When the Bharatiya Janata Party (BJP) released its election manifesto for 2019, it pledged to spend $1.44 trillion on infrastructure. The boost to infrastructure would boost the economy and raise living standards, as it would “lead to the creation of a large number of jobs and livelihood opportunities”.

Post the election victory, analysts across the country are betting on it.

Vinod Nair, Head of Research at Geojit Financial Services, informed Moneycontrol that the government’s growth agenda will give an impetus to certain sectors; namely Financial, Industrial, Infrastructure and Cement.

Shubham Jain, group head and vice-president, corporate ratings, ICRA, believes that “with the continuity in the government, the total budgetary allocation towards the major infrastructure segments is estimated to grow and remain in the range of Rs 4-4.5 lakh crore per annum."

Developing India’s infrastructure is a no-brainer. India’s infrastructure is vastly deficient and has been much maligned. This very apparent infrastructure deficit in India is what resulted in the birth of the infrastructure theme over a decade ago.

In 2006 and 2007, investors flocked to infrastructure funds with no apparent concept of how such investment products need to be positioned in a portfolio. They were expecting these funds to deliver some sort of pop or sizzle to the portfolio. Instead, their hopes were dashed to the ground in the market crash of 2008 and the resulting down cycle in most sectors of the infrastructure segment.

If you believe that this time it is different and you would like a specific exposure to this theme, ensure that such funds do not corner a massive portion of your portfolio. Also, stay in for the long haul and don't let turbulence affect you.

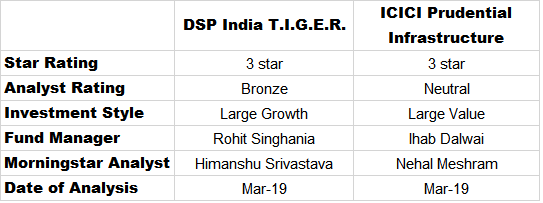

Our analysts look at two infrastructure funds.

ICICI Prudential Infrastructure

The fund has an experienced team and a disciplined investment approach, but its inconsistent track record and portfolio manager rotation limit our conviction. While we gain comfort from the continued presence of Sankaran Naren and believe the fund has potential under his leadership, it remains a watch point, especially since Dalwai does not have a robust track record of managing funds.

The managers follow a combination of top-down and bottom-up processes with a focus on quality stocks. They run the fund with meaningful investment across sectors, over a 2- to 3-year time frame. The fund has an inherent bias toward large-cap stocks, which is a positive, given the cyclical nature of the infrastructure sector.

Large caps cushion the fund from a liquidity perspective, given that the managers can take sizable positions in illiquid stocks based on the conviction levels and views on companies' long-term growth prospects. The fund will maintain about 50% to 60% in large-cap stocks, and as valuations in the mid-cap space will get attractive, the managers will increase the exposure to such stocks but ensure that such a segment does not constitute a major portion of the portfolio. While investing in small and mid-cap space, the managers focus is mainly on companies that are good on quality parameters with a low debt/equity ratio, well-managed working capital, high corporate governance standards, and strong management.

Given its thematic bent, the fund can tend to exhibit a cyclical performance pattern. The fund has performed well under Dalwai's tenure and was able to contain the downside well with its robust stock selection process.

However, we believe it's important to monitor the fund over the long term, especially when he lacks a long track record.

DSP India T.I.G.E.R.

Rohit Singhania started comanaging this fund in June 2010 and took over as the lead manager in June 2012. We believe his skills are well suited to the job as he has extensive analyst experience in tracking infrastructure-related sectors.

Singhania’s core investment universe encompasses infrastructure sectors and those that are subject to economic reforms. Sectors such as technology, consumer staples, autos (consumer related), and domestic pharmaceuticals don’t form a part of the investment universe. Singhania follows an unconstrained approach while investing and invests in growth and value-style stocks, with strong emphasis on the former. He focuses on understanding the key drivers of a business, the company’s underlying assets, management capabilities, and its scalability prospects. He invests in issues whose returns on equity and returns on capital employed are on an uptrend and uses historical valuations to evaluate a company’s fair value.

Within the defined limits, Singhania’s stock-picking criteria are varied and flexible enough to allow for nearly any type of pick. The strategy relies heavily on the manager getting his calls right, leaving little margin for error. The risks are amplified here, as stocks from the infrastructure sector are prone to intense cyclicality.

Having said that, this is Singhania’s favourite playing ground, and the strategy allows him to play to his strength.