A valuation-driven investment approach could potentially help improve return prospects.

Dhaval Kapadia, Director, Portfolio Specialist, Morningstar Investment Advisers India, explains why valuations matter even for long-term investors.

Why do we believe that valuations are a key driver of returns and risk generated from equity investments?

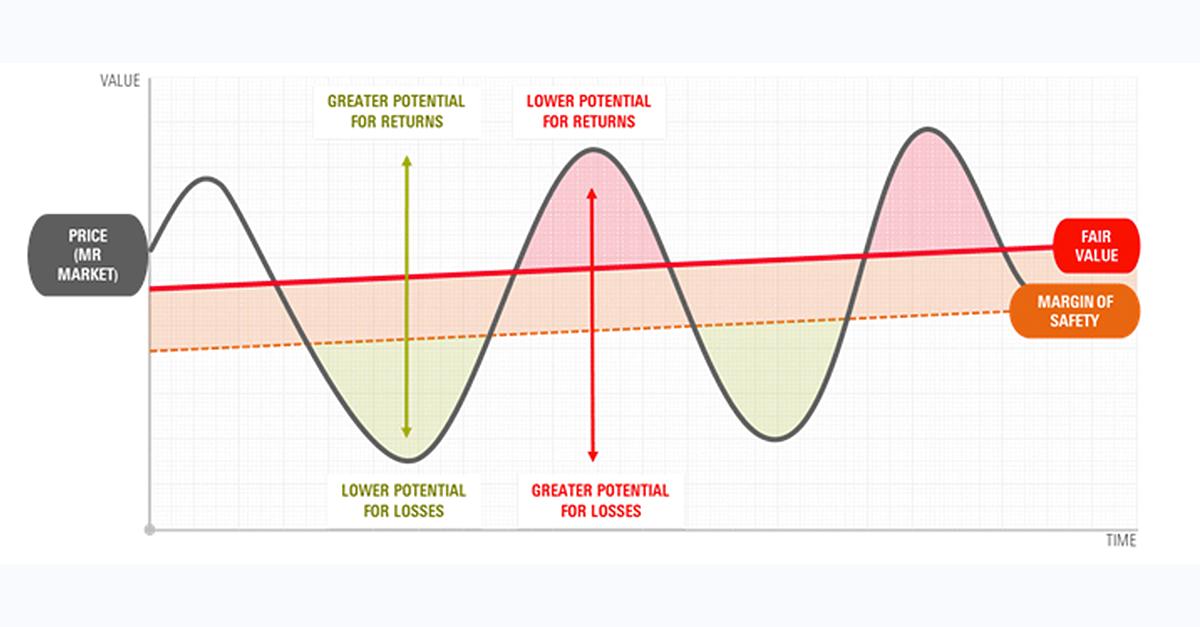

- X-axis: Time

- Y-axis: Value

- Grey line: Price of a security or basket of stocks referred to as Mr. Market

- Red line: Fair value (FV) of a stock / market say based on its underlying earnings

Typically, over longer periods of time, the FV of an equity index or stock tends to increase gradually as underlying earnings grow. Hence the red line gradually moves upwards. Whereas, the grey line tends move around a fair bit.

At times, the market may be overvalued i.e. when the price of an index such as Sensex or Nifty is trading significantly above its FV. At other times it may be trading near or below its FVwhen it is referred as ‘market is at FV or undervalued’.

Typically, we believe that valuations tend to revert to their long-term averages or mean levels over the medium to long term.

When the market is trading above FV, the potential for returns is low whereas the potential for losses is high. When the market is trading below FV, the potential for returns is high and potential for losses is low.

Clearly, the risk-reward is superior when the market is trading below its FV as compared to when it's trading above FV.

Valuations are typically tracked by investors while evaluating individual stocks. Do they matter if one is investing in a basket or portfolio of stocks such as a large cap index.

Let’s look at how the market has behaved across time periods.

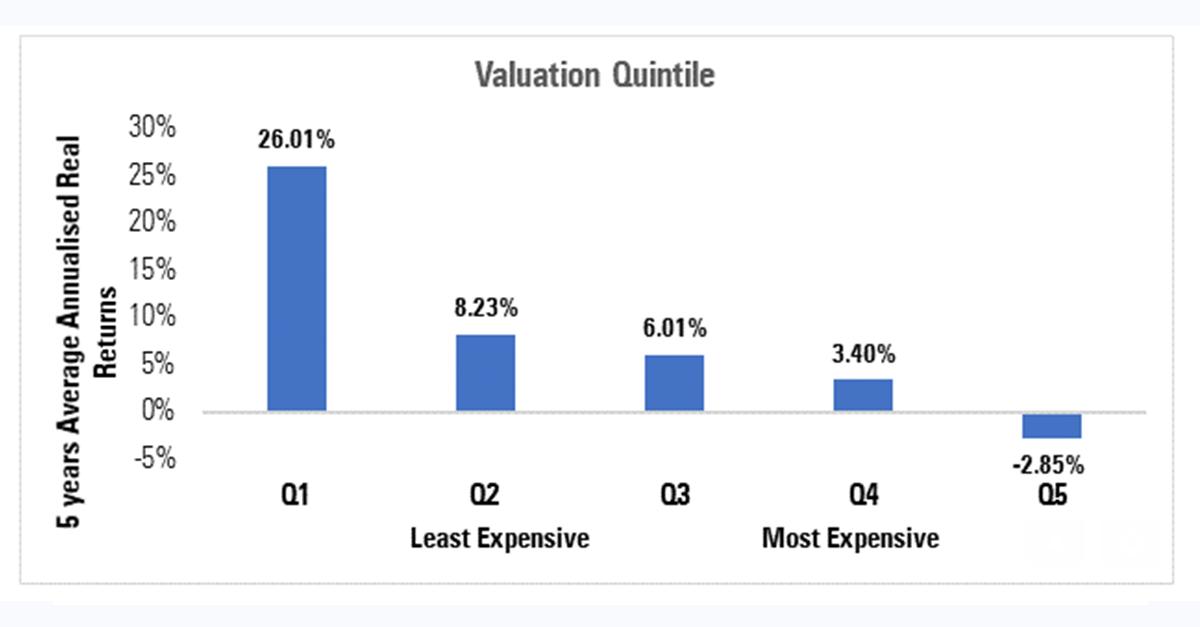

The above chart shows real returns for 5-year monthly rolling periods for the Sensex starting from January 1991. To elaborate, we’ve calculated the returns every month for each 5-year period starting from January 1991 to December 2018.

These returns are then adjusted for inflation to make them comparable.

For instance, the 5-year real return as on December 1995 if one had invested in the Sensex in Jan 1991 was 25.93%.

Similarly, the 5 year real return for each subsequent month was calculated.

All of these monthly return periods were divided into 5 valuation buckets from least to most expensive. And the average return for each valuation bucket is displayed . Clearly, if one had invested in the least or lesser expensive periods the returns were higher than in other more expensive periods.

In fact, investments made during the most expensive periods (Q5) actually generated negative real returns on an average even if the investment was held for 5 years.

Clearly, the valuations at which one makes equity investments has an impact on the returns generated even over longer time periods.

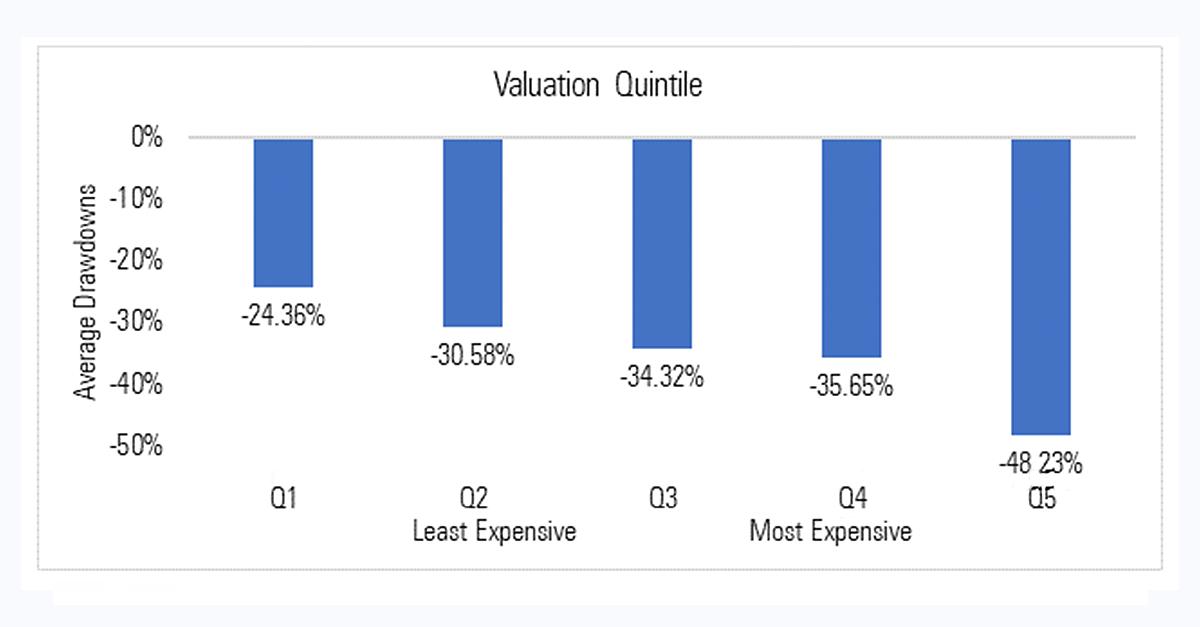

Let’s look at the impact of valuations on potential losses.

This chart shows the average drawdowns or losses for the Sensex for the same period (January 1991 to December 2018).

Here again, the observations have been split or divided into the same valuation buckets or quintiles based on valuation levels.

Drawdowns are falls in investment values during 5-year holding periods which in most cases were recovered if one held onto the investment for the entire 5-year period.

Clearly, the average drawdowns / falls in investment values for the Sensex were greater if one invested in more expensive periods.

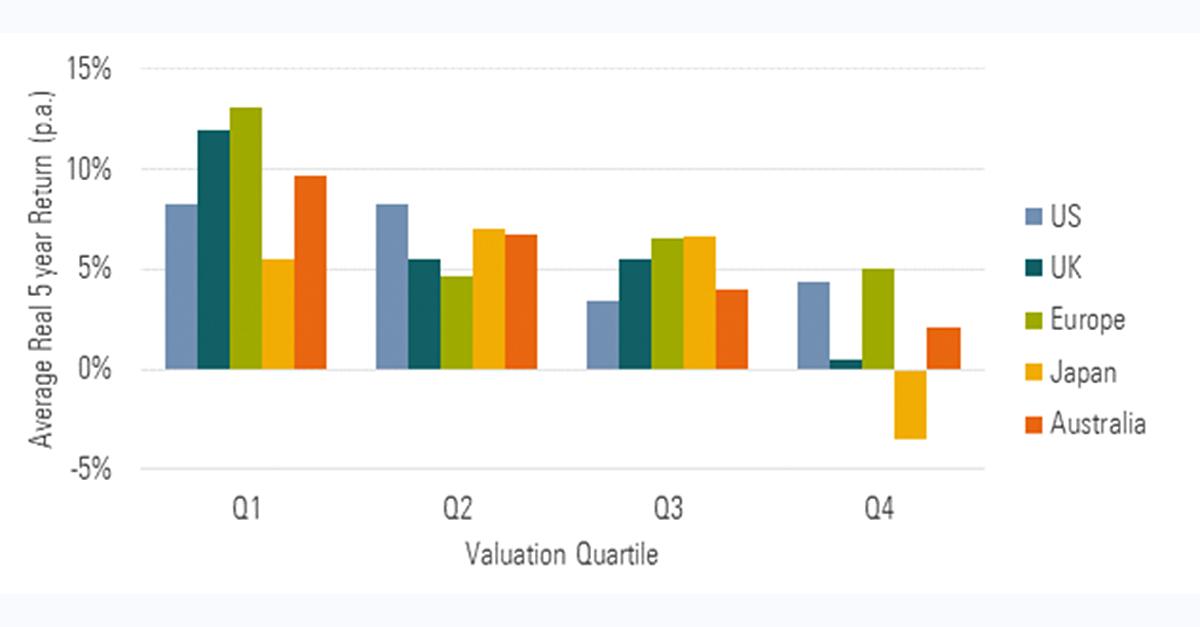

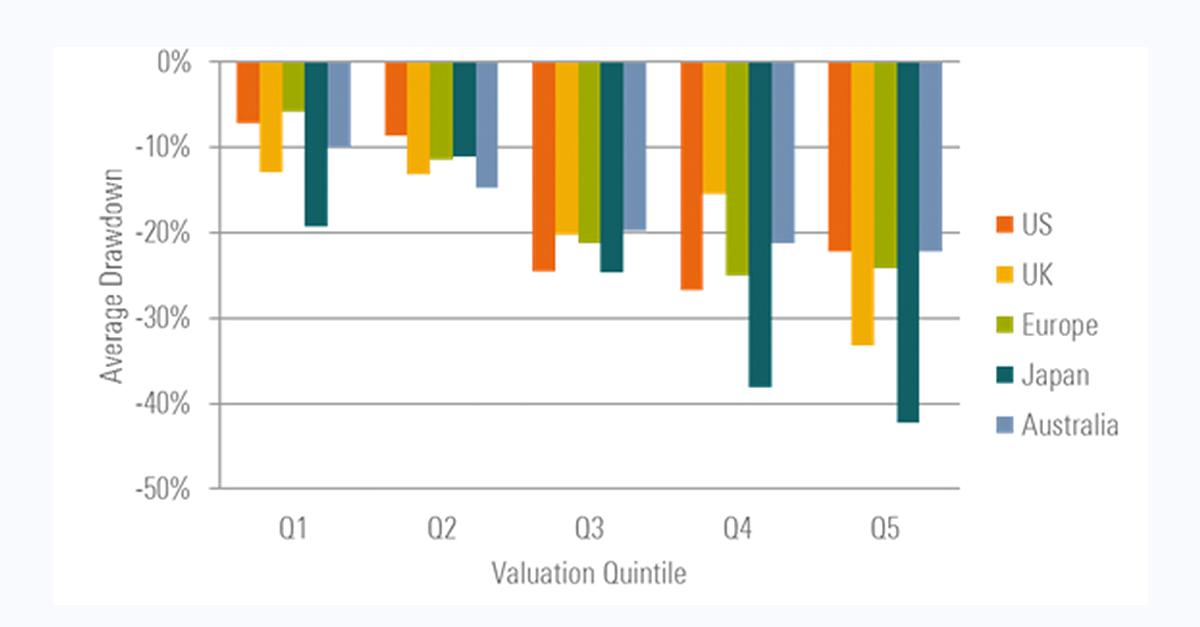

A similar exercise was carried out for other major markets globally. Again we calculated 5-year real returns for each market index and divided them into four valuation buckets from least to most expensive.

The trend is quite similar with real returns falling when valuations are higher at the time of investment.

Even average drawdowns generally tend to increase with rising valuation levels.

Clearly, valuations do play an important role in driving equity performance from a risk & return perspective even over long holding periods such as 5 years and above.

How does one include valuation while building asset allocation models?

While building asset allocation models, we follow a process.

The first step is to identify the opportunity set of asset classes to be included in the model.

Next, we build long term (10 years and above) risk and return estimates for each asset class or index based on fundamental factors such as inflation expectations, dividend yield growth and earnings growth. For instance, we build risk and return estimates for Indian large caps, mid caps & small caps.

These long term returns expectations are then adjusted based on current market valuations. If markets are overvalued relative to historical levels, the returns would be adjusted downwards and vice-versa.

Asset class weights are adjusted based on risk and return expectations of each asset class.

For instance, if we believe Indian equities are broadly overvalued the we would move to underweight. Similarly, we would assess the risk-reward for large, mid and small and accordingly adjust weights for each asset class.

These risk and return estimates are reviewed on a regular basis.