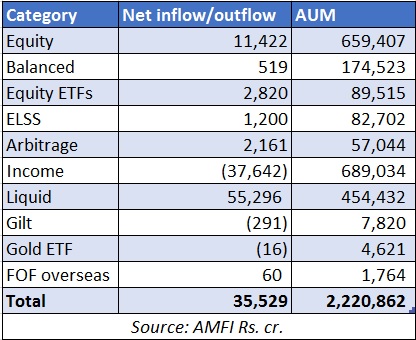

Despite volatility, investors continued to stay the course in equities which is evident by Rs 11,422 net inflows received in equity funds in October 2018, shows Association of Mutual Funds in India, or AMFI, data. Industry experts are of the view that healthy inflows in SIPs has contributed to this momentum. The industry has collected Rs 7,985 crore in SIPs in October 2018, taking the total inflow to Rs 52,472 crore this fiscal.

Balanced funds continued to lose sheen after the introduction of dividend distribution tax for equity schemes in Budget 2018. From receiving inflows of Rs 7,665 in January 2018, inflows have trickled down to just Rs 519 crore in October 2018. Balanced funds assets stood at Rs 1.74 lakh crore as on October 2018.

Among other categories of equity funds, tax saving funds saw net inflows of Rs 1,200 crore in October 2018.

Net inflow/outflow in October 2018

Income funds lose sheen

Income funds saw net outflows to the tune of Rs 37,642 crore in October 2018, largely due to redemptions from ultra short term bond funds. Net outflows have ballooned to Rs 1.22 lakh crore YTD in this category. Income funds account for 31% or Rs 6.89 lakh crore of industry’s total Rs 22.23 lakh crore asset base.

Liquid funds make a comeback

Liquid funds, which saw net outflows to the tune of Rs 2.11 lakh crore in September due to quarter end, received inflows of Rs 55,296 crore in October 2018.

Overall, industry’s total asset base inched up by 1% from Rs 22.04 lakh crore in September 2018 to Rs 22.23 lakh crore in October 2018 due to healthy inflows in liquid and equity funds.