As technology continues to develop, we begin to find new ways to enjoy our favorite things. And in the bargain, old industries get innovatively disrupted: Netflix (DVD and videos), Wikipedia (encyclopedia industry), Uber (taxi industry), Amazon (brick-and-mortar retail), etc.

In this post, Patrick Fisher states that companies that best use technology to create a competitive advantage will win. The world's largest companies, by market capitalization, are software companies: Alphabet, Amazon, Apple, Facebook, Microsoft. But as technologies become more and more pervasive across industries and functions, companies varied as Goldman Sachs, Exxon, GE, Citi and Walmart are becoming “technology companies” as well. When pointing out that the distinction between a technology company and non-technology company is becoming less relevant, he asks a pertinent question: Is Tesla a tech company learning to become and automotive organization or is Ford an automobile company learning to become a tech company?

On the subject of digital disruption, Emma Wall, Morningstar’s senior international editor, penned down her thoughts on Morningstar.co.uk.

Artificial Intelligence, or AI, will make all businesses more efficient in the future, says Janus Henderson – not just tech stocks – driving up productivity and adding a significant boost to global GDP.

AI will be implemented at every stage of the production chain, from factory manufacturing and smart buildings to autonomous drivers for distribution, says Richard Clode manager of the Global Technology Fund. “Blue-collar jobs were replaced by machines in the industrial revolution. Now white-collar jobs are being replaced by or robotic algorithms,” he says.

Just as the agricultural industry was disrupted by the advent of machinery, so chatbots are now replacing call centre workers. Quoting a Business Insider report, Clode lists the roles that are most likely to be replaced by robots over the next 20 years as telemarketers, accountants, retail salesperson, estate agents, typists and commercial pilots.

However, this won’t mean people will be left unemployed – as the scaremongers like to threaten – we won’t all be replaced by robots. Instead Clode likens the shift to the impact of ATMs on bank tellers. “Bank tellers were not replaced by ATMS,” he explains. “Instead their roles changed. Rather than counting and distributing money, which could now be done faster by a machine, bank tellers more value add jobs; such as selling you wealth management services or insurance – which is a more productive use of the employee’s time.”

So far, disruptive technologies have broadly impacted just two sectors; traditional media and retail. Next up, Clode expects financial services, healthcare and transport to be impacted.

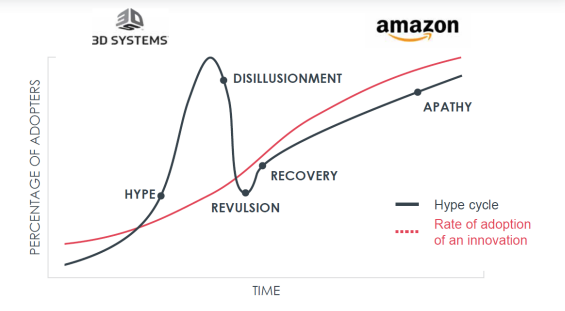

He believes he key themes driving disruption are payment digitalisation, internet transformation, next generation infrastructure and AI. But there will be victims of this transition – not all companies will survive the revolution. “The trends are consistent, but the stocks can be subject to extreme volatility,” he warned. “The trick is to work out which are the long-term winners.”

He cited the two examples of Google and 3D Systems – both affected by investor hype since their IPOs, but only one has gone on to deliver consistently for shareholders.

3D Systems floated at $10 in 1988, but really came in investors’ attention in 2012 when 3D printing hit the headlines. Investor hype pushed the share price to $94 in January 2014, but it subsequently fell to $8.95 the following year, and now sits at $12.51. Google's IPO took place in August 2004 at $85 per share. It has been a bumpy ride –but the stock is now worth $1,092 and has been as high as $1,291 this year.