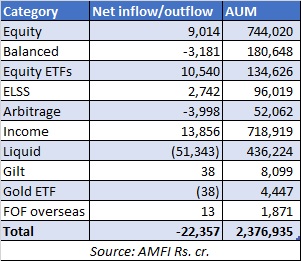

The pre-election rally helped the industry collect net inflows of Rs 9,014 crore in pure equity funds (excluding balanced, ETFs, ELSS and arbitrage) in March 2019, during which Sensex went up by 8%. In comparison, the net inflows had slowed down to Rs 3,948 crore in February 2019 when the Sensex fell by 1%.

Liquid funds saw net outflows to the tune of Rs -51,343 crore due to quarter end while balanced funds lost Rs -3,181 crore. Arbitrage funds and Gold ETFs saw net outflows of Rs -3,998 crore and Rs -38 crore, respectively. Thus, the industry saw net outflow of Rs -22,357 crore in March 2019.

Growth in FY18-19

Overall, equity funds mopped up net inflows of Rs 99,087 crore this fiscal year. As a result, equity asset base jumped by 13% from Rs 6.58 lakh crore in April 2018 to Rs 7.44 lakh crore in March 2019, representing 32% of total industry assets. The total industry AUM inched up by 2% from Rs 23.25 lakh crore in April 2018 to Rs 23.79 lakh crore in March 2019.

Equity exchange traded funds also had a stellar run this fiscal. Assets under management in this category jumped by 74% from Rs 77,501 crore in April 2018 to reach Rs 1.34 lakh crore in March 2019. This was primarily due to the good response to government’s divestments in public sector utilities through the launch of Central Public Sector Enterprises (CPSE) and further fund offer of Bharat 22 ETFs. Bharat 22 ETF mopped up Rs 8,400 crore in June 2018 and its recent FOF in March 2019 mopped up close to Rs 10,000 crore.

Net inflow/outflow in March 2019