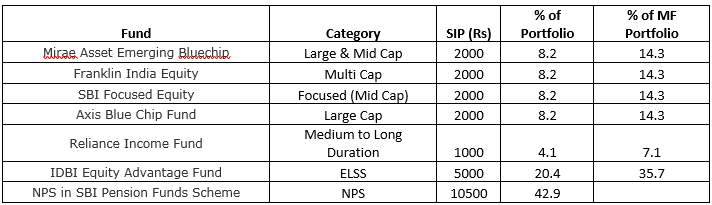

Over the past year, my investments via SIPs are: Rs 2,000 each in Mirae Asset Emerging Bluechip, Franklin India Equity, SBI Focussed Equity and Axis Blue Chip Fund. Rs 1,000 in Reliance Income Fund, Rs 5,000 in IDBI Equity Advantage Fund and Rs 10,500 every month in NPS in SBI Pension Funds Scheme. My goal is to save Rs 2.5 crores in 20 years and Rs 4 crore in 30 years.

- Rishi

- We like most of the funds in your portfolio and you can continue to hold them.

- We recommend switching IDBI Equity Advantage with Axis Long Term Equity.

- Increase allocation towards large-cap funds.

- Reduce allocation towards Reliance Income which is a Duration fund and instead invest into Short Duration funds, which run lower interest rate risk.

- Increase your monthly SIP by 10% every year to comfortably meet your goals for 20 and 30 years.

- You can find a list of top rated funds here.

I have been invested in HSBC Small Cap for the last year and as with the entire small cap market the investments are down 29%. I would like to know if I should continue to hold HSBC Small cap or exit and invest in another small / mid cap fund?

- Sanjay

The small and mid cap segment has seen a sharp correction over the last one year, but over an investment horizon of 7-10 years you can expect this segment to outperform their large-cap peers, albeit with greater interim volatility.

We recommend switching to another small-cap fund like Franklin India Smaller Companies, DSP Small Cap or HDFC Small Cap. You can read our analyst views and investment rationales of these funds here.

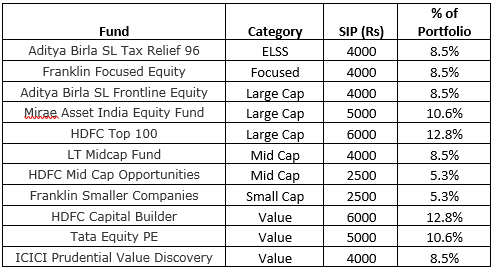

I have the following SIPs in mutual funds and my target is Rs 3 crore in 15 years.

- Rs 4,000 each in Aditya Birla SL Frontline Equity, Franklin Focused Equity, ICICI Prudential Value Discovery, Aditya BSL Tax Relief 96, L&T Midcap

- Rs 5,000 each in Mirae Asset India Equity Fund and Tata Equity PE

- Rs 6,000 each in HDFC Capital Builder and HDFC Top 100

- Rs 2,500 each in HDFC MidCap Opportunities and Franklin Smaller Companies

- Amit

- Increase the SIP amount by 10% every year in order to meet your investment goals.

- Introduce fixed income allocation to your portfolio: 20-25%.

- You can invest into Short Duration and Corporate Bond Funds. You can find a list of funds below:

- Reduce allocation to Value style funds to 15-20% of overall equity portfolio. Value funds are good diversifiers in a portfolio, but growth style funds should be the core holding in a portfolio.

- Overall the funds you are invested in are good and don’t need to exit any specific funds.

I am a 28-year old and currently investing Rs 6,000 per month in mutual funds via SIPs: DSP Blackrock Equity Fund (Rs 3,000) and Rs 1,000 each in Mirae Asset Emerging Bluechip Fund, Franklin India Equity Fund and SBI Blue Chip Fund. My investment horizon is 12-15 years.

- Abhishek

DSP BlackRock Equity corners the bulk of your portfolio – currently 50%. We recommend switching out of your exposure in DSP Blackrock Equity. Do read our analysis of the fund. You could pick a replacement multi-cap fund from here.

The other funds in your portfolio are well managed, continue with those SIPs.

Increase your SIP investments by 10-15% every year so that you accumulate enough wealth to meet your goals.

I have selected SBI Bluechip, Axis Bluechip, Axis Midcap, Reliance Small Cap, Tata Digital India Fund, Franklin India Low Duration.

- Sandeep

We don’t know the exact proportion of each fund in your portfolio. Neither do we know your time horizon.

Equity and Debt allocation should be decided by your risk return expectations and investment time horizon. If you are an aggressive investor and have at least a 10-year investment horizon, you can invest 75% in equity and 25% in debt.

Large Cap and Multi Cap funds should form a core part of your equity portfolio typically 60%+. Small and Mid Cap funds should typically be limited to 30-35% of your portfolio. Sector/Thematic funds overall shouldn’t be more than 10% of your portfolio, with a maximum of 5% in any one sector/theme.

I am going to retire by December. I would like to invest Rs 50 lakhs in mutual funds for steady returns with capital protection as well as capital appreciation. Kindly suggest a few funds.

- Nilanjan

Given your emphasis on capital protection, we suggest investing into fixed income funds like Short Duration Fund and Corporate Bond funds. These funds run limited credit risk as well as interest rate risk. Do make it a point to evaluate the credit breakup of the funds before investing. You can find a list of our analyst views here.

I am 32. Want to retire by 45 or 46. I need at least Rs 3.5 crores. I currently invest Rs 41,500 per month via SIPs.

- Mirae Asset Emerging Bluechip: Rs 25,000

- Canara Robeco Emerging Equity: Rs 10,000

- L&T Emerging Business: Rs 2,000

- Axis Long Term Equity: Rs 3,000

- ABSL Tax Relief 96: Rs 1,500

- Fixed deposits and PPF: Rs 30 lakh

- Srinjoy

- Your portfolio has a significant skew towards mid and small caps. We recommend that your overall portfolio allocation towards this market cap segment should not exceed 35%.

- There is a fair bit of concentration in Mirae Asset Emerging Bluechip and Canara Robeco Emerging Equity with 85% of the SIP amount invested in them. Reduce the SIP value for these two funds.

- Add a large-cap and multi-cap strategy to your portfolio. You can choose funds from here.

- Increase your SIP amount by 10% every year in order to meet your goals for retirement.

My risk appetite is moderate. My investment horizon is 20 years. What do you think of my choice of funds? HDFC Hybrid Equity and Parag Parikh Long Term Equity (Rs 15,000 each), ICICI Prudential Bluechip, Reliance Large Cap Fund and Mirae Asset Emerging Bluechip Fund (Rs 10,000 each).

- Rijesh

- HDFC Hybrid Equity: 25% of the portfolio

- Parag Parikh Long Term Equity: 25%

- ICICI Prudential Bluechip: 16.7%

- Reliance Large Cap: 16.7%

- Mirae Asset Emerging Bluechip: 16.7%

We think you overall portfolio funds are well managed and don’t see a need to make any fund level changes. Given your investment horizon of 20 years, we suggest you could look to increase your small and mid cap fund exposure to 30% of your overall portfolio if your risk appetite allows it. These funds will be more volatile in the short run but are excellent wealth creators over the long term.

You can read our analyst views on specific funds here.

Post your query by accessing the Ask Morningstar tab. Our team will endeavor to answer queries ONLY related to mutual funds and portfolio planning from our registered readers.