on Twitter.

Don’t get emotional about the current market downturn and cash out.

Over time, you will be rewarded.

It is good to be reminded of the long-term perspective during market upheavals. The below graph tracks the Sensex close of every trading day since January 1, 1998 till February 5, 2018 (source: BSE). The CAGR over these two decades is 11.85% (source: Morningstar Direct).