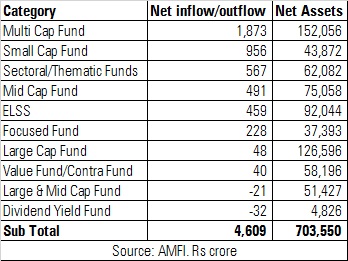

The new fiscal year has started on a mixed note for the industry. Net inflows in equity funds dropped by 49% to Rs 4,609 crore in April 2019 as compared to Rs 9,014 crore in March 2019. Overall, the industry received net inflows of Rs 1 lakh crore, largely on account of robust inflows in liquid funds. As a result, the average assets under management of the industry increased by 6% from Rs 23.79 lakh crore in March 2019 to reach Rs 25.27 lakh crore in April 2019.

Equity

In terms of categories, multi cap funds were the most favored, which received net inflows of Rs 1,873 crore, followed by small caps which collected Rs 956 crore. The BSE Small Cap Index is down by almost 4% YTD. Over a one year period, the small cap index is down by 22%. This correction seems to have presented an opportunity for investors to enter small cap funds.

Investments through systematic investment plans continued to be robust at Rs 8,238.28 crore in April 2019, up from Rs 8,055 crore in March 2019.

Folios

Equity linked savings scheme have the highest number of folios in equity category at 1.14 crore, followed by multi caps at 87.18 lakh folios. Equity folios account for 70% (5.79 crore) of the total folio base of the industry at 8.27 crore.

Debt

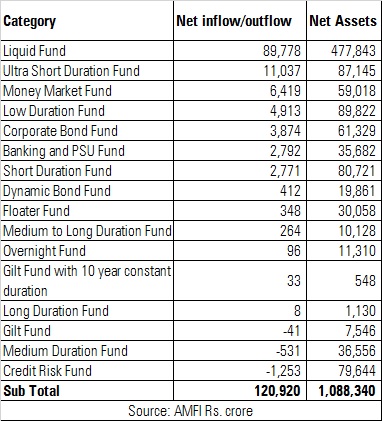

The recent episodes of downgrades seem to have turned investors cautious. This is evident by net outflows of Rs -1,784 crore from credit risk and duration funds combined. Investors are moving towards the shorter end of the yield curve (liquid, ultra-short, money market, low duration, and overnight funds) received combined net inflows of Rs 1.12 lakh crore.

Overall, debt category received total net inflows of Rs 1.20 lakh crore, largely due to inflows in liquid funds (Rs 89,778 crore) due to the start of the quarter.

Other Schemes

After eight consecutive months of net inflows, equity exchange traded funds saw net outflows of Rs 4,259 crore in April 2019. With net assets of Rs 1.31 lakh crore, ETFs have had a good run due to the issuances of Central Public Sector Enterprises (CPSE) ETFs.

Fund of funds investing overseas received net inflows of Rs 21 crore in April 2019. International funds investing in US markets have delivered double digit returns due to the rally in US stocks. The Nasdaq 100 index is up 11% over a one-year period. DHFL Pramerica Global Equity Opportunities Fund which has 63% of assets invested in US markets through its underlying fund PGIM Jennison Global Equity Opportunities Fund, has delivered 18% over one-year period. Other international funds offered by ICICI Prudential, Motilal Oswal, Franklin and Reliance have posted 17%, 15%, 12% and 15% returns respectively, during the same period.