Lackluster performance of equity funds is making investors hit the panic button, which is evident by the sustained decrease in equity flows. The month of December was no exception.

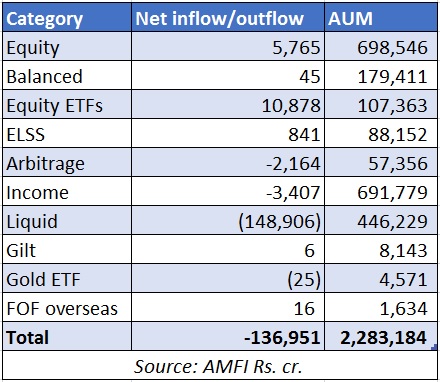

The latest Association of Mutual Funds in India, or AMFI, data shows that equity fund collections fell to Rs 5,765 crore in December 2018 as compared to Rs 7,579 crore in November 2018. The dip in net inflows was primarily due to higher redemptions in December 2018 which stood at Rs 10,673 crore as compared to Rs 6,858 crore in November 2018. Net inflows in pure equity funds YTD stood at Rs 81,211 crore as on December. The AUM of equity funds stood at Rs 6.98 lakh crore.

Volatile markets have impacted the returns of most equity funds. Except technology funds, all other categories of equity funds delivered negative returns over the last one year. For instance, infrastructure (-20.15%), small cap (-20.44%), energy sector funds (-15.69%), mid cap (-14.15%) were the worst hit over a one-year period. Distributors said that many direct plan investors have started exiting or stopping their SIPs after seeing negative returns.

Net inflow/outflow in December 2018

Arbitrage

Arbitrage funds too saw net outflows to the tune of Rs 2,164 crore. The category currently manages assets worth Rs 57,356 crore.

ELSS

Equity linked saving schemes received net inflows of Rs 841 crore in December 2018. ELSS schemes manage assets worth Rs 88,152 crore, which is 4% of industry AUM.

Liquid Funds

Liquid funds saw net outflows of Rs 1.48 lakh crore in December 2018 due to quarter end. Liquid funds manage assets worth Rs 4.46 lakh crore, which is 20% of industry’s total assets.

New Fund Offers

There were three ETF launches in December which collectively mopped up Rs 17,125 crore. The bulk of the money (Rs 17,000 crore) was collected by Reliance Mutual Fund – CPSE ETF FFO 3. As a result, equity ETF assets crossed Rs 1 lakh crore for the first time. Income funds collected Rs 4,176 crore. Equity funds, including close end, collected Rs 1,255 crore. All in all, collections from NFOs stood at Rs 22,966 in December 2018.

All in all, the industry’s asset base fell by 5% from Rs 24.03 lakh crore in November 2018 to Rs 22.85 lakh crore in December 2018 largely due to higher outflows from liquid funds.