Two months ago, Walmart confirmed officially that it would pay $16 billion to acquire a 77% stake in Flipkart, an Indian online retail firm, translating into a valuation of more than $21 billion for a firm founded just over 10 years ago.

Now Walmart and Flipkart are in talks with additional potential investors to raise $2 billion to help accelerate growth of the business in India.

Aswath Damodaran, Professor of Finance at the Stern School of Business at NYU, wrote a while back on the deal. Here is an excerpt.

Is Flipkart an Amazon wannabe?

Flipkart was founded in October 2007 by Sachin and Binny Bansal, both ex-Amazon employees and unrelated to each other, with about $6,000 in seed capital. The revenues for the company increased from less than $1 million in 2008-09 to $75 million in 2011-12 and accelerated, with multiple acquisitions along the way, to reach $3 billion in 2016-2017. The revenue growth rate in 2016-17 was 29%, down from the 50% revenue growth recorded in the prior fiscal year.

Flipkart lost money in its early years, as growth was its priority. More troubling, though, is the fact that the company not only continues to lose money, but that its losses have scaled up with the revenues. In the 2016-17 fiscal year, for instance, the company reported an operating loss of $0.6 billion, giving it an operating margin of minus 40%. The continued losses have resulted in the company burning through much of the $7 billion it has raised in capital over its lifetime from investors.

- Borrowed money to plug cash flow deficits

Perhaps unwilling to dilute their ownership stake by further seeking equity capital, the founders have borrowed substantial amounts. The costs of financing this debt jumped to $671 million in the 2016-17 fiscal year, pushing overall losses to $1.3 billion. Not only are the finance costs adding to the losses and the cash burn each year, but they put the company’s survival, as a stand-alone company, at risk.

- It has had issues with governance and transparency along the way

Flipkart has a complex holding structure, with a parent company in Singapore and multiple off shoots, some designed to get around India’s byzantine restrictions on foreign investment and retailing and some reflecting their multiple forays raising venture capital.

Is Walmart an ageing giant?

- Growth has slowed to a trickle

Walmart experienced stellar growth in the 1980s and 1990s from an Arkansas big-box store to a dominant U.S. retailer. It reshaped the retail business in the U.S. Walmart’s growth engine started sputtering more than a decade ago, partly because its revenue base is so overwhelmingly large ($500 billion in 2017) and partly because of saturation in its primary market, which is the U.S.

- More of it is being acquired

As same store sales growth has leveled off, Walmart has been trying to acquire other companies, with Flipkart just being the most recent (and most expensive) example.

- Its base business remains big box retailing

While acquiring online retailers like Jet.com and upscale labels like Bonobos represent a change from its original mission, the company still is built around its original models of low price/ high volume and box stores. The margins in that business have been shrinking, albeit gradually, over time.

- Its global footprint is modest

For much of the last few years, Walmart has seen more than 20% of its revenues come from outside the United States, but that number has not increased over the last few years and a significant portion of the foreign sales come from Mexico and Canada.

Walmart is a mature company, perhaps on the verge of decline. Very few companies age gracefully, with many fighting decline by trying desperately to reinvent themselves, entering new markets and businesses, and trying to acquire growth. A few do succeed and find a new lease on life. The Flipkart acquisition is one of the strongest signals that the company does not plan to go into decline, without a fight. That may make for a good movie theme, but it can be very expensive for stockholders.

The common enemy

Flipkart and Walmart are very different companies, at opposite ends of the life cycle.

Flipkart is a young company, still struggling with its basic business model, that has proven successful at delivering revenue growth but not profits.

Walmart is an aging giant, still profitable but with little growth and margins under pressure.

They are both facing off against perhaps the most feared company in the world, Amazon.

Over the last few years, Amazon has aggressively pursued growth in India, conceding little to Flipkart, and shown a willingness to prioritize revenues (and market share) over profits.

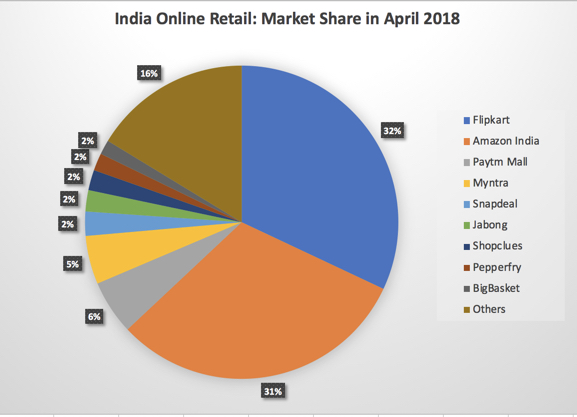

While Flipkart remains the larger firm, Amazon India has continued to gain market share, almost catching up by April 2018, and more critically, it has contributed to Flipkart’s losses, by being willing to lose money itself.

Over the last 20 years, Walmart has seen Amazon lay waste to the brick and mortar retail business in the U.S. and while the initial victims may have been department stores and specialty retailers, it is quite clear that Amazon is setting its sights on Walmart and Target, especially after its acquisition of Whole Foods.

It may seem like hyperbole, but a strong argument can be made that while some of Flipkart and Walmart’s problems can be traced to management decision, scaling issues and customer tastes, it is the fear of Amazon that fills their waking moments and drives their decision making.

Will the $16 billion price for a 70% stake in Flipkart pay off?

No matter what one thinks of Flipkart’s business model and its valuation, it is true, at least after the Walmart offer, that the game has paid off for earlier entrants. By paying what it did, Walmart has made every investor who entered the pricing chain at Flipkart before it a “success”, vindicating the pricing game, at least for them. If the essence of that game is that you buy at a low price and sell at a higher price, the payoff to playing the pricing game is easiest seen by looking at the Softbank investment made just nine months ago, which has almost doubled in pricing, largely as a consequence of the Walmart deal. In fact, many of the private equity and venture capital firms that became investors in earlier years will be selling their stakes to Walmart, ringing up huge capital gains and moving right along. Is it possible that Walmart is playing the pricing game as well, intending to sell Flipkart to someone else down the road at a higher price?

My assessment: Since the company’s stake is overwhelming and it has operating motives, it is difficult to see how Walmart plays the pricing game, or at least plays it to win. There is some talk of investors forcing Walmart to take Flipkart public in a few years, and it is possible that if Walmart is able to bolster Flipkart and make it successful, this exit ramp could open up, but it seems like wishful thinking to me.

- The Big Market Entrée (Real Options)

The Indian retail market is a big one, but for decades it has also proved to be a frustrating one for companies that have tried to enter it for decades. One possible explanation for Walmart’s investment is that they are buying a (very expensive) option to enter a large and potentially lucrative market. The options argument would imply that Walmart can pay a premium over an assessed value for Flipkart, with that premium reflecting the uncertainty and size of the Indian retail market.

My assessment: The size of the Indian retail market, its potential growth and uncertainty about that growth, create optionality. But given that Walmart remains a brick and mortar store primarily and that there is multiple paths that can be taken to be in that market, it is not clear that buying Flipkart is a valuable option.

As with every merger, I am sure that the synergy word will be tossed around, often with wild abandon and generally with nothing to back it up. If the essence of synergy is that a merger will allow the combined entity to take actions (increase growth, lower costs etc.) that the individual entities could not have taken on their own, you would need to think of how acquiring Flipkart will allow Walmart to generate more revenues at its Indian retail stores and conversely, how allowing itself to be acquired by Walmart will make Flipkart grow faster and turn to profitability sooner.

My assessment: Walmart is not a large enough presence in India yet to benefit substantially from the Flipkart acquisition and while Walmart did announce that it would be opening 50 new stores in India, right after the Flipkart deal, I don’t see how owning Flipkart will increase traffic substantially at its brick and mortar stores. At the same time, Walmart has little to offer Flipkart to make it more competitive against Amazon, other than capital to keep it going. In summary, if there is synergy, you have to strain to see it, and it will not be substantial enough or come soon enough to justify the price paid for Flipkart.

Earlier, I noted that both Flipkart and Walmart share a common adversary, Amazon, a competitor masterful at playing the long game. I argued that there is little chance that Flipkart, standing alone, can survive this fight, as capital dries up and existing investors look for exits and that Walmart’s slide into decline in global retailing seems inexorable, as Amazon continues its rise. Given that the Chinese retail market will prove difficult to penetrate, the Indian retail market may be where Walmart makes its stand. Put differently, Walmart’s justification for investing in Flipkart is not they expect to generate a reasonable return on their $16 billion investment but that if they do not make this acquisition, Amazon will be unchecked and that their decline will be more precipitous.

My assessment: Of the four reasons, this, in my view, is the one that best explains the deal. Defensive mergers, though, are a sign of weakness, not strength, and point to a business model under stress. If you are a Walmart shareholder, this is a negative signal and it does not surprise me that Walmart shares have declined in the aftermath. Staying with the life cycle analogy, Walmart is an aging, once-beautiful actress that has paid $16 billion for a very expensive face lift, and like all face lifts, it is only a matter of time before gravity works its magic again.

Why I think that the odds are against Walmart on this deal

Given what it paid for Flipkart.

If the rumors are true that Amazon was interested in buying Flipkart for close to $22 billion, I think that Walmart would have been better served letting Amazon win this battle and fight the local anti-trust enforcers, while playing to its strengths in brick and mortar retailing.

I have a sneaking suspicion that Amazon had no intent of ever buying Flipkart and that it has succeeded in goading Walmart into paying way more than it should have to enter the Indian online retail space, where it can expect to lose money for the foreseeable future.

Sometimes, you win bidding wars by losing them!

You can read the original and more detailed blog post here.

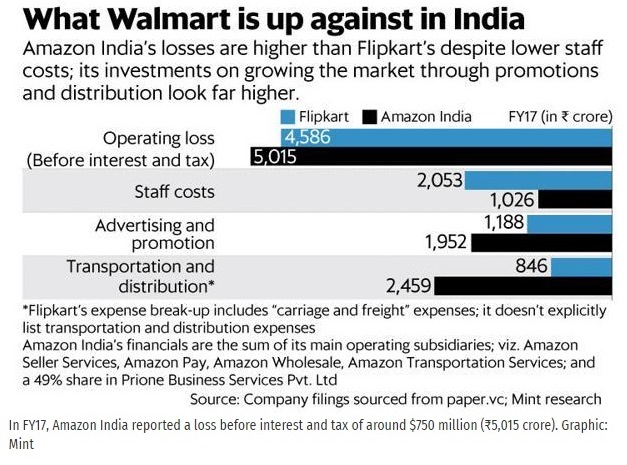

Taking off from the above post, a very interesting article appeared in Mint last month where the stock analyst states that if Flipkart losses haven't alarmed Walmart, Amazon India's should.

Brushing off Flipkart’s high losses is one thing, doing the same with Amazon.com Inc.’s Indian unit is quite another. In FY17, Amazon India reported a loss before interest and tax of around $750 million (₹5,015 crore). This is despite the fact that it has considerably lower outgoes than Flipkart in areas such as staff costs. This suggests that Amazon India has been spending far higher amounts on business promotion and logistics, evidently with the view of growing its market share. This should be a reason for big worry at Walmart’s headquarters.

Amazon is obsessed with market leadership, and no cost seems too high for it to get to this target in the markets it fancies. “We believe that a fundamental measure of our success will be the shareholder value we create over the long term. This value will be a direct result of our ability to extend and solidify our current market leadership position,” Jeff Bezos wrote to shareholders in the company’s 1997 annual report. Its shareholders have been willing partners in this strategy, and have funded losses and lived with suboptimal returns for years.

Walmart has daringly jumped into a market where Amazon has already invested billions of dollars. For now, it looks more like bravado than bravery.