At Morningstar, we have always advocated term insurance. It’s the purest form of insurance and the cheapest. Not to mention, extremely simple to comprehend.

Having said that, this form of insurance has its own set of nuances.

Abhishek Kumar of SahajMoney tackled one issue in Is a lengthy term insurance policy worth it? Here he looks at an individual contemplating the purchase of a life insurance cum income plan.

The scenario:

- Individual: Amol

- Age: 25

- Gender: Male

- Requirement: Non-linked, Non-participating life insurance plan.

(Unlike a unit-linked insurance plan, or ULIP, a non-linked plan is a traditional insurance plan. Non-participating life insurance policy is one whose policyholders do not receive dividends.)

Specifics of this plan:

- Annual Premium (including GST) = Rs 2.05 lakhs

- Premium payment term = 12 years

- Policy term = 12 years, in this case, once the policy holder turns 37 the sum assured ceases to exist

- Payout Period = 12 years with payout of Rs 3 lakhs each year (1.5x annual premium amount excluding taxes)

- Sum Assured: Rs 48 lakhs (24x annual premium payment)

Alternative situation:

Let’s simulate a scenario where Amol buys a term plan with a cover of Rs 50 lakh till he turns 65 (as he plans to retire by then). His premium is Rs 5,600 annually.

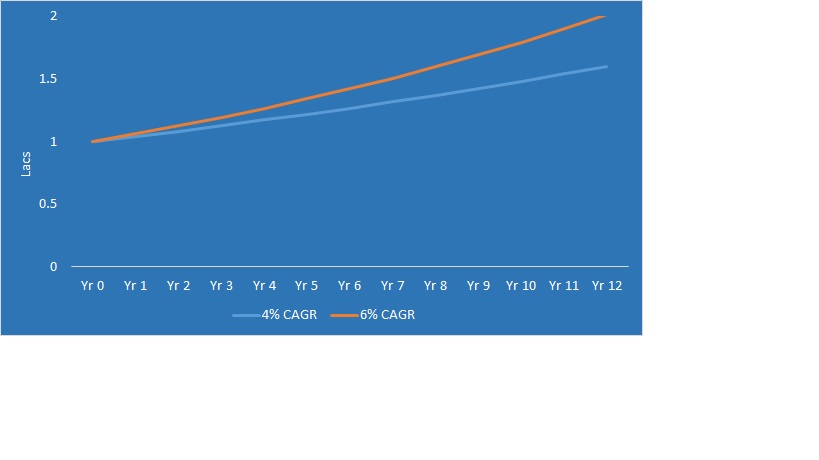

Amol then invests Rs 1.95 lakhs each year for 10 years in a debt instrument (let’s go with 10-year G-Secs) with a yield to maturity of 6% on a post-tax basis. The invested amount would double in 12 years instead of just 1.5 times (effective CAGR 4%) as proposed in the non-linked, non participating life insurance plan.

Conclusion

Amol would be better off by buying a term plan till his working years and invest the difference in other investment avenues (debt of equity) which could give a CAGR of at least 6% over a long term as that would give him better bang for the buck.

For the sake of simplicity, the above example has overlooked the tax benefit aspect of premium payment under Section 80C of India Direct Tax Law.

For the sake of simplicity, the above example has overlooked the tax benefit aspect of premium payment under Section 80C of India Direct Tax Law.