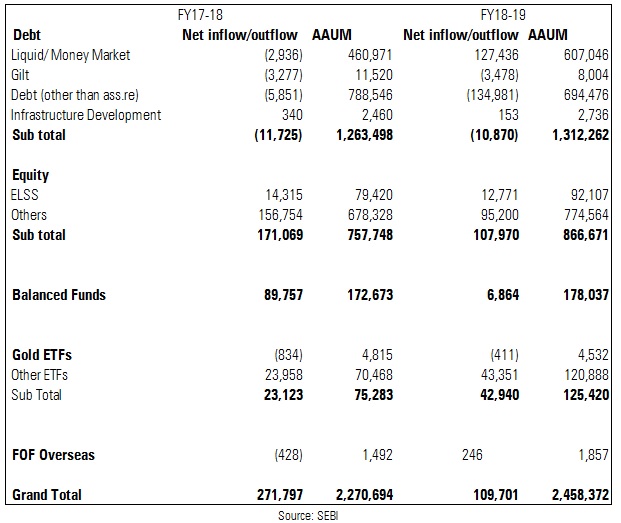

The mutual fund industry recorded a growth of 8% in assets under management last fiscal as the AUM went up from Rs 22.70 lakh crore in FY17-18 to Rs 24.58 lakh crore in FY18-19. Equity funds was major contributor (58%) to the industry’s growth. The AUM in equity funds (excluding balanced and ETFs) went up by Rs 1.08 lakh crore from Rs 7.57 lakh crore in FY17-18 to Rs 8.66 lakh crore in FY18-19. That said, net inflows in equity funds fell by 37% from Rs 1.71 lakh crore in FY17-18 to Rs 1.07 lakh crore in FY18-19 due to the volatility in markets. The Sensex was up 18.77% last fiscal.

Overall, the industry’s folio base went up by 1.11 crore from 7.13 crore to 8.24 crore during the same period. Here’s how different categories of funds fared last fiscal.

Liquid fund assets rise

Folios in liquid funds recorded a healthy 50% growth from 10.95 lakh in FY17-18 to 16.49 lakh FY18-19. Reflecting this positive trend, liquid fund assets went up by 32% from Rs 4.60 lakh crore to Rs 6.07 lakh crore during the same period.

Default crisis hit debt funds

Debt fund (excluding gilt and liquid) assets dipped by 12% from Rs 7.88 lakh crore in FY17-18 to Rs 6.94 lakh crore in FY18-19. This was partly due to the credit crisis in debt market. Higher redemptions resulted in net outflows of Rs 1.34 lakh crore in FY18-19 in this category.

ETFs are getting popular

Government’s divestment programme through CPSE ETFs and Bharat 22 ETFs boosted the AUM in this category. ETF (excluding gold) assets jumped by 72% from Rs 70,468 crore in FY17-18 to Rs 1.20 lakh crore in FY18-19. Similarly, the folio base increased by 7.51 lakh to 10.71 lakh during the same period. ETFs collected net inflows of Rs 43,351 crore last fiscal.

Balanced funds are losing sheen

Compared to net inflows of Rs 89,757 crore in FY17-18, inflows dipped drastically to Rs 6,864 crore in FY18-19. Balanced funds had gained sudden popularity as they were being offered to investors as regular income products in the form of dividends. As the tide turned, net inflows in the category are seeing a continuous decline. The introduction of dividend distribution tax has dampened the interest in this category. Balanced fund assets stood at Rs 1.78 lakh crore as on March 2019.

Despite the headwinds, the industry managed to clock a decent growth last fiscal, owing to healthy inflows in equity, liquid funds and ETFs.