Sunil Jhaveri of MSJ Capital has an interesting perspective on the role of insurance in one's life.

Many investors believe in taking a life insurance cover for themselves and their families. And in the search for a good product, they may opt for term insurance, an endowment plan or a unit linked insurance plan, or ULIP. One of them, or a combination.

I am not against insurance policies and their importance in financial planning.

But I would recommend that investors take a hard relook at the effectiveness of life insurance policies with regards to the life stage they are at.

There are 4 stages in everyone’s life:

- Accumulation Phase: Starting of one’s career

- Consolidation Phase: Mid 30s-50s

- Spending Phase (Retirement): 60s-80s

- Gifting Phase

Once an investor has amassed enough wealth during his accumulation phase, while entering consolidation phase; he should get away from the traditional thought process of continuing with these policies and look to create wealth for his retirement by switching from paying insurance premiums to investing in equity mutual funds through systematic investments.

Ideally, an insurance policy should be taken at a young age, as soon as one starts earning.

Let’s look at an individual’s life to make sense of this. Let’s call him Anand.

Accumulation Phase

Anand starts working at the age of 25. At this point, he should opt for a pure term cover which gives money to the family in case he tragically passes away. Anand is in the accumulation phase since he has just started earning and is now in a position to accumulate various assets by investing his savings.

Ideally, he should start systematically investing in equity as an asset class (preferably through the mutual fund route).

At 27 he gets married. Now he has his parents and wife to look after. As he grows in his career, his income begins to increase. Which means his savings potential rises too and he continues to invest in SIPs for his retirement. But his expenses also rise. He may graduate to a 4-wheeler from a 2-wheeler.

At the age of 29, his first child is born and he starts to look for a bigger house. Now he has an increase in expenses, dependents and increase in savings goals too – Buying a bigger house (by taking a housing loan), Retirement, Child’s education and marriage.

During this phase of his life he has:

- Started taking loans to have better quality of life; lower income = borrowing for accumulating assets like car and house.

- Increasing his standard of living; thereby getting his family used to a better quality of life.

- Investing and increasing his investments at every increment in his salary.

This is when term insurance comes in handy since this is when his family and dependents are most vulnerable. Besides the term cover taken at the start of his career, which should provide an income for his family, he should also take a term cover for all his loans so that his family is not left in any debt should he pass away.

Consolidation Phase

This is the time Anand increases his savings, invests wisely and builds wealth, and pays off all loans.

As this phase progresses, he should not continue to hold onto these insurance policies and pay premiums on the same. (This will depend on each individual as to what investment and asset creation is sufficient for a family when the bread earner is no longer alive.)

If the same amount of premium gets invested in say further SIPs, Anand can actually retire a very wealthy man through these investments. Original sum assured in such a case will look very miniscule (as inflation also would have eroded the value of such initial sum assured) and Anand would have been much better off with investments in mutual fund schemes through SIP.

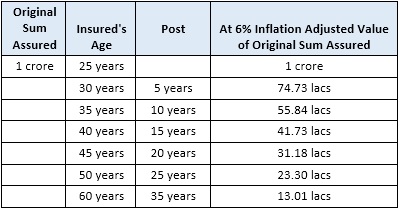

What looked like a good amount of sum assured when the policy was taken out at the age of 25, it looks abysmally low years down the road. The original value of Rs 1 crore has come down to Rs 23.30 lakh in purchasing power after 25 years of him paying premiums on these policies. Anand needs to take a hard look at continuing with these policies and their effectiveness in his overall scheme of financial planning.

He must relook his assets/liabilities, his investments in insurance v/s outstanding liabilities, value of his investments through SIP for various life goals and accordingly take a call of surrendering or discontinuing all his life insurance and money back policies. But he must simultaneously concentrate on furthering his investments and generating wealth.

The above makes it amply clear – the importance of investment v/s paying premiums under either Term or Money Back Policies.

By converting from Money Back/Term Policy to investment in SIP from say 45-65 years (20 years), Anand has increased the possibility of generating wealth beyond what traditional insurance policies could have generated over the same period of time. In the case of traditional policies, inflation adjusted values are actually on negative side v/s huge positive that would happen over the same period in the case of well managed equity funds over the same period.

This is NOT a general rule for every investor to get out of insurance policies and invest in equity mutual funds via SIPs. Here’s what to keep in mind.

- Take Term Insurance at the start of your career and cover your loans with additional cover.

- Simultaneously create SIPs for different life goals and increase the same with every increment. In short, do not depend on insurance policies to generate wealth.

- Assess your situation during the Consolidation phase and be debt free latest by 45-50 years of age, and stop paying for your insurance policies. Same premiums or additional can go towards creating further SIPs to generate long term wealth (better inflation adjusted than what these policies can manage).

- During Consolidation phase, take stock of your assets/liabilities, investments, and other factors at various times over this phase. If you objectively believe you are comfortable and have no outstanding loans, then adopt the above strategy, since continuing with paying insurance premiums will be detrimental to your financial health.